Avalanche Price Prediction: AVAX could rally 40% if it overcomes this barrier

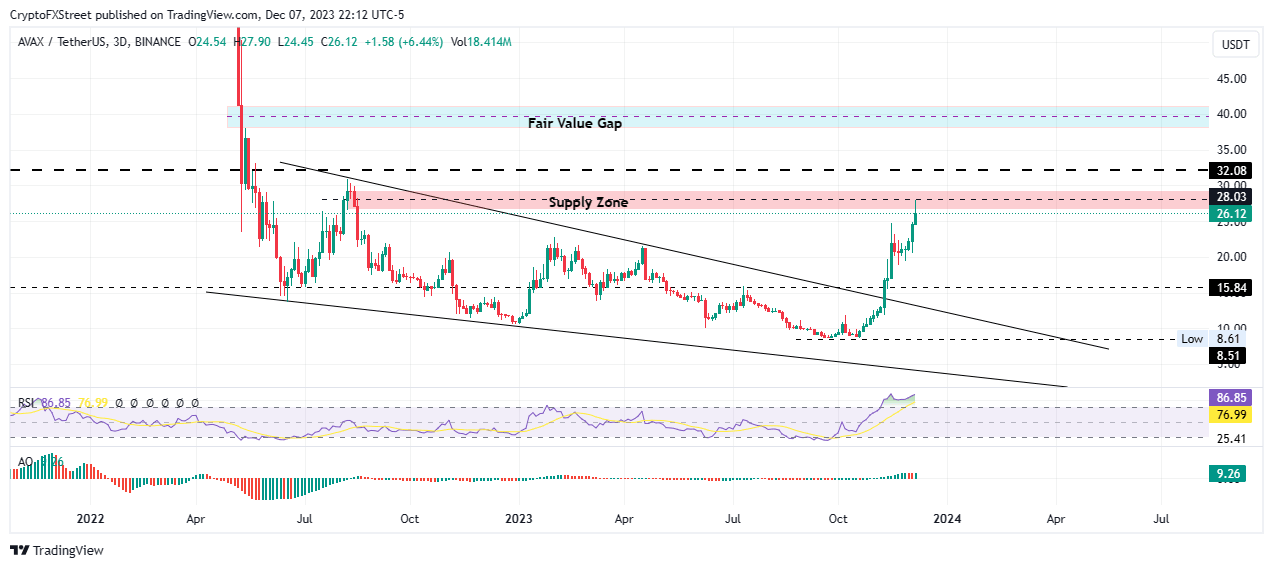

- Avalanche price is stalling after a 236% climb as it confronts a formidable supply barrier.

- AVAX could extend the climb 40% to the FVG at $38.12 if it manages to overcome the $38.03 mean threshold.

- The bullish thesis will be invalidated once the price breaks and closes below the $15.84 support level.

Avalanche (AVAX) price is trading with a bullish bias after activating a bullish technical formation, with prospects for more gains depending on how the bulls play their hand going forward.

Also Read: Avalanche bulls set the stage to double

Avalanche price momentum running out of steam, but…

Avalanche (AVAX) price is up 236% since the market turned bullish, but the uptrend could be running out of steam as the altcoin faces a supply barrier extending from $26.56 to $29.34. As of 3:30 a.m. GMT time, it is trading for $26.12 with prospects for more gains amid rising momentum.

The Rising momentum is seen with the Relative Strength Index (RSI), which remains northbound despite AVAX being overbought. The Awesome Oscillator (AO) indicator is also bullish, moving in the positive territory with green histogram bars pronounced.

Increased buying pressure above current levels could see Avalanche price overcome the midline of the supply zone at $28.08, with a decisive break and close above it confirming the continuation of the trend. Further north, the gains could extend past the $30.00 psychological level, or higher, tagging the $32.08 resistance level.

In a highly bullish case, Avalanche price could abide by the effective pull of the fair value gap (FVG), which extends from $38.12 to $41.07. A break and close above the midline of this order block at $40.00 would confirm the extension north. Such a move would constitute a 40% climb above current levels.

AVAX/USDT 3-day chart

On the flip side, a rejection from the supply zone could send Avalanche price south, possibly pulling to the $20.00 psychological level. In the dire case, the rejection could send AVAX price down to lose the $15.65 support, with a decisive candlestick close below this level invalidating the bullish thesis.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.