AVAX price to shed 17% as range tightens amid bearish onslaught

- AVAX price shows a tight consolidation inside a symmetrical triangle after a 25% crash.

- A breakdown of this range could result in a 17% crash to $15.75.

- A daily candlestick close above the $20.16 level will invalidate the bearish thesis for Avalanche.

AVAX price is taking a break from trending in one direction after the recent sell-off. Instead, the altcoin is consolidating, hinting at a potential downswing breakout.

AVAX price ready for more sell-off

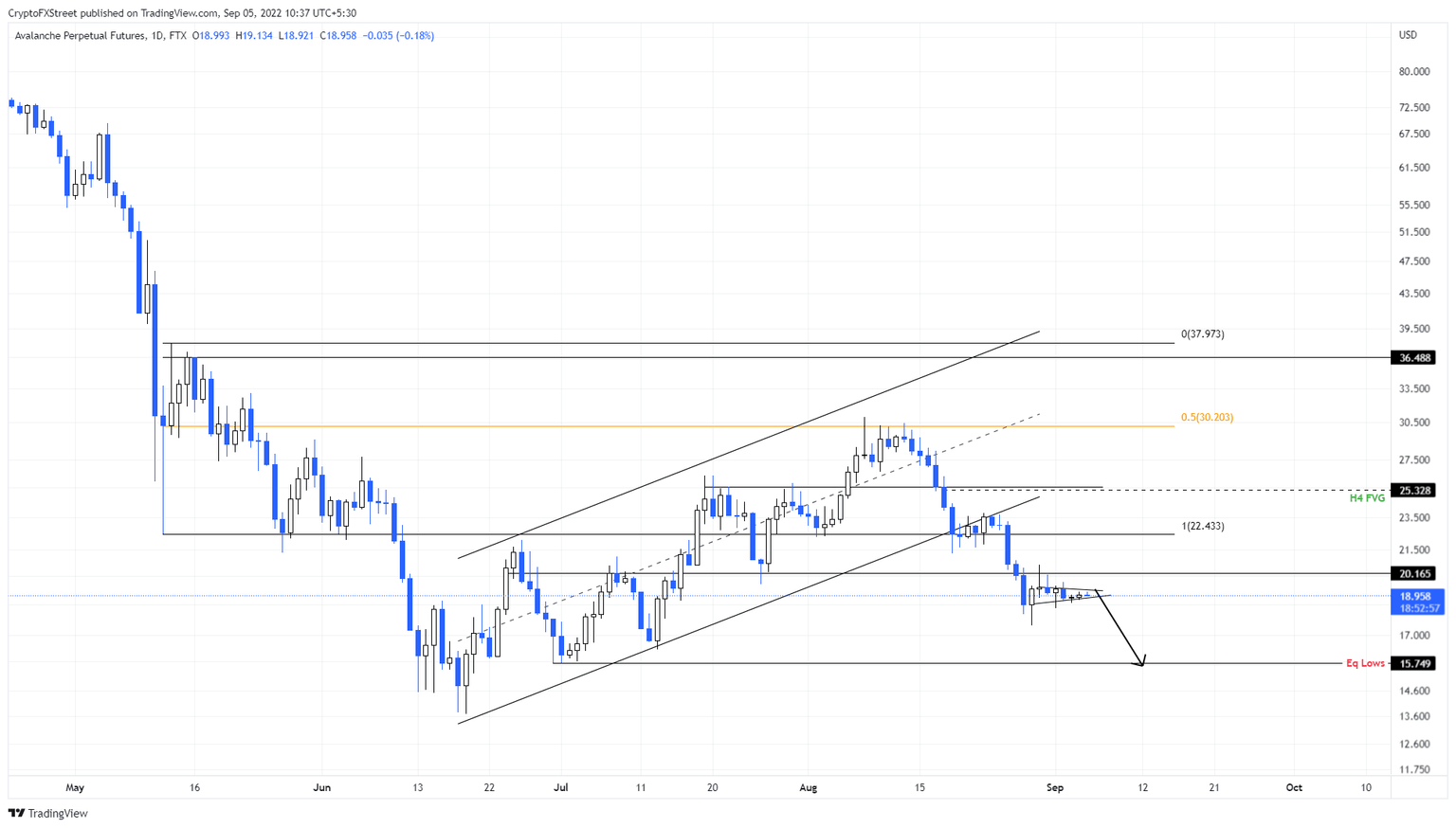

AVAX price breached the ascending parallel channel on August 19 but failed to recover. This bearish development led to a 26% crash, creating a swing low of $17.46. Since then, Avalanche has lost its directional bias and consolidated in a symmetrical triangle.

With Bitcoin price looking to sweep the recently created lows at $19,511, altcoins will follow the move. Moreover, for AVAX price, a breakdown of the symmetrical triangle could result in a 17% crash to $15.75, which is an equal low containing sell-stop liquidity resting below the consolidative formation.

Hence, investors should look for signs to short AVAX price to $15.75 in the near future. The first confirmation of the downtrend will arrive after the altcoin creates a lower low below the September 4 swing low at $18.70.

Beyond this, investors need to wait for a retest and rejection at the lower boundary of the symmetrical triangle.

AVAX/USDT 1-day chart

While things are looking bearish for AVAX price, a surge in buying pressure that pushes it to produce a daily candlestick close above $20.16 would dampen the bearish pressure. If bulls manage to flip this level into a support floor, it will invalidate the bearish outlook and trigger a potential rally to $22.43 and even $25.32.

Note:

The video attached below talks about a potential retracement for Bitcoin before a recovery rally. Due to altcoins' high correlation, BTC could provide signal that could help investors anticipate the downtrend in AVAX price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.