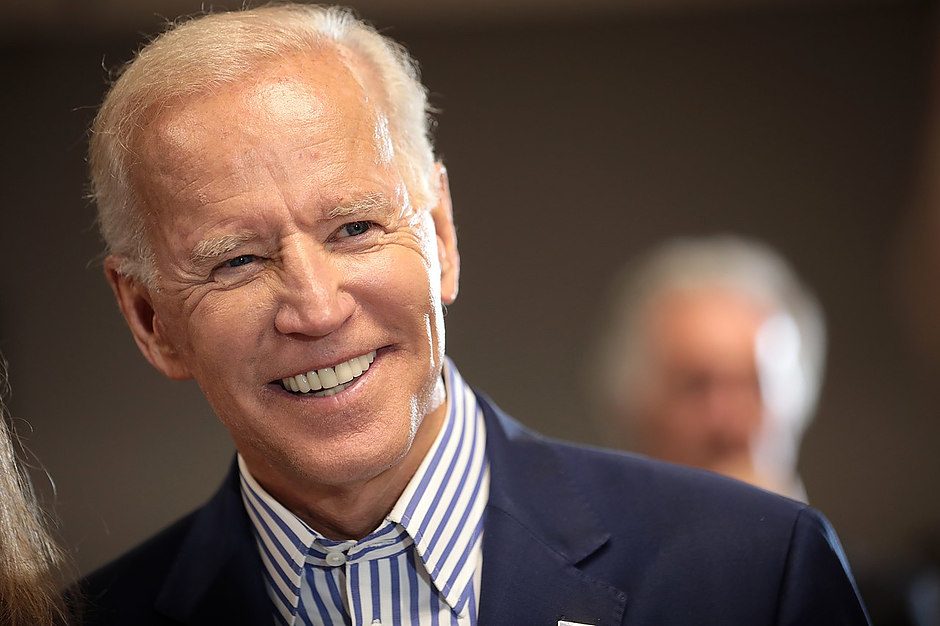

Biden budget plan would close crypto tax loss harvesting loophole

US President Joe Biden's proposed budget, set to be unveiled Thursday, will include a provision to close tax loss harvesting on crypto transactions.

A White House official confirmed that the budget will include a tax provision intended to reduce wash sales trading by crypto investors. At present, investors can sell any cryptocurrencies at a loss, claim the loss on their taxes and then buy the same amount and type of cryptocurrencies again.

According to the Wall Street Journal, the provision would be expected to raise up $24 billion.

The president's proposed budget will lay out his fiscal priorities. White House officials told the Journal the plan would lower the U.S. deficit by $3 trillion over the next 10 years.

Any budget would need passage through the House of Representatives and the Senate before going to the president's desk for his signature.

This isn't Washington's first effort to close this "loophole" – lawmakers introduced a bill in late 2021 that would similarly prevent investors from claiming a loss only to re-purchase the same cryptocurrencies again.

The president's team has already passed one crypto tax-related piece of legislation into law; in 2021, the Bipartisan Infrastructure Framework, which later became the Infrastructure Investment and Jobs Act, included a controversial tax provision that would impose certain reporting rules onto brokers facilitating crypto transactions. The definition of "broker" was seen by many in the industry to be overly broad, to the point where miners and other types of entities that don't directly facilitate transactions or collect personal data from those conducting the transactions could be considered brokers.

The US Treasury Department has indicated that it would define the term brokers more narrowly, though it has yet to publish formal guidance on the matter.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.