AVAX price would be able to reclaim its six-month-old losses only if it can breach this level

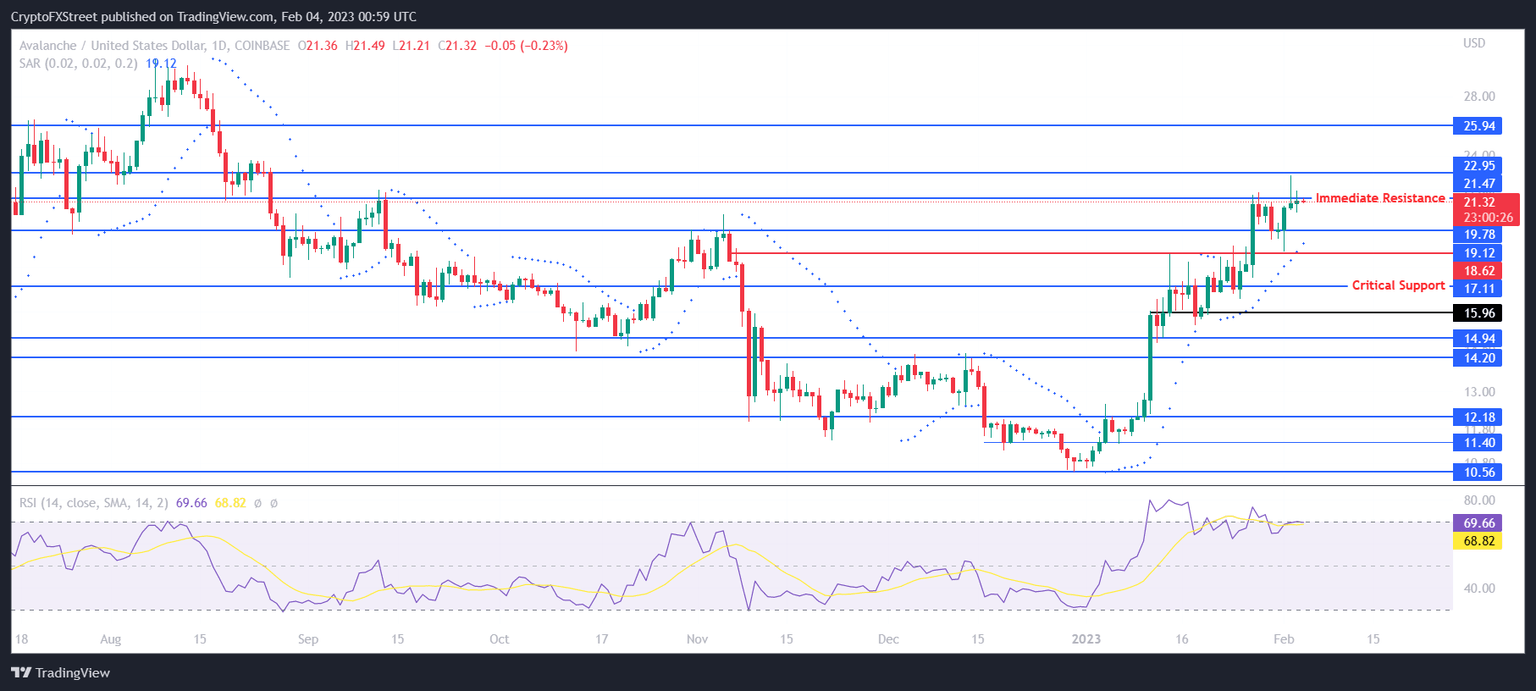

- AVAX's price is currently right at the cusp of breaching its immediate resistance at $21.47.

- If the altcoin flips $22.95 into a support floor, it could be able to rally on toward $25.94 and chart a 21% rally.

- Should the market lose its strength, AVAX would fall as well, potentially bringing the price to $17.11.

AVAX price made significant improvement in the last month, but the recent break in the uptrend is beginning to worry investors. How this could impact Avalanche is the same as the rest of the cryptocurrencies since there is no significant immediate development noted in the ecosystem that could alter the altcoin's trajectory.

AVAX price may not go anywhere

AVAX price is currently teetering at the immediate resistance level, trading at $21.40 at the time of writing. The altcoin would be able to flip the $21.47 resistance level into a support level if it manages to close above the same in the next 24 hours.

Generally, this is considered a positive sign as, following it, the altcoin gets the room it needs to rally further. At the moment, aiming at $22.95 and flipping it into a support floor would be ideal.

This is because, in order for the cryptocurrency to chart new highs, Avalanche will need to breach the resistance level at $25.94 as well. Doing so would create a concrete support floor at $22.95 and also help AVAX chart a 21% rally.

FTT/USD 1-day chart

However, the condition of the market must be taken into consideration as well. By the looks of the Relative Strength Index (RSI) is indicating that the cryptocurrency is scheduled for a cool down and not a rally. The presence around or above 70.0 is a sign of the cryptocurrency being overbought.

Thus if further cooldown takes precedence, the altcoin would remain consolidated between $21.47 and $19.78. But if the $19.78 support level is lost, the AVAX price would be in trouble as the only chance for it to bounce back is at $19.12 and $17.11.

The latter price level marks the critical support line. A daily close below this level would invalidate the bullish thesis, pushing the price to $15.96 and lower.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.