Bitcoin may retreat further before another run to $9,000

- Bitcoin loses its market share as altcoins are more successful.

- BTC/USD bulls have a chance to hit the target of $9,000.

Bitcoin passed several important barriers and hit $8,900 during early Asian hours. At the time of writing, BTC/USD is changing hands at $8,643, down 2% since the beginning of the day. Despite the retreat, it is still 2% higher from this time on Tuesday.

Notably, Bitcoin's market dominance dropped to 66.1%, which is the lowest level since the end of November. Thee decrease of the market share is caused by strong growth of Bitcoin forks, including Bitcoin Cash, Bitcoin SV, Bitcoin Gold and Bitcoin Diamond. Some other altcoins like DASH, ZCash and Ethereum Classic also experienced strong double-digit growth.

$9,000 within reach?

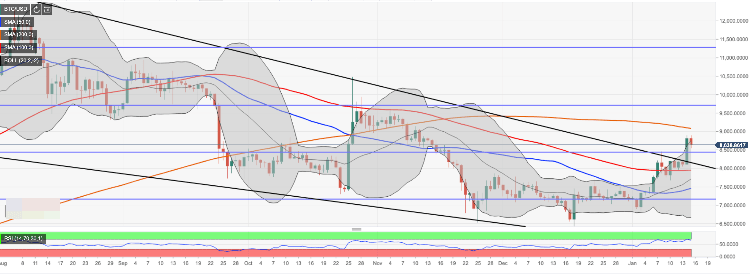

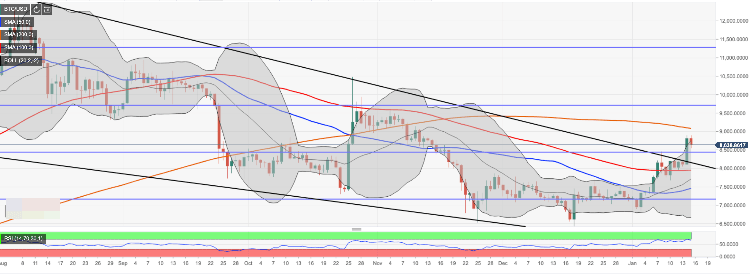

Now that Bitcoin broke above the descending wedge, many traders expect further recovery with the next aim at $9,000, followed by $9,700 (38.2% Fibo retracement for the upside move from December 2018 low to July 2019 high. This level may slow down the upside momentum and even trigger a downside correction before another bullish wave towards a psychological $10,000. Once $9,000 is out of the way, this target will move from a distant dream status to a total possibility.

On the downside, the initial support is created by $8,500 that served as resistance during the. previous week. Reinforced by 50% Fibo retracement, it is likely to limit the downside correction for the time being. If it is broken, the bearish sentiments may intensify with the next price target at $$8,150 (broken wedge) and $7,950 (SMA100 daily). Considering that the RSI on a daily chart has reversed to the downside, further correction likes likely at this stage

BTC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst