Axie Infinity price inching closer to fresh 2023 lows could leave over 94% of investors at a loss

- Axie Infinity price is trading at $4.47 after failing a breach of the 50-day EMA, setting up for a potential decline.

- A drawdown in price would result in another 2.89 million AXS slipping underwater, resulting in 94.4% of investors facing losses.

- The lack of action from Whales, holding 94% of the supply, is the main reason for dormant price action.

Axie Infinity price has been in a downtrend since the beginning of the year after marking the 2023 highs in late January. AXS could see some movement in the upward direction, but for the same to happen, one crucial cohort would need to change their stance from inactive to active. This cohort is the Whale addresses that have been dormant for nearly 17 months now.

Axie Infinity price close to new lows

Axie Infinity price is presently trading at a low of $4.47 after failing to breach the 50-day Exponential Moving Average (EMA). In doing so, the Relative Strength Index (RSI) also slipped to below the neutral line at 50.0, suggesting a bearish momentum could be building up. This would set off a further decline in the altcoin's price, pushing it to fall through the present year-to-date low of $4.13.

Not only would Axie Infinity price mark a new 2023 low, slipping below $4.00 but also fall back down below the downtrend line. This line has been breached only once, in mid-August.

AXS/USD 1-day chart

However, should it manage to bounce off the downtrend line as well as the $4.13 support line, Axie Infinity price might be able to prevent a steep fall. Furthermore, if the recovery momentum manages to push AXS above the resistance level marked at $4.84, it would invalidate the bearish thesis, opening the altcoin up to a two-month high.

The chances of a recovery are faint

At the moment, a slip towards the $4.13 support level can prove to be devastating to the users since nearly the entire supply of the altcoin is underwater. According to the Global In/Out of the Money (GIOM), about 2.89 million AXS worth nearly $13 million is vulnerable to facing losses.

According to the metric, this supply was bought at an average price of $4.52, with the lowest purchase noted at $4.39. A decline below this price point would send the entire supply underwater, resulting in an additional 1.59k addresses joining the cohort of loss-bearing investors.

Axie Infinity GIOM

Presently, about 93% of all AXS holders are far from profits, and the addition of another 1.59k addresses would bump up this ratio to 94.4%. But the chances of this happening interestingly sit in the hands of the very cohort that could also suffer these losses - Whales.

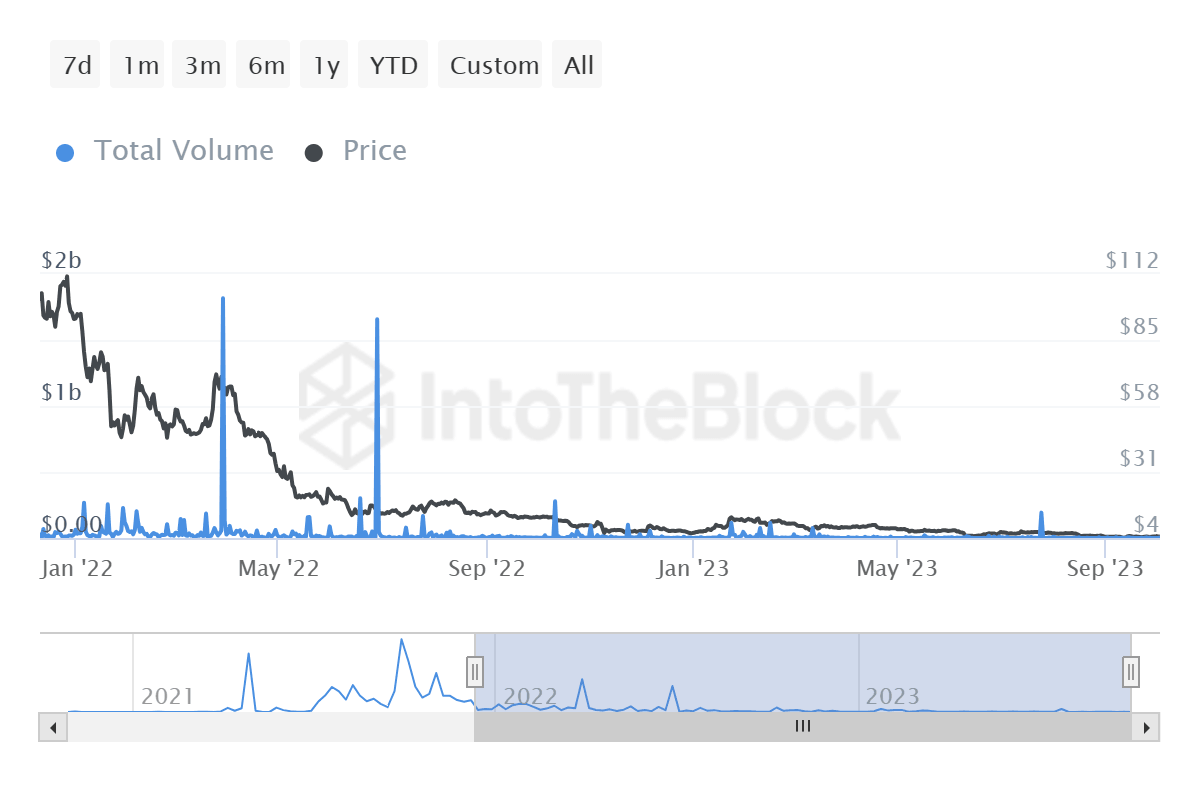

Whale addresses currently hold about 255 million AXS worth over $1 billion, representing 94.5% of the entire circulating supply. Thus, their actions have a considerable effect on the price, too. However, these investors have been sitting ducks for nearly 17 months now.

Their transaction volume has been averaging at less than $5 million since May 2022, with some spikes noted every now and then. These spikes have further disappeared since 2023 began, and for the past nine months, the average has dropped to $3 million.

Axie Infinity whale transaction volume

Since whales hold most of the supply, the lack of transactions from them is resulting in no recovery, as well as a consistent decline in price. If this continues, Axie Infinity price might end up forming new 2023 lows. Thus, investors looking to jump in on AXS must watch the whales' activity.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.