AVAX price nears March lows following Bitcoin's lead as Cortina upgrade hype dissipates

- AVAX price trading under $15 is close to the range low of $14.4 after failing to breach 2023 highs at $21.5 for the second time.

- Avalanche active addresses noted a severe decline of 50% in the span of ten days as Cortina upgrade fanfare waned.

- AVAX shares a correlation of 0.71 with Bitcoin, making recovery difficult given BTC fell below $27,500 this week.

AVAX price, similar to all the other altcoins in the crypto market, is bound by the broader market cues, which have been rather bearish this month. Nearly halfway through the second quarter, the cryptocurrency has wiped out most of the growth it noted in the last four months. Plus, the lack of investors' support seems to be making it harder to mark a recovery.

AVAX price back to key support level

AVAX price noted another red candlestick on May 11 after the altcoin slipped by 3.74% during the intra-day trading hours to change hands at $14.9. Declining for the fourth time in a week, the altcoin has plunged by 14% in the span of five days. Consequently, the cryptocurrency has inched closer to the March low of $14.4, which is also the range low for Avalanche.

Acting as the critical support level, this price point has been the range low for the altcoin, with $21.3 acting as the range high. Consolidated within this zone since January this year, the cryptocurrency fell back down after failing to breach the resistance level.

AVAX/USD 1-day chart

However, looking at the broader market cues, a bearish outlook seems highly probable since the leader of the cryptocurrencies, Bitcoin itself, is in the red right now.

The US Bureau of Labor Statistics (BLS), on Wednesday, reported that the inflation rate declined to 4.9% on a yearly basis in April from 5% in March. Following the release of the Consumer Price Index (CPI) data, Bitcoin price whiplashed initially to $26,800 and $28,300, although at the time of writing, BTC stands at $27,150.

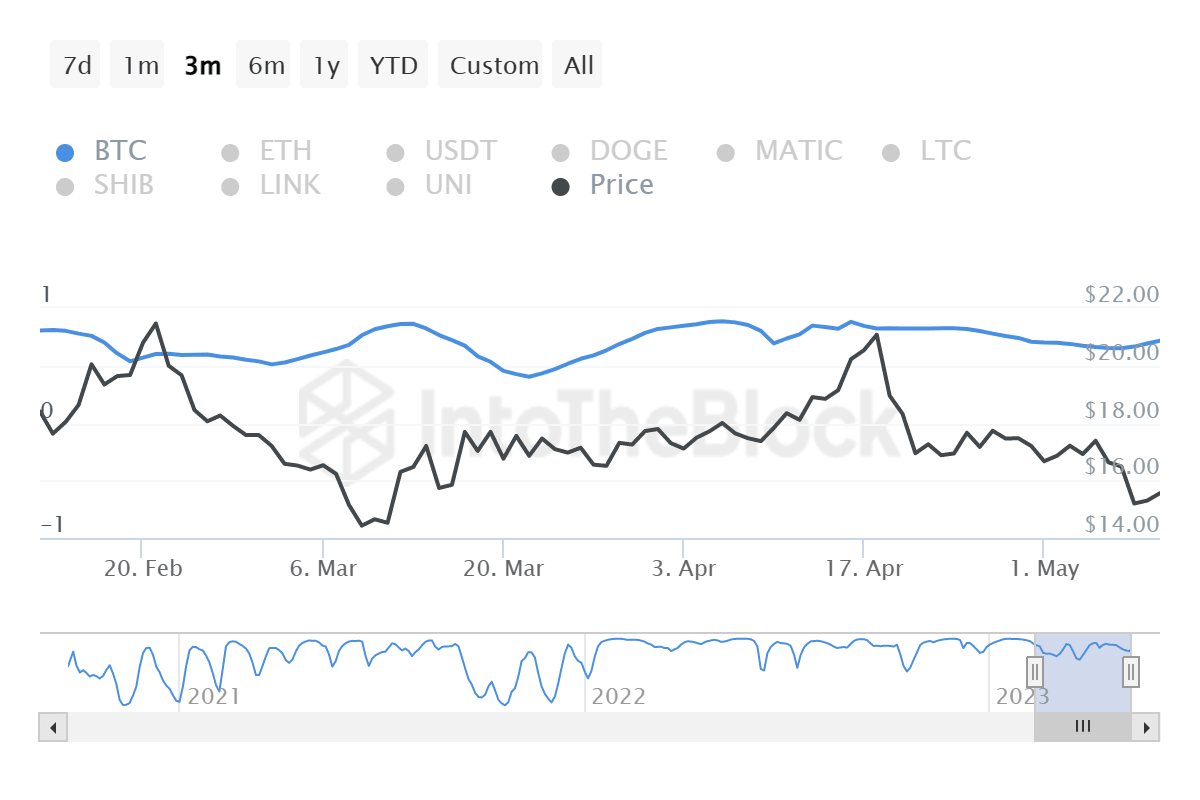

This is concerning for AVAX price too, since the altcoin shares a correlation of 0.71 with Bitcoin. Thus, it is bound to follow the biggest cryptocurrency's lead. To make this worse, external market developments are also losing the impact they had on the price action, leaving Avalanche's investors disinterested.

Avalanche correlation with Bitcoin

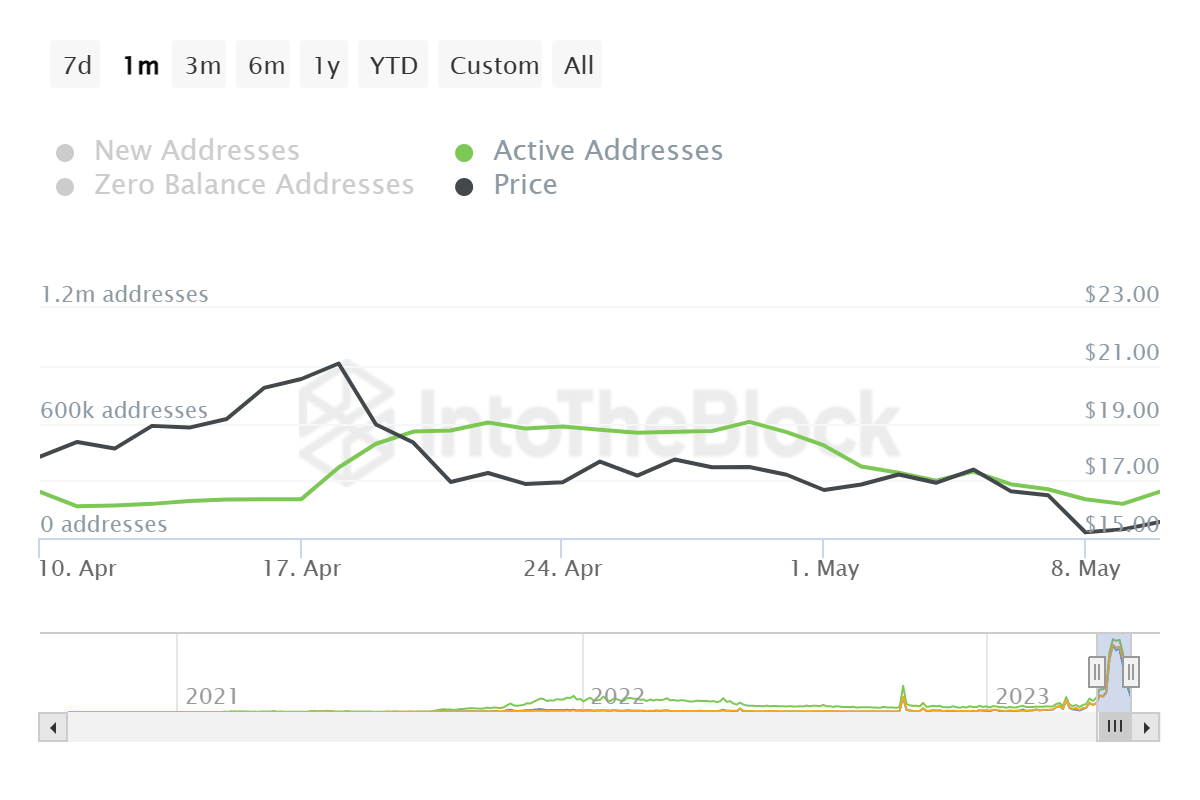

The last critical development Avalanche noted was the Cortina upgrade, which went live on April 25. In anticipation of this upgrade, investors began transacting on the network in large numbers bringing participation to an all-time high. However, this was short-lived as over the last ten days, active addresses have declined by more than 50%.

The number of addresses participating on-chain stood at 483,000 towards the end of April, and at the time of writing, these investors came down to just 241,000.

High interest and activity from AVAX holders could have countered the increasing bearishness, but the lack of same could further the ongoing decline and even push Avalanche below the $14.4 mark exposing the $10 price area.

Avalanche active addresses

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.