AVAX Price Forecast: Avalanche bulls set the stage to double

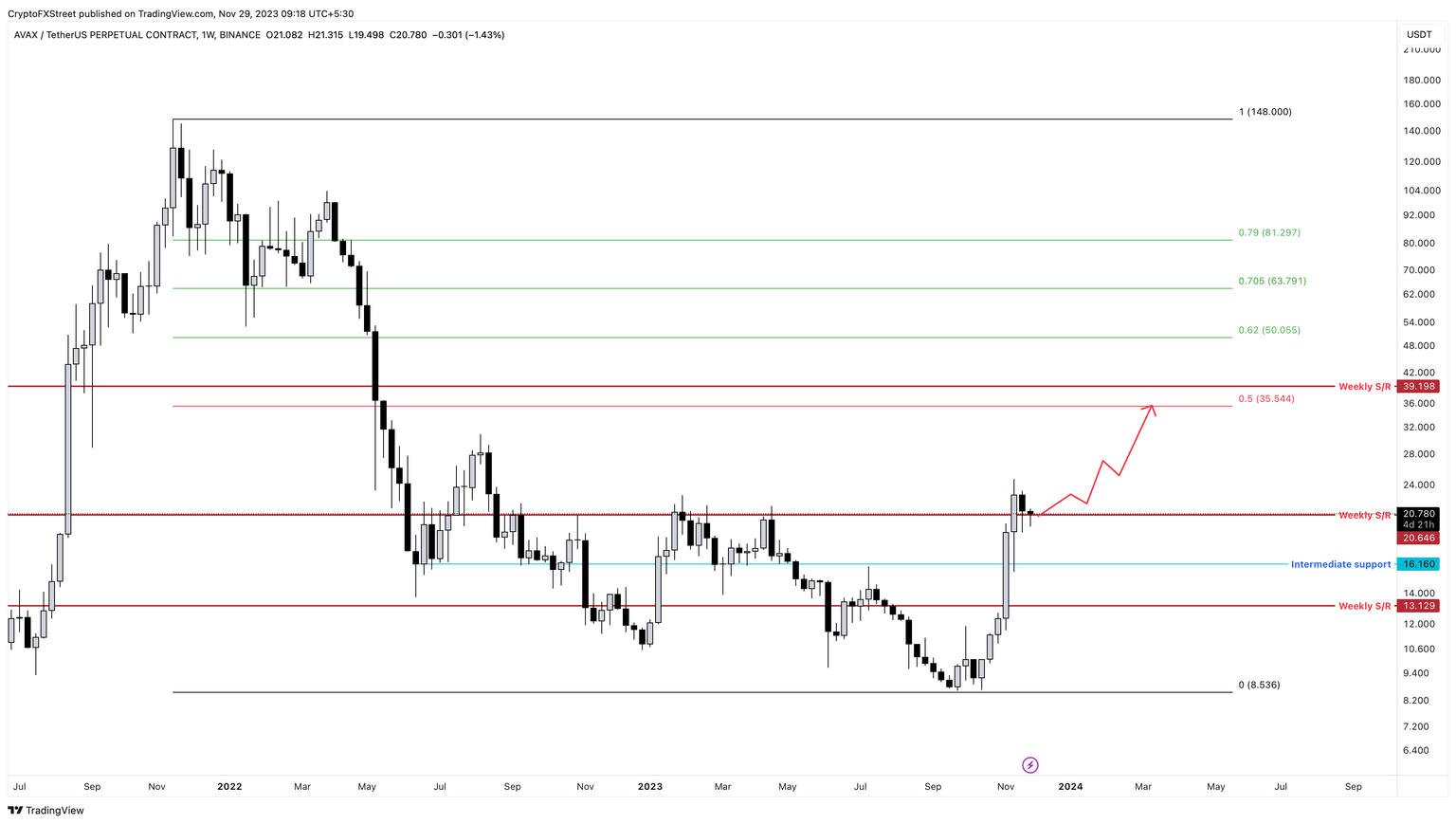

- AVAX price knocks on $20.65, which is a critical barrier to watch on the weekly time frame.

- A flip of this hurdle into a support floor could catalyze a 70% rally to $35.44.

- In some cases, AVAX could extend higher and tag the weekly resistance level at roughly $40.

- Invalidation of the bullish thesis will occur if Avalanche bulls fail to defend the weekly support level at $20.65.

Avalanche (AVAX) price is at a significantly important level from a high time frame point of view. Clearing this hurdle could allow the altcoin to inflate significantly, but a rejection could prove costly for AVAX holders.

Also read: Why Solana (SOL), Avalanche (AVAX), and Chainlink (LINK) are the top cryptos to keep an eye on

AVAX price ready to move higher

AVAX price rallied a whopping 186% from September 25 to November 13. This impressive upswing produced the first weekly candlestick close above the $20.65 resistance level. This hurdle has rejected Avalanche bulls’ momentum for more than a year, leading to massive corrections.

But the recent development breathes hope into AVAX holders, signaling that the uptrend is here to stay, especially if Avalanche price manages to retest and stay above $20.65. In such a case, AVAX price could trigger a quick 70% rally to retest $35.44, which is the midpoint of the 94% bear market rally witnessed between November 2021 and September 2023.

In case of a stronger bullish momentum, AVAX price could extend higher and tag the weekly resistance level at $35.54, which could constitute an 87% gain from the current price level of $20.85.

Ideally, this rally continues above $35.54 and tags the $40 psychological level, which could mean a 100% rally.

AVAX/USDT 1-week chart

While the bullish outlook for AVAX price makes logical sense, a breakdown or rejection around the $20.65 weekly support level will invalidate the bullish thesis. This development could delay the uptrend and trigger a 22% correction to the immediate support level at $16.16.

Read more: Avalanche price faces selling pressure from $213 million AVAX unlock

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.