Bitcoin Price Forecast: Can BTC bears manifest a 30% crash?

- Bitcoin price shows a clear sign of exhaustion after the recent 4% slump.

- A minor pullback to retest the breaker could trigger a 30% crash for BTC.

- A daily candlestick close above $30,540 will invalidate the bearish thesis.

Bitcoin price shows a loss of bullish momentum, and it could be due to investors booking profits. Since BTC has produced a lower low, this move could trigger a notorious slide, catching late bulls off-guard.

Read more: Assessing the local top for Bitcoin price from a macro perspective

Bitcoin price prepares for a big move down

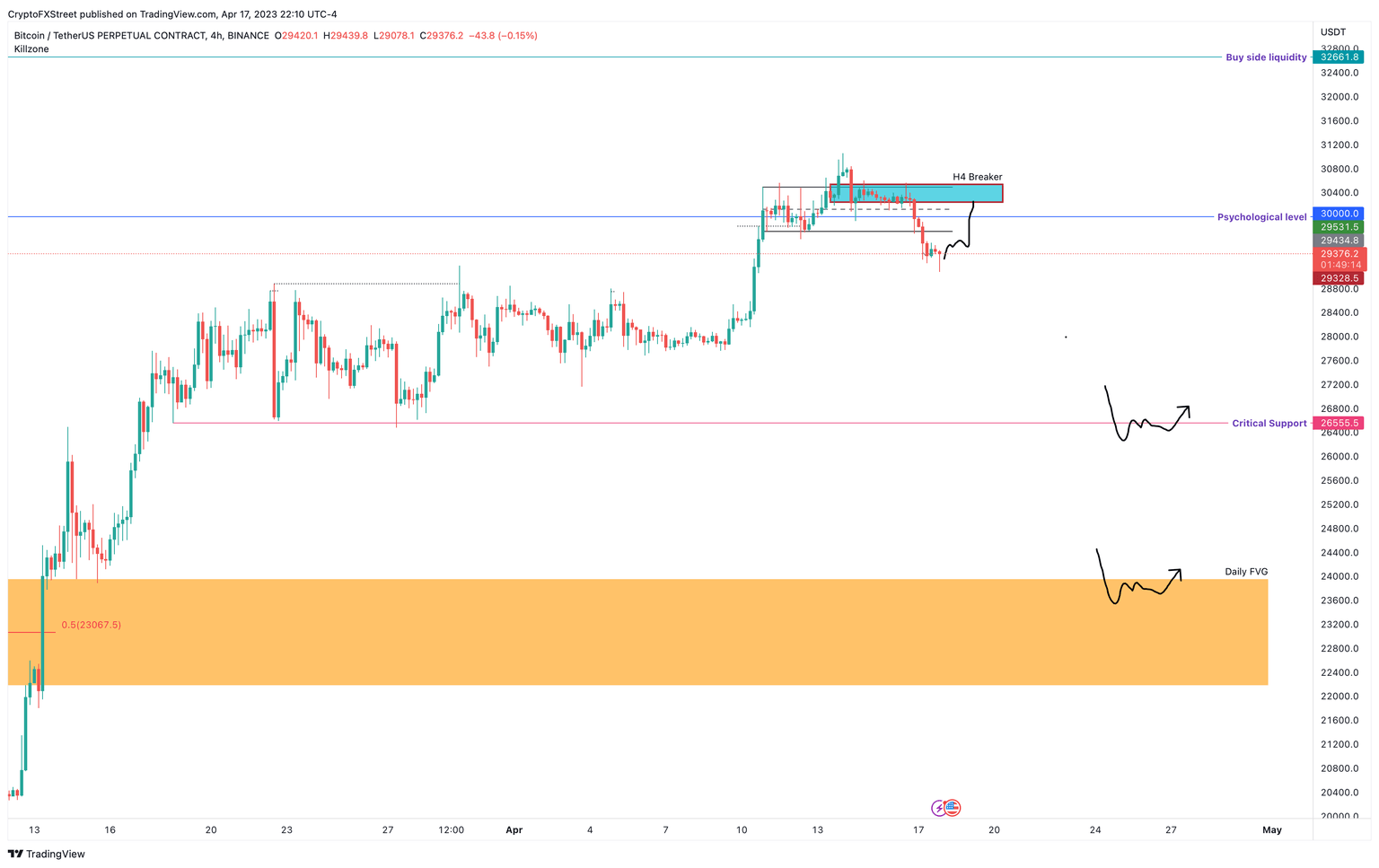

Bitcoin price has set up a bearish breaker on the four-hour chart. As explained previously, this setup contains two higher highs, which paints the illusion of an uptrend, inviting more bulls to join. However, as the price slides and produces a lower low, these early investors are now trapped and looking for an exit.

As the asset’s price pulls back and retests the last down candlestick between the higher highs, it faces immense selling pressure. This retest can be a good entry point for bears.

For Bitcoin price, the bearish breaker extends from $30,539 to $30,244, so a retest of the lower limit could be a good place for shorting BTC. But investors could choose to sell their holdings earlier at the $30,000 psychological level.

BTC/USDT 1-day chart

While things are looking gloomy for Bitcoin price, a swift move above the $30,000 psychological level will be the first sign of bearish weakness. If this move continues to propel BTC higher and produces a daily candlestick close above $30,540, it will invalidate the bearish thesis.

A confirmation of the bullish outlook will arrive when Bitcoin price produces a higher high and tags the next critical hurdle at $32,661.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.