Band Protocol must defend this critical support level to avoid plummeting to $4

- Band Protocol price faces strong selling pressure as on-chain metrics turn bearish.

- The digital asset could be poised for a massive pullback down to $4.

Band Protocol has been trading fairly sideways for the past two months despite the cryptocurrency market turning bullish. The digital asset now faces steep resistance ahead and bulls have to absolutely defend a critical support level to survive.

Band Protocol price needs to defend $5.45 to avoid slipping

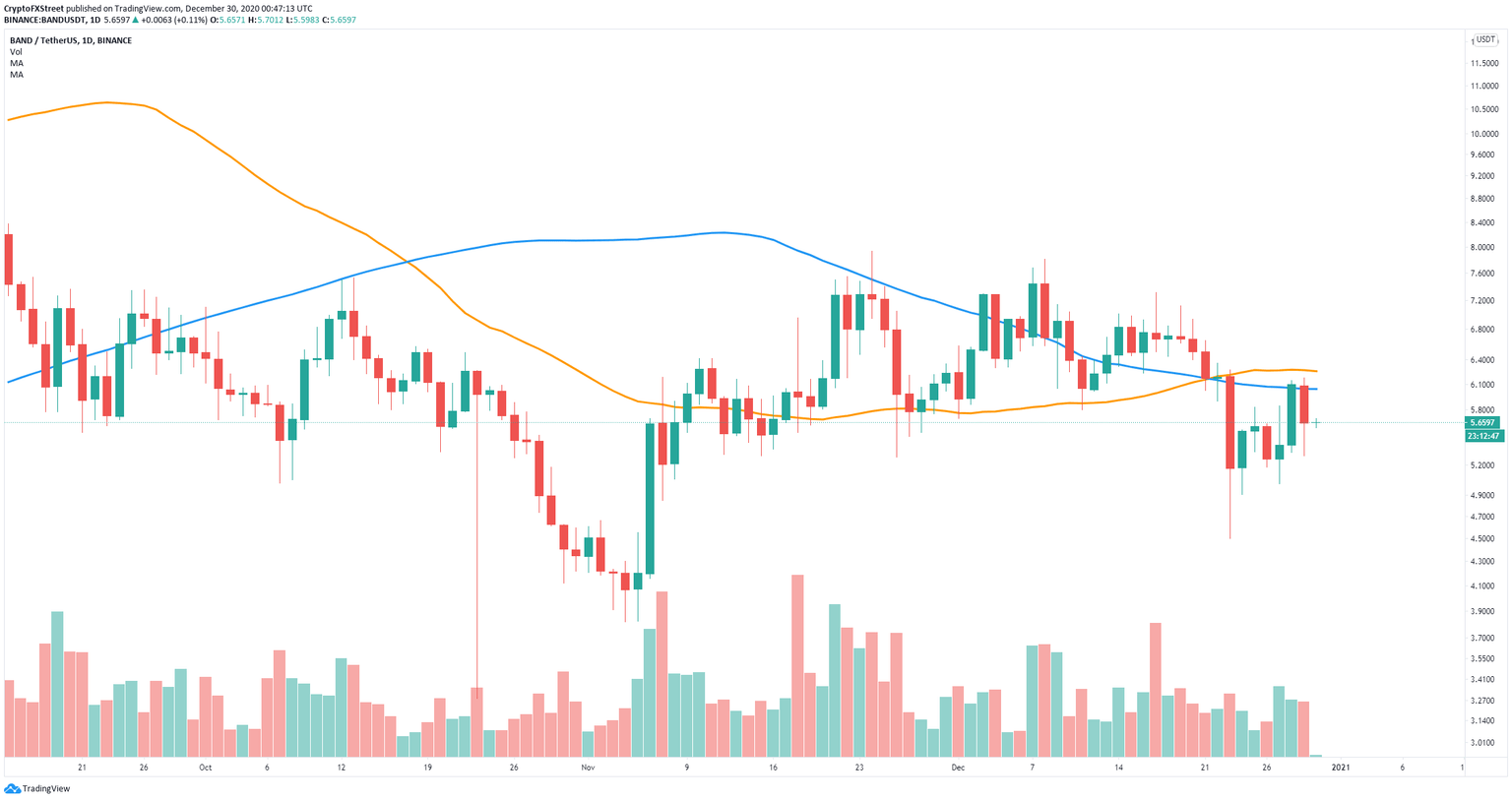

On the daily chart, Band Protocol established a downtrend and dipped below the 50-SMA and the 100-SMA turning both into resistance levels. There is very little support on the way down, which means bears have a good chance of pushing Band Protocol price down to at least the last low of $4.5.

BAND/USD daily chart

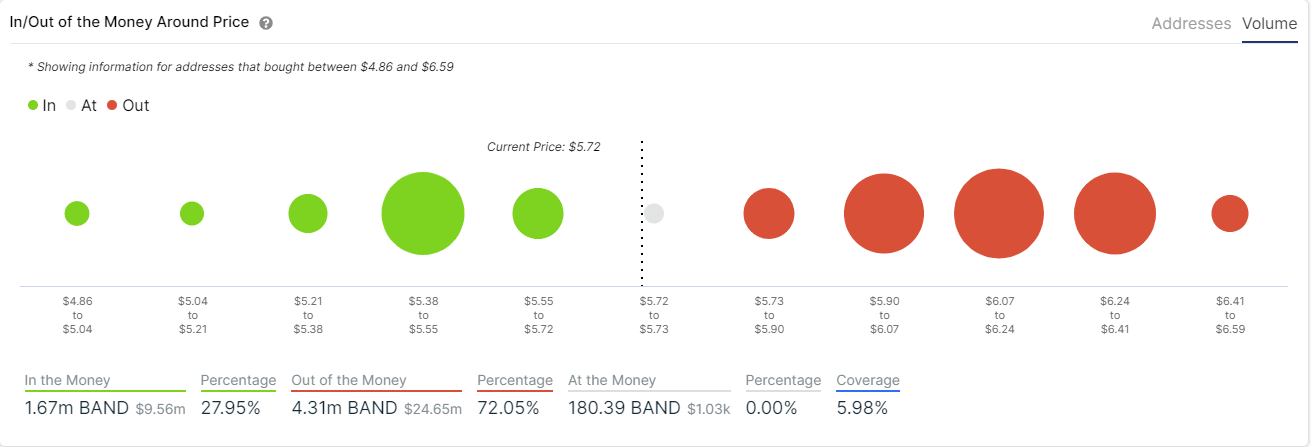

The In/Out of the Money Around Price (IOMAP) shows colossal resistance above $5.73 up to $6.41. The most significant support area is located between $5.38 and $5.55, a breakdown below this range can quickly push Band Protocol down to $4.5 and as low as $4 in the long-term.

BAND IOMAP chart

Additionally, it seems that the number of whales holding between 100,000 and 1,000,000 coins has dropped significantly since its peak on December 09 at 19, to a low of 14. This indicates that large holders are taking profits and exiting Band.

BAND Holders Distribution chart

The only chance for the bulls is to reconquer the 50-SMA and 100-SMA resistance points on the daily chart. A breakout above $6.3 could push Band Protocol price up to $7 as the IOMAP chart shows very little resistance from $6.3.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B01.50.03%2C%252030%2520Dec%2C%25202020%5D-637448863214224189.png&w=1536&q=95)