AVAX price eyes 22% crash after recent breakdown

- AVAX price has broken below an ascending parallel channel, hinting at a sell-off.

- Investors can expect a 22% crash to $17.58, but bulls could prematurely reverse the dip around the $20.16 barrier.

- A daily candlestick close above $25.47 will invalidate the bearish thesis for Avalanche.

AVAX price has denoted an end of its uptrend after nearly two months of up-only movement. This development comes after the recent Bitcoin price crash, which has also caused many altcoins to suffer.

AVAX price ready to nosedive

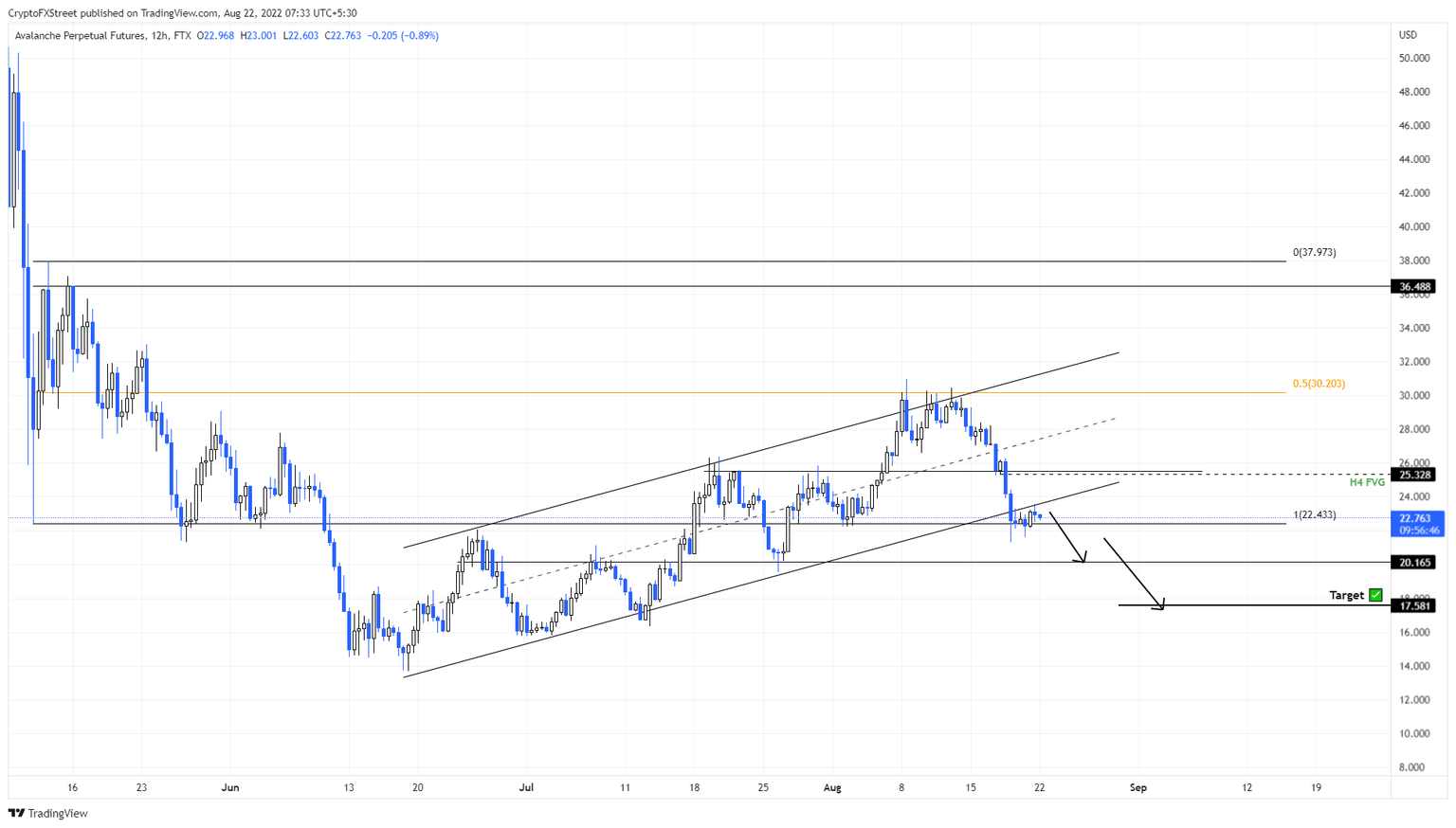

AVAX price racked up 126% in gains between June 19 and August 8. This massive run-up that set a swing high at $30.98 was in the form of higher highs and higher lows. Connecting trend lines to these swing points reveals an ascending parallel channel.

On August 18, AVAX price consolidated around the $25.47 support level for a moment before crashing nearly 20%. This nosedive pushed the altcoin to produce a bearish breakout of the ascending parallel channel.

Now, AVAX price hovers around the $22.43 support floor and could theoretically crash 22% to reach its target at $17.58. However, buyers at the $20.16 support floor could stop this sell-off prematurely and potentially trigger a reversal.

Another scenario that market participants need to be mindful of is the throwback to the four-hour fair value gap at $25.32 before a crash to $20.16 or $17.58. In such a case, the short-sellers would be at an advantage as the potential gain would go from 24% to 30%.

AVAX/USDT 12-hour chart

On the other hand, if AVAX price flips the $25.47 resistance level, it will not only recover inside the ascending parallel channel but will also invalidate the bearish thesis. In such a case, the re-ignition of the rally could see Avalanche revisit the $30.20

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.