Where will the 2023 crypto bull rally top? – ICT

This article will get a little technical and interesting for traders. The main topic addressed is Bitcoin price and its local top for the ongoing bull rally. The secondary topic will be an alt season and why Layer 2 tokens, especially, Optimism, will rally next.

Also read: Floki Inu price could rally 30% ahead of this FLOKI announcement

Bitcoin price could form local top at $36,000

Michael Huddleston, a popular Forex and Stock market trader known commonly as InnerCircleTrader (ICT), posted his take on Bitcoin price on April 16.

The chart details two important formations on the weekly – a bearish breaker and FVG, both of which could limit the upside potential for Bitcoin. Hence, ICT is suggesting that there is a potential for BTC to form a local top anywhere from $34,243 to $41,330.

Bitcoin... pic.twitter.com/rjFxAfDYDU

— The Inner Circle Trader (@I_Am_The_ICT) April 16, 2023

BTC/USDT 1-week chart

Also read: Bitcoin Weekly Forecast: What to expect from BTC after overcoming $30,000

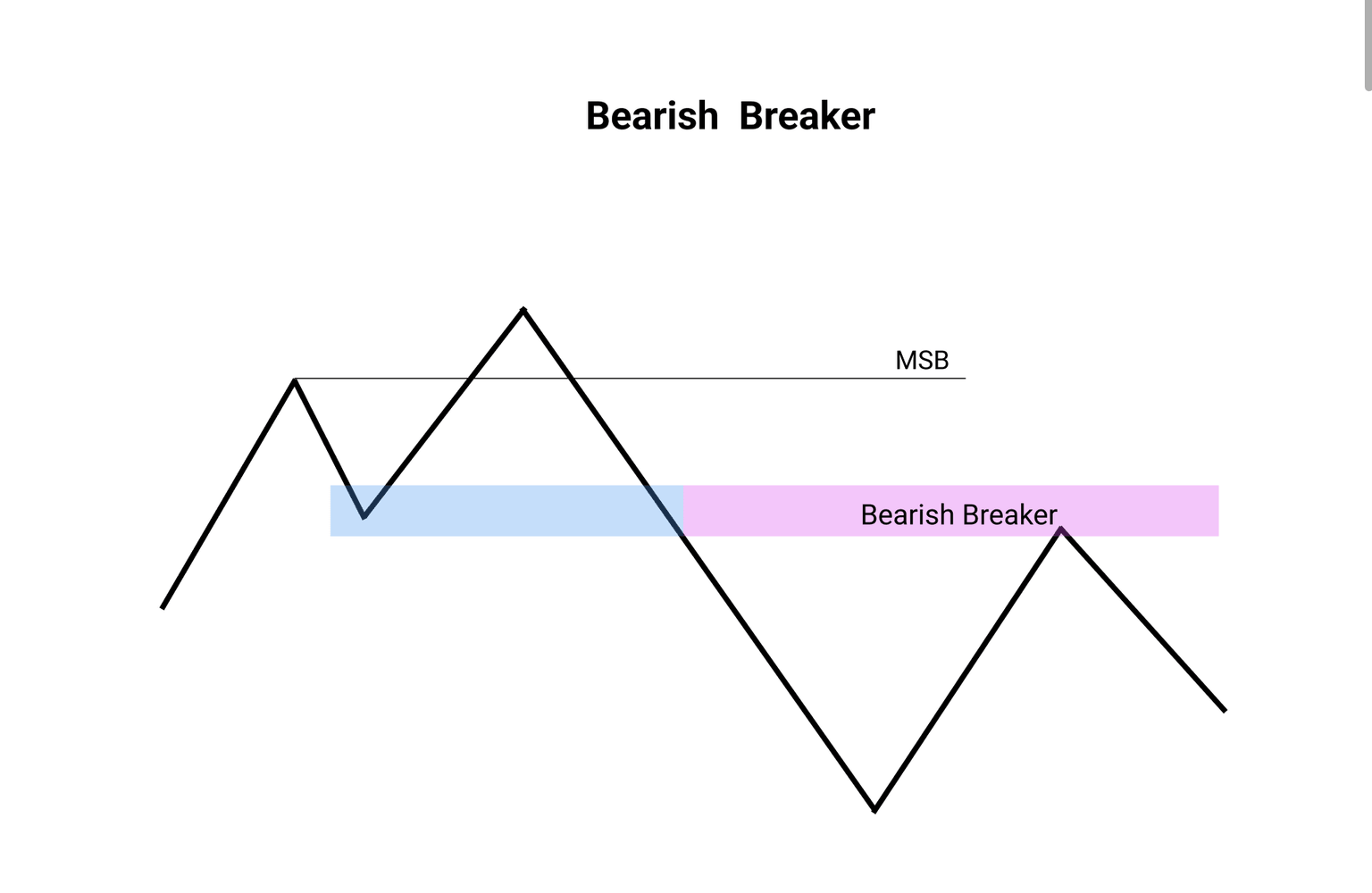

What is Bearish Breaker?

A bearish breaker is a setup that focuses on the down candlesticks between two higher highs. As seen in the chart below, the asset forms two higher highs and then proceeds to correct, producing a lower low. Come recovery time, the said asset typically faces heavy selling pressure as it tags the down candlesticks between the higher highs.

Bearish Breaker

Fair Value Gap (FVG)

An FVG is an inefficiency formed when the asset moves quickly in a single direction without allowing the other camp to participate. As a result, gaps are formed on candlesticks where the wicks on either side of a candlestick do not fill it.

The image below shows FVGs formed after a sudden spike in buying pressure and a quick selloff, respectively.

FVG

Alt season and what to expect next?

While the local top is still far from being formed, investors need to focus on alt season and the coins that are likely going to pump next. With Arbitrum taking a massive leap over the last week and BTC looking comfortable at around $30,000, these profits are likely going to rotate into the next big thing – and it could be Optimism.

Before Arbitrum, Optimism got all the hype, so it is only natural to assume that these profits will find their way into OP or other Layer 2 solutions.

OP/USDT 1-day chart

Read more on alt season: Ethereum and altcoins gear up for alt season with this move in Bitcoin dominance

Top 3 reads

Bitcoin Weekly Forecast: What to expect from BTC after overcoming $30,000

Ethereum holders lose risk appetite, here's what it means for ETH price

Ripple counters SEC’s argument on ‘Fair Notice’ defense, this is how they set the record straight

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.