Bitcoin, Cryptocurrencies Still Ranging

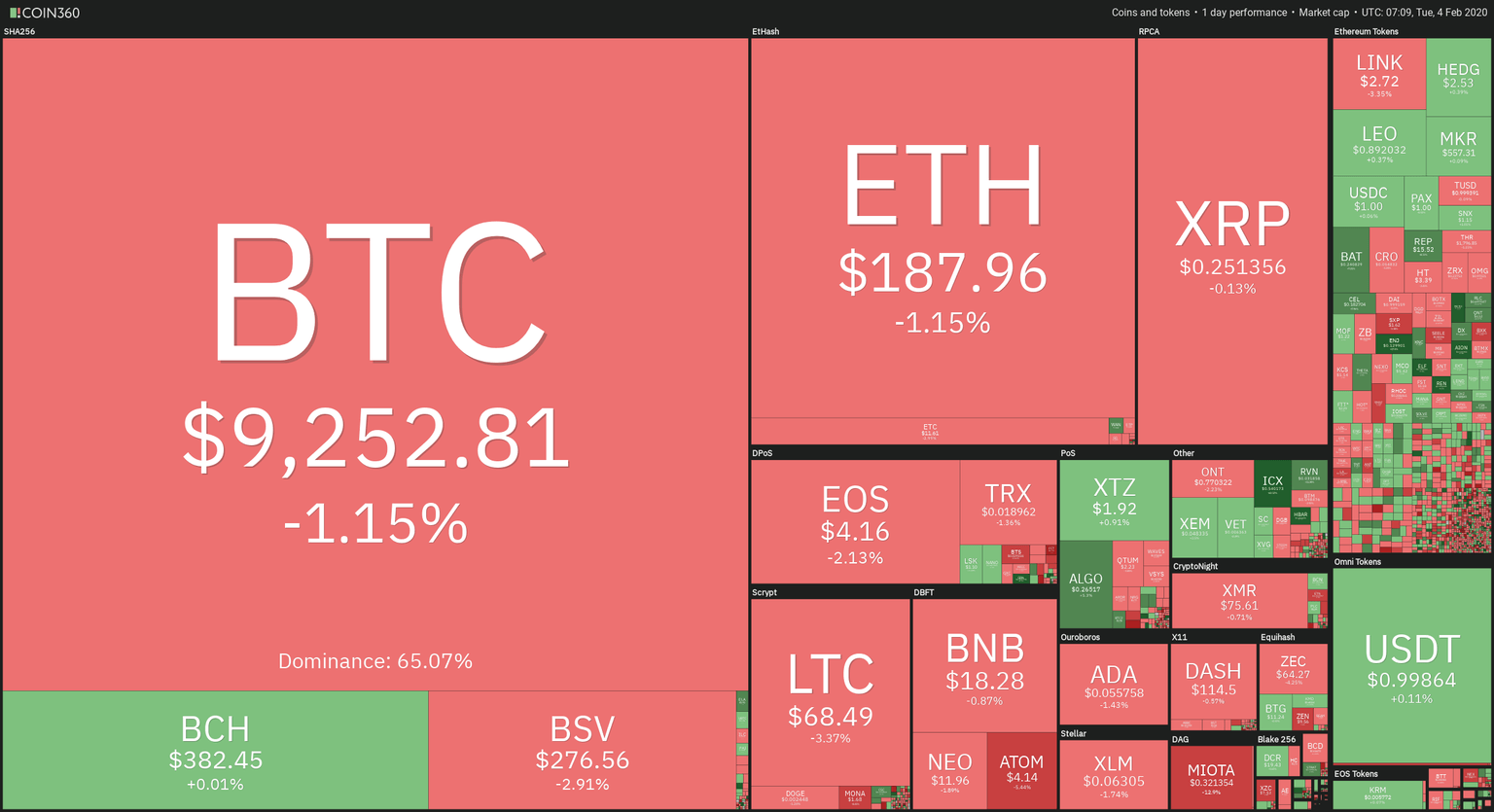

Cryptocurrencies are losing steam, as Bitcoin couldn't manage to surpass the $9,550 yesterday. All major cryptos are retracing, although moderately. Ripple (-0.52%) is almost break-even, Bitcoin(1.5%) and Ethereum(-1.68%), Litecoin (-3.31%) and Bitcoin SV (-2.79%) move moderately down. The Best performer is ICON (+49.7%).

Ethereum tokens are having a mixed day, but the top tokens are mostly in the green. Bat(+7.5%), CEL (+7.88%), REP (+8.1%), ENJ (+17.7%), and AION(+27%) are among the best performers. LINK (-3.22%) is releasing some of the gains of past sessions.

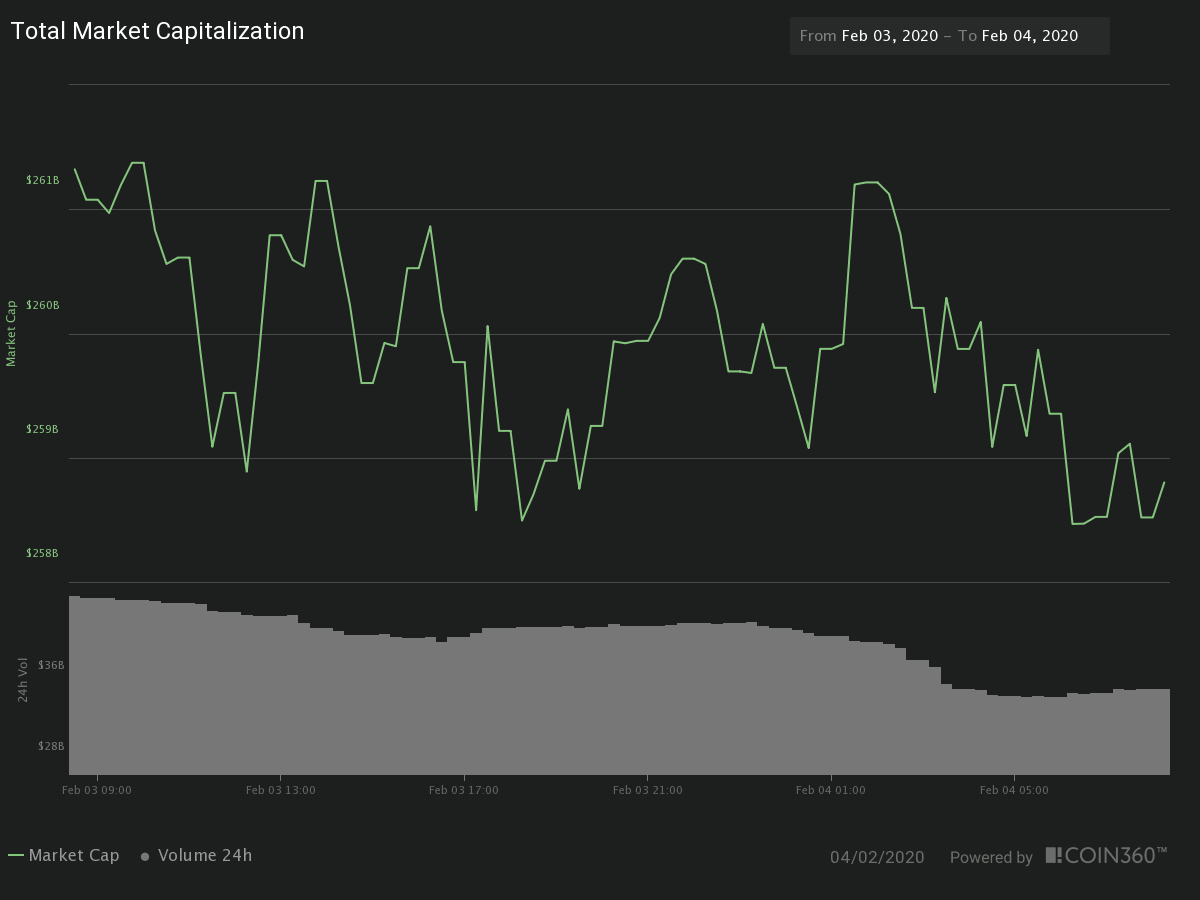

The Market Cap of the cryptocurrency sector dropped by 0.33 percent, to $258,801 billion. That happened with $35.685 billion traded in the last 24 hours, a 16 percent drop. Also, the dominance of Bitcoin is descending slightly and now is 65.11 percent.

Hot News

Open source blockchain platform Waves set a non-profit association sit in Frankfurt, Germany called Waves Association. In the press released it stated that the Waves Association will collaborate with universities and research centers, as well as companies and government agencies around the world to develop DAO and blockchain-based solutions.

Coinfirm has raised $4 million to create a piece of code that aims to help crypto exchanges comply with the new anti-money laundering rules while keeping the privacy of their customers.

The US Marshals Service is going to auction off 4,040.54069820 bitcoins, about $37.500 million worth on Feb 18. A $200,000 deposit is required to those that wish to participate.

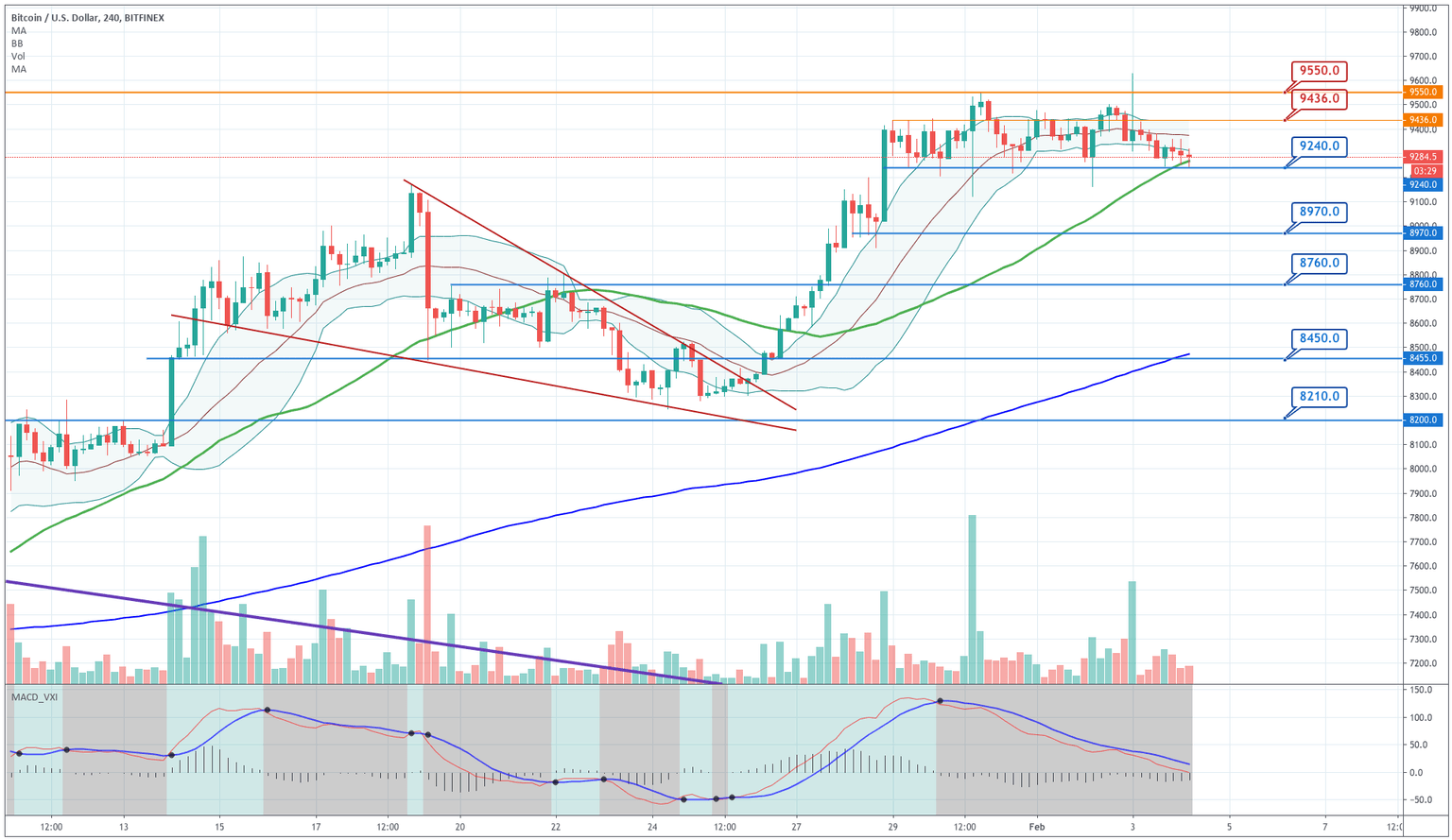

Technical Analysis: Bitcoin

Bitcoin continues moving in the a range between $9,240 and $9,550. The last leg has driven the price below the $9,300 mark and it, even, touched the $9,240 level. The MACD still shows no sign of the end of this corrective phase. We can see also that the 50-period SMA is currently touching the price.

The level to keep an eye on is $9,240. A close below that level would mean more downside for the BTC, probably down to $8,970.

|

Support |

Pivot Point |

Resistance |

|

9,240 |

9,400 |

9,550 |

|

8,970 |

9,800 | |

|

8,760 |

10,070 |

Ripple

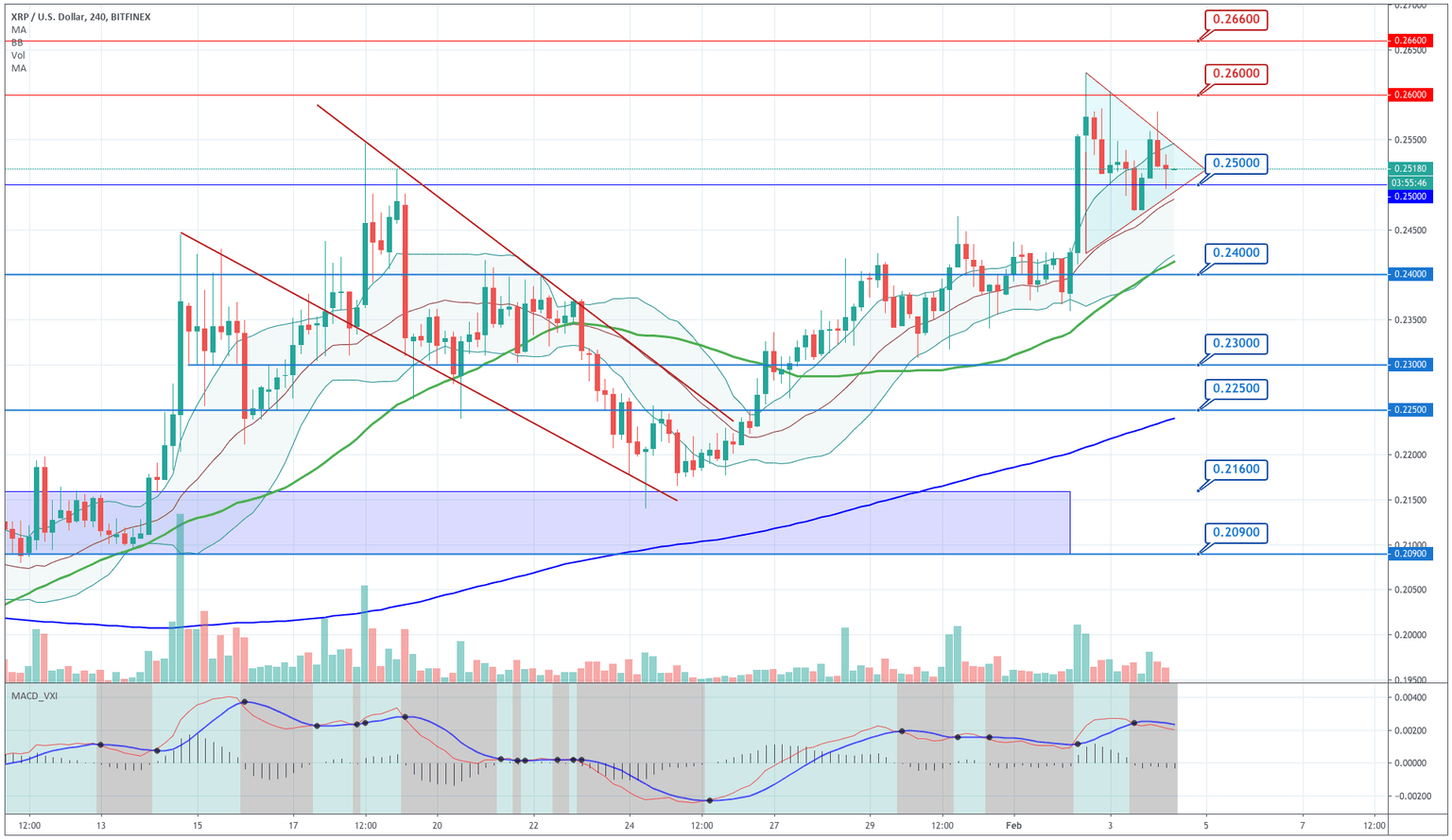

Ripple is still moving sideways above the $0.25 level, creating a triangular structure, which is a continuation pattern most of the time. The price still moves in the upper Bollinger band, and the Bands move pointing upwards, Also, the price is above its 20, 50 and 200 SMA. That shows the trend continues to be upwards.

|

Support |

Pivot Point |

Resistance |

|

0.2470 |

0.2540 |

0.2600 |

|

0.2400 |

0.2670 | |

|

0.2350 |

0.2750 |

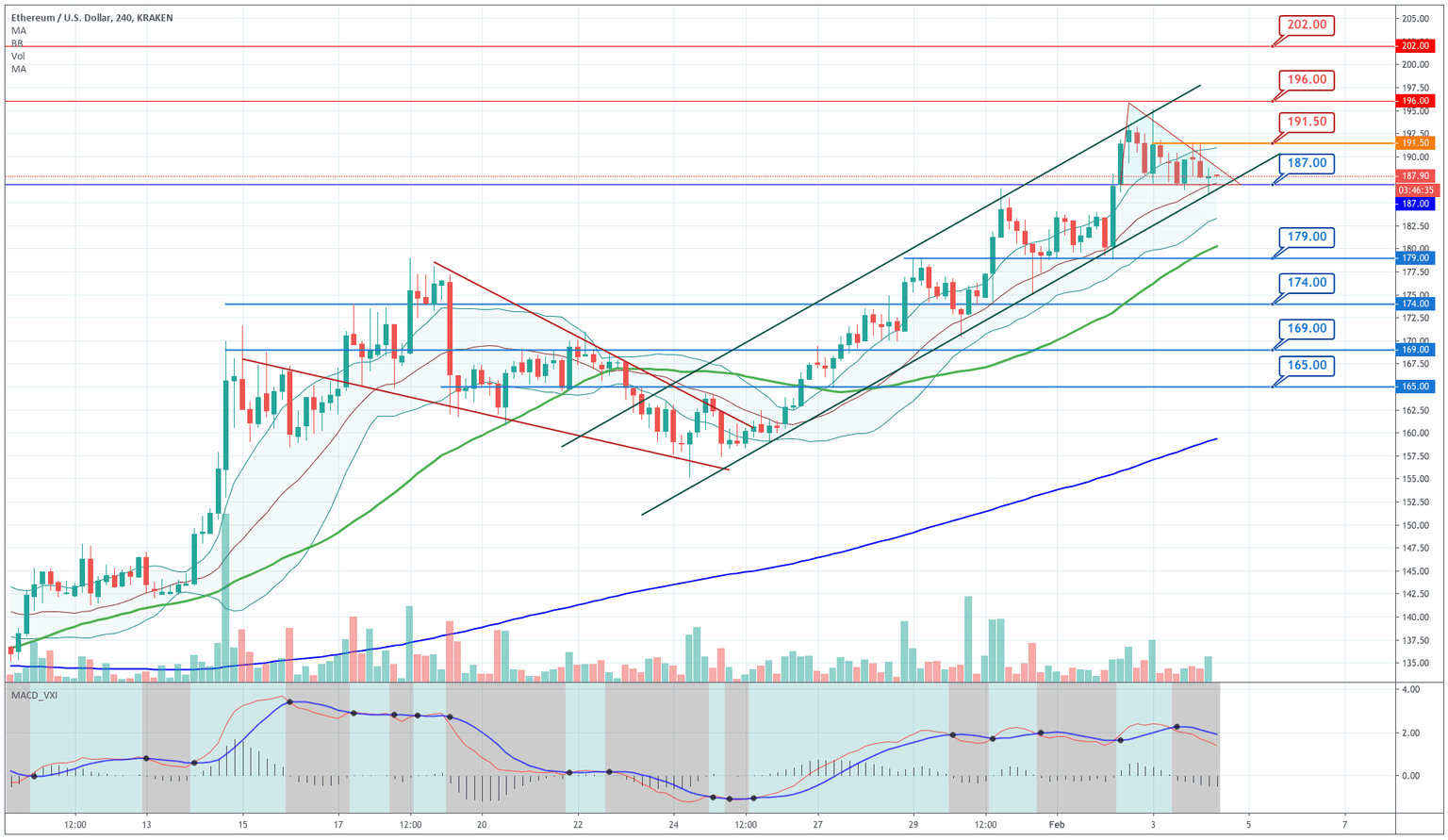

Ethereum

Ethereum is still moving in an upward channel, although the last leg is an horizontal consolidation structure that carried the price close to then lower trendline of this channel. The price still moves above the mid-Bollinger line and the Bollinger Bands move pointing upward, so, the overall trend is bullish. $ 187 is the current support for the price. Also, $191.5 is the nearest resistance level to break and raise the interest of the buyers.

|

Support |

Pivot Point |

Resistance |

|

187.00 |

191.50 |

196.00 |

|

183.00 |

200.00 | |

|

179.00 |

202.00 |

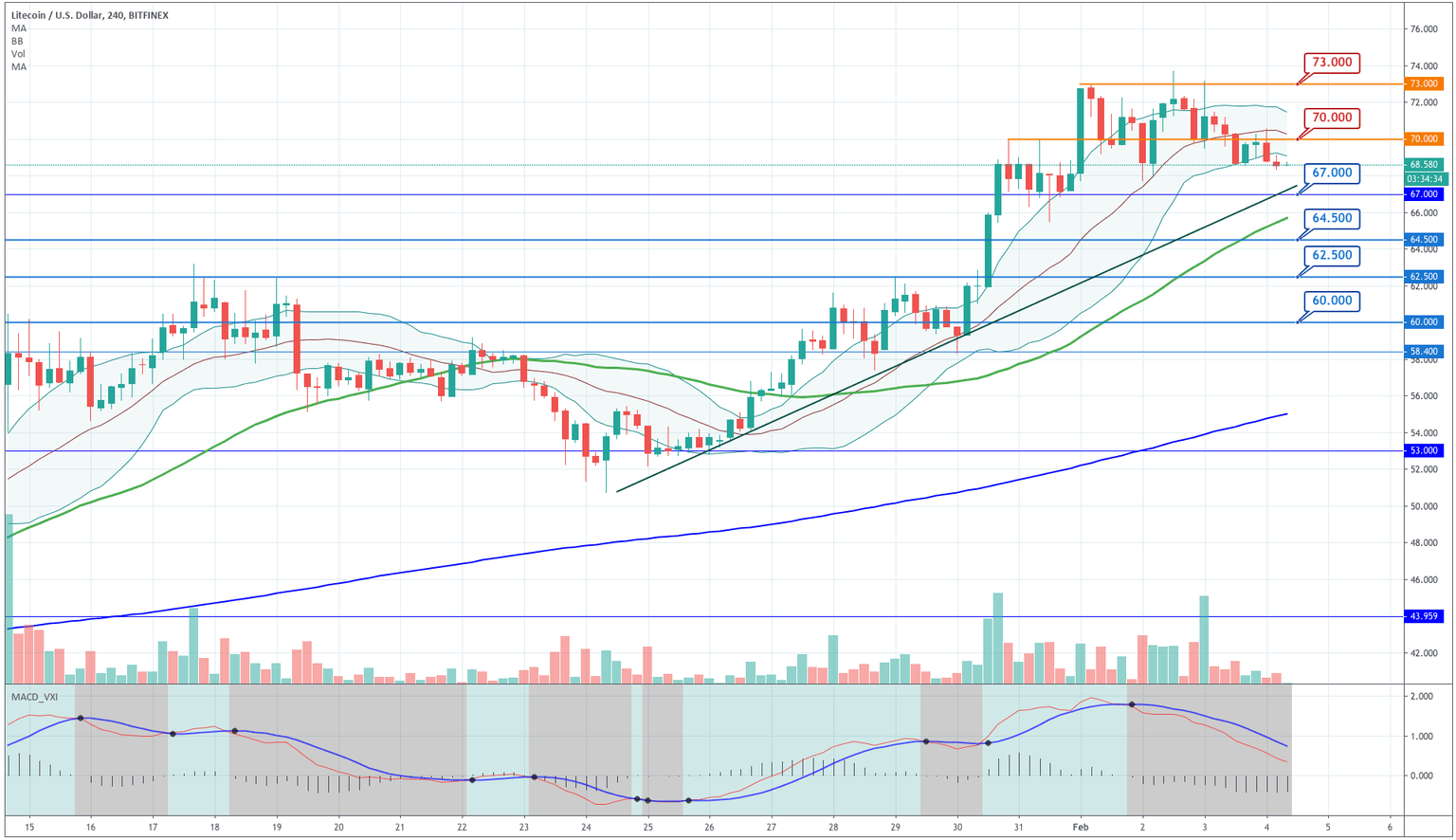

Litecoin

Litecoin moves in a horizontal range, although in the last hours the price made a descent from $73 to $68.7. The price now moves below the -1SD line and is approaching its ascending trendline. THe MACD seems to start curving up, which would indicate the end of this corrective phase. Since the price still moves above its 50 and 100-period SMA, and, also, above the ascending trendline, we still think this is just a healthy consolidation of a very large movement, and keep our bullish bias on Litecoin.

|

Support |

Pivot Point |

Resistance |

|

67.00 |

70.00 |

73.00 |

|

64.60 |

75.00 | |

|

62.50 |

77.00 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and