Bitcoin Price Forecast: BTC trades around $95,900 as US government funds weigh in

Bitcoin price today: $95,900

- Bitcoin price hovers around $95,900 on Tuesday after a mild correction the previous day.

- Traders should be cautious as the US government moved 10,000 BTC from the Silk Road seized address to Coinbase Prime on Monday.

- Gemini’s Head of US OTC Trading, Olivier Mammet, highlights factors that might affect BTC price in the short to medium term.

Bitcoin (BTC) price hovers around $95,900 on Tuesday following a mild correction the previous day. Market sentiment turned cautious after the United States (US) government transferred 10,000 BTC worth $962.88 million from a Silk Road-seized wallet to Coinbase Prime. Gemini’s Head of US OTC Trading, Olivier Mammet, outlines potential short-to-medium-term price influences.

Bitcoin price slides below $95,000 as US government moves 10K BTC

Bitcoin’s price declined in the Asian session but recovered slightly during the early New York session on Tuesday, trading around $95,900 after a mild correction on Monday. If the downturn continues, it could lead to a short-term crash towards $90K as the US government moves BTC to exchange.

According to data from the crypto intelligence tracker Arkham, a wallet related to the US government, moved on Monday 10K BTC worth $962.88 million from the Silk Road seized address to Coinbase Prime. Transferring such a large amount of Bitcoin to an exchange, especially Coinbase Prime, often signals an intent to sell or distribute and can create bearish sentiment as market participants anticipate increased supply.

Traders should be cautious, as the US government sold 29,799 BTC on July 29, leading to a sharp price drop, with Bitcoin losing over 20% in value in a week. Such large-scale government sales typically create significant selling pressure.

10K BTC ($963M) has been moved from 33Tg to Coinbase Prime. pic.twitter.com/D2kijONsmL

— Arkham (@arkham) December 2, 2024

QCP’s report on Tuesday highlights that optimism persists on the institutional demand side.

“Spot ETFs recorded another $350 million in inflows yesterday, while MARA Holdings has followed MicroStrategy’s lead, acquiring $618 million worth of BTC over the past two months,” says QCP’s analyst.

“Other crypto mining companies like Riot Platform are increasingly likely to halt BTC sales, with some considering expanding holdings. Coupled with news of Microsoft contemplating a BTC purchase, this underscores growing corporate interest in Bitcoin as a reserve asset,” added.

In an exclusive interview with FXStreet, Olivier Mammet, Gemini’s Head of US OTC Trading, discussed factors influencing Bitcoin price in the short and medium term. He stated “the main factor that could influence the price of Bitcoin in the short-term remains the expectations about the new Trump administration in the US, including who will be nominated in key agency positions.”

“For the past four years, much of the environment for the crypto industry in the US has been difficult, with an approach of ‘regulation by enforcement’ by the current Administration,” he added.

However, it’s hoped that the new political party entering the White House, the Securities and Exchange Commission (SEC), and the Department of Treasury will support regulation promoting the crypto industry’s growth.

“Other factors that may play a part are developments around ongoing lawsuits, Tornado Cash being the most recent one. The market is trading in a positive direction as we near the US presidential inauguration in January, so it’s important to keep an eye on overall market sentiment and social media indicators.” said Olivier Mammet.

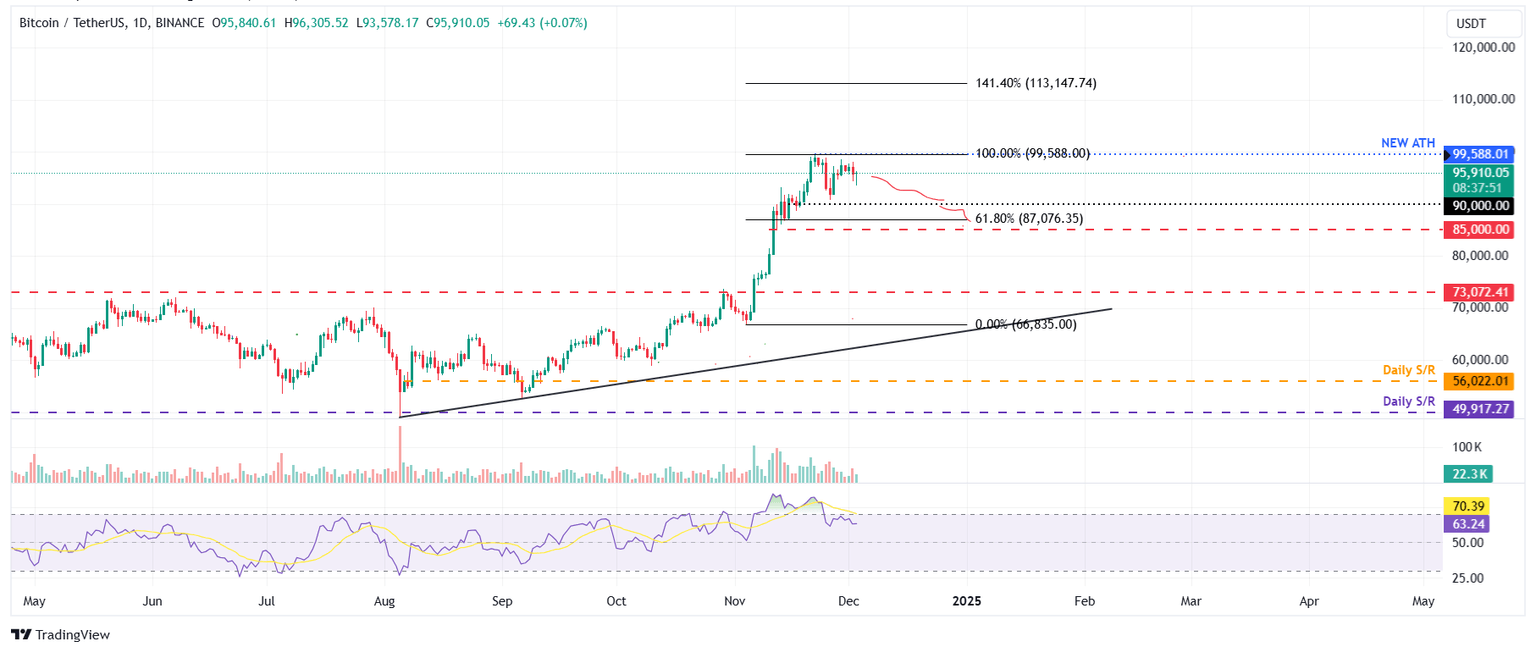

Bitcoin Price Forecast: Correction towards $90K

Bitcoin price dropped slightly in the early Monday session after a correction last week. At the time of writing on Tuesday, it hovers around $95,900.

If BTC faces a pullback, it could extend the correction to retest its $90,000 support level.

The Relative Strength Index (RSI) on the daily chart reads at 61, rejected for its overbought level of 70 and points downwards, indicating a weak bullish momentum. Moreover, the Moving Average Convergence Divergence (MACD) indicator also showed a bearish crossover on November 26, generating sell signals. The MACD also shows rising red histogram bars below the neutral line zero, suggesting that Bitcoin’s price could experience downward momentum.

BTC/USDT daily chart

However, if BTC continues its upward momentum, it could rally to reach its all-time high (ATH) level of $99,588.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.