BASE meme coins’ gains surge, taking over Solana's trading frenzy

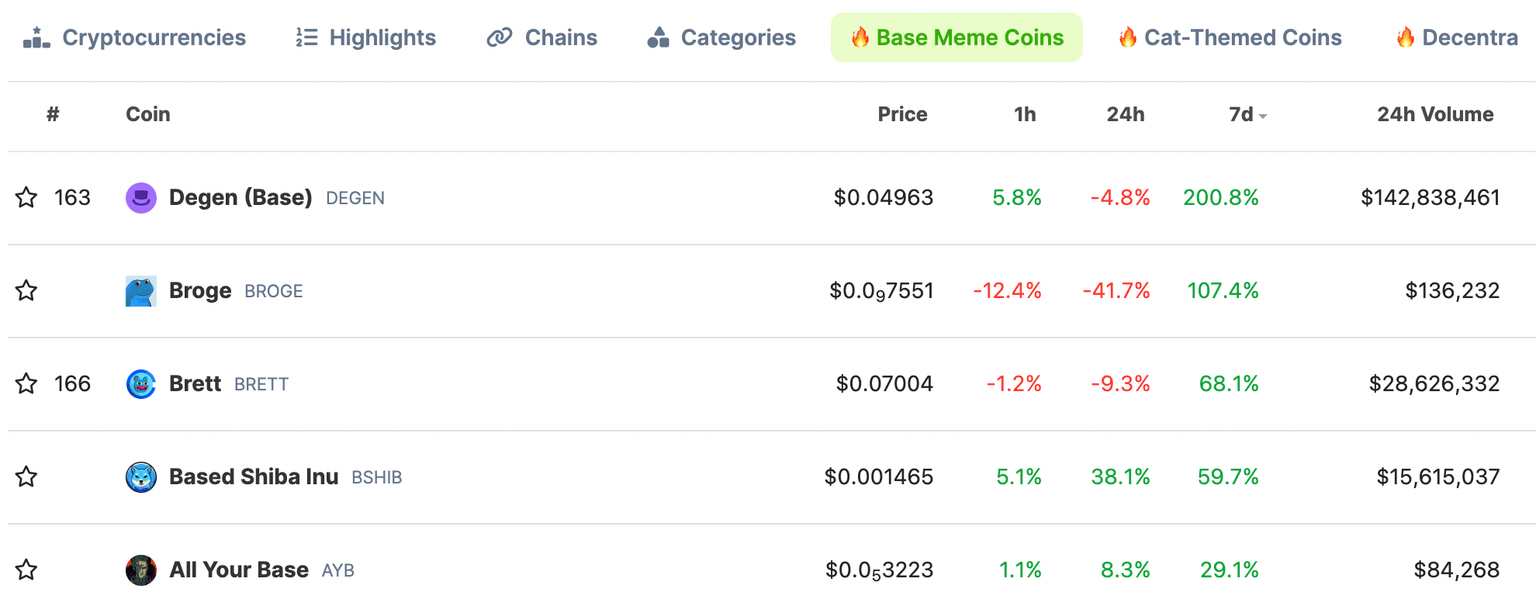

- BASE-based meme coins Degen, Brett, All Your Base, Based Shiba Inu and Broge post double-digit weekly gains.

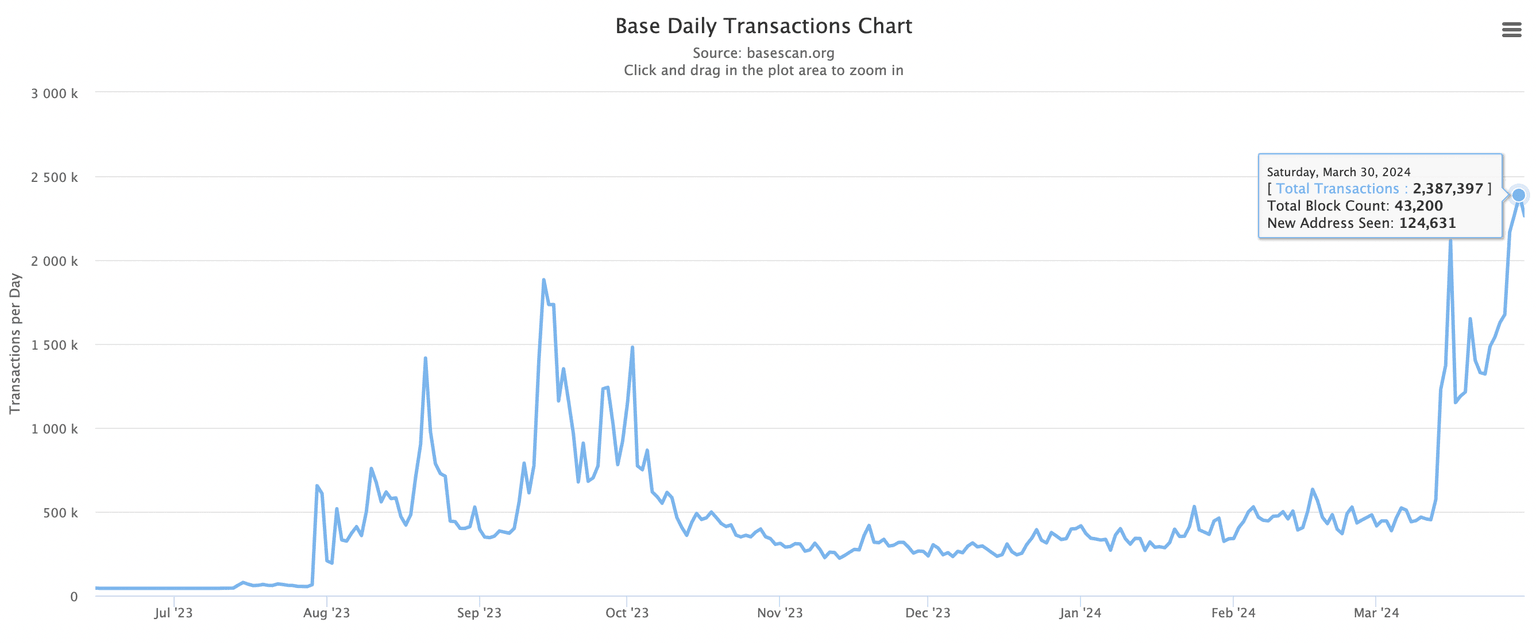

- Coinbase’s chain recorded its highest daily transactions on Saturday, hitting a new all-time high of 2.38 million.

- Crypto analysts identify BASE-based meme coins as a new category towards which NFT holders are likely to rotate capital.

BASE, Coinbase’s Layer 2 chain, has seen a rapid spike in daily transactions in recent days as market participants get drawn to the meme coin frenzy towards tokens related to its ecosystem. Degen (DEGEN), Brett (BRETT), All Your Base (AYB), Based Shiba Inu (BSHIB) and Broge (BROGE) have yielded between 30% and 200% weekly gains.

BASE exceeds $1.16 billion in TVL, hits record in daily transactions

Coinbase’s Layer 2 chain BASE is gaining relevance among traders, locking in $1.166 billion worth of cryptocurrencies on Monday, according to data from DeFiLlama. The number of daily transactions on BASE has hit a new all-time high, climbing past 2.38 million on Satuday.

BASE Daily Transactions Chart

The spike in daily transactions can be attributed to the increasing popularity of certain meme coins on the Layer 2 chain. Top BASE-based meme coins yielded double-digit weekly gains in the past week, as seen on CoinGecko.

BASE-based meme coins weekly gains

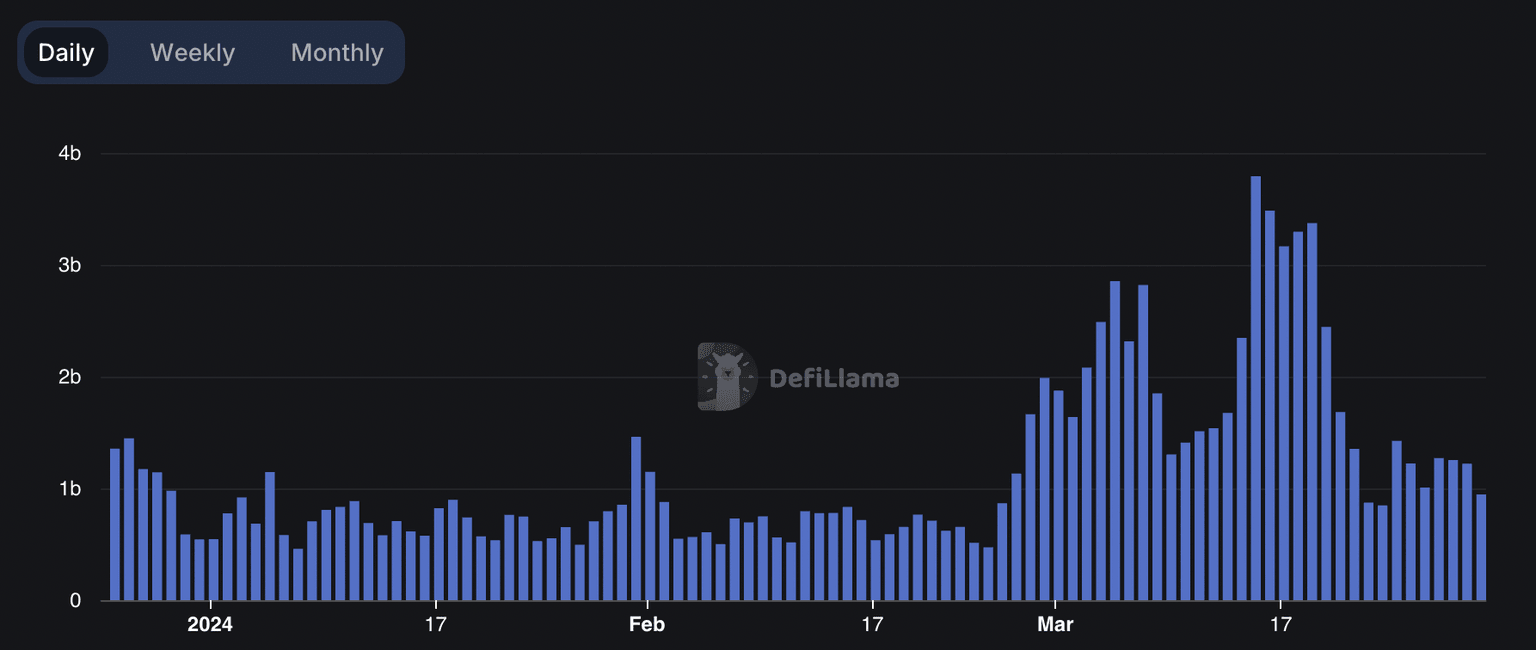

As BASE-based meme coins gain popularity, the volume on Solana’s decentralized exchanges is on a decline, as seen on DeFiLlama.

Solana DEX volume.

The decline in volumes suggests the meme coin frenzy on Solana – which boasted trading volumes and network usage for the network over the last month– is slowly waning.Capital appears to be rotating to Layer 2 chains like Base, where meme coins are seeing a resurgence and a rapid increase in daily transactions, trade volume, and returns.

Regarding these sudden shifts from traders, NFT expert and influencer behind the X handle @punk9059 said on Monday that the “once-was NFT community” has moved to different branches of the market, namely meme coins, DEGEN (Base-based meme coins), Ordinals and Bitcoin, and Farming blast.

It feels like the once-was NFT community has moved into many different branches:

— NFTstats.eth (@punk9059) April 1, 2024

1) Memecoins

2) Farcaster/$DEGEN/Base

3) Ordinals and Bitcoin

4) Farming Blast

Totally different ecosystems and each is pretty all-encompassing.

The feed is all over the place.

As its own category, Base-based meme coins are likely seeing capital rotation. If this continues, it could extend gains for these tokens’ prices.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.