Autopsy of DeFi reveals that decentralized finance is a pipe dream

- Decentralized finance once again criticized for being too centralized.

- The majority of the projects are controlled by the developers.

- Users have an illusion of transparency and no censorship, but this is not the case.

Where's the beef?

Decentralized finance, or DeFi, refers to blockchain projects based on smart contract technology that offer people financial services not controlled by a third-party authority. To put it simply, it is run automatically, and no one can stop the protocol, roll back or suspend transactions, or otherwise interfere with it.

Savings, investments, payments, loans, margin trading, insurance - you name it - virtually any service offered by a traditional financial system can be taken on a smart contract and transformed into a Defi application.

The idea behind the system is to make the financial services more efficient, affordable, and, above all means, transparent. However, as ever as it is usually is, easier said than done.

Vulnerabilities and other tech issues aside, all those decentralized services are not so decentralized after all. As long as our artificial intelligence is not actually intelligent, there will always be a human behind any machine or protocol who can pull a stop switch in case of an emergency.

Where's the catch?

The highest decentralization level implies that every component of a DeFi protocol, including platform development, and governance is decentralized. However, no existing DeFi protocol satisfies these criteria in full.

The recent KuCoin hacking incident allowed us to peep into the DeFi backstage to see that decentralization can be and is falsified in many cases.

When several decentralized projects like Ampleforth (AMPL) and Ocean Protocol (OCEAN) rolled back transactions and tweaked their smart contracts to stop the hacker, they effectively proved that there IS an authority after all that can step up and exercise censorship when they deem it necessary.

Who controls the stop switch?

"Jeff Bezos could shut down most of these Ethereum-based "DeFi" apps by simply shutting off AWS."

A prominent hardcore Bitcoiner and a founder of Morgan Geek Digital Antony Pompliano, aka Pomp, expressed this view recently on Twitter.

The provocative statement triggered many discussions with; however, considering that Amazon Web Services have the largest share of the cloud services market in 2020, this argument stands to reason.

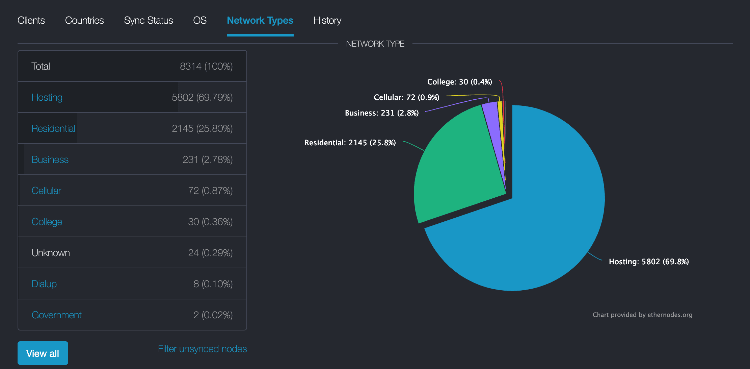

According to the Ethereum mainnet statistics, nearly 70% of ETH nodes are hosted.

Ethereum mainnet data

Source: Etherenodes.org

However, as Camila Russo from Defiant news noted, it does not mean they all are using the same service. Actually, Amazon servers host 37% of the total.

Who controls the money?

Anyway, Bezos's ill will is probably the least likely threat of all. Maybe someday he decides to pull the rug from the whole Internet by switching off AWS, but the chances are slim.

On the contrary, exit scams are real, and the industry has no shortage of examples when the creators of the DeFi protocols walk off into the sunset with users' coins or influence the token price.

YFDEX.Finance (YFDEX), a supposed liquidity mining pool within the decentralized finance ecosystem, is the perfect example. The creators ran a massive promotion campaign in social media and disappeared into thin air with $20 million worth of investors' funds two days after launch.

A popular crypto community influencer CryptoWhale tweeted about the scam.

Another day, another DeFi scam!

— CryptoWhale (@CryptoWhale) September 9, 2020

After promoting themselves on Twitter for 2 whole days, Yfdexf has taken a total of $20M of Investors funds in their recent exit scam.

99.99% of DeFi Tokens are scams, and will go this route. Please be very careful if you are heavily Invested. pic.twitter.com/WEkg7Sqo9i

The expert believes that the overwhelming majority of the DeFi projects are 100% controlled by the owners who can eventually freeze the funds, disable protocols, and steal all the money. Replying to the Pomp's tweet, e called them Delusional Finance.

Who controls the code?

As the above-mentioned example with KuCoin showed, in many cases, the developers control the code and can twist and tweak it when they deem necessary. The community can hardly influence this process and wake up to changed the terms and conditions of the smart contract one day.

That's not the case with all DeFi protocols. Hayden Adams, a founder of Uniswap, claims that the project is based on the immutable smart contract on Ethereum, and no one can amend it or turn it off.

However, even in the case of Uniswap, the team behind the project matters. As Udi Wertheimer noted, people were buying UNI and using the service because they believed in the group and their ability to deliver the updates.

This is totally obvious, but toxic ETH maxis will happily ignore that.

— Udi Wertheimer (@udiWertheimer) October 8, 2020

When anyone’s buying $UNI they do that because they believe in the team to deliver the next Uniswap version, to market it, etc

But sure, let’s play pretend

Who controls the freedom?

And last but not least, all DeFi projects are vulnerable to legal actions against their founders. Adam Cochran recently explained the issue.

The expert emphasized that DeFi protocols were not entirely outside the reach of the authorities. They can shut down the developers, seize domain names and hosting services. If this happens, users are likely to run from the platform, eventually killing it.

Conclusions

Decentralized finances may be a promising idea, but most of the projects fail to live up to the name of being controlled by individuals or groups of people. All existing DeFi projects are centralized to a different extend.

Unlike the flagship cryptocurrency, Bitcoin, they are dependant on the people who create code, promote, and support them. As a result, they can be closed, destroyed, scammed, changed, and abandoned, leaving users holding the bag.

Author

Tanya Abrosimova

Independent Analyst