Arbitrum price declines 11% as final Security Council voting round approaches

- Arbitrum price fell below the $0.90 mark, inching closer to the 2023 low of $0.76.

- The Arbitrum Security Council nominations were completed this week, and the final round of voting is set to begin on October 6.

- If six of the 18 final-round nominees aren't selected, the Security Council election will be delayed by a week.

Arbitrum price moves often depend on the broader market cues; however, for the past couple of days, a major external factor has come into play. The ongoing Arbitrum Security Council Elections are preparing for the final round, which is interestingly bearing a negative impact on the altcoin.

Arbitrum Security Council Elections underway

Arbitrum specified the Security Council and the elections pertaining to establishing it in the DAO constitution and is now working towards turning it into a reality. The ongoing elections, which started with the first voting round towards the end of September, are preparing for the second voting round.

The previous round’s voting resulted in 18 nominees being qualified for the round 2 voting, which will begin on October 6. If the results of the round lead to the selection of just the necessary number of candidates, the elections will likely finish.

However, given the existing number of nominees, it is possible that the second and final round may not bear six candidates for joining the Security Council. This would lead to the execution of the third phase of the elections, wherein another voting round will be conducted to select the six nominees.

Arbitrum Security Council Round 2 Nominees

This could push the end of the elections to mid-October or further since the voters would be given more than seven days to cast their votes. The impact on Abrbitrum price of the same can be concerning.

Arbitrum price decline continues

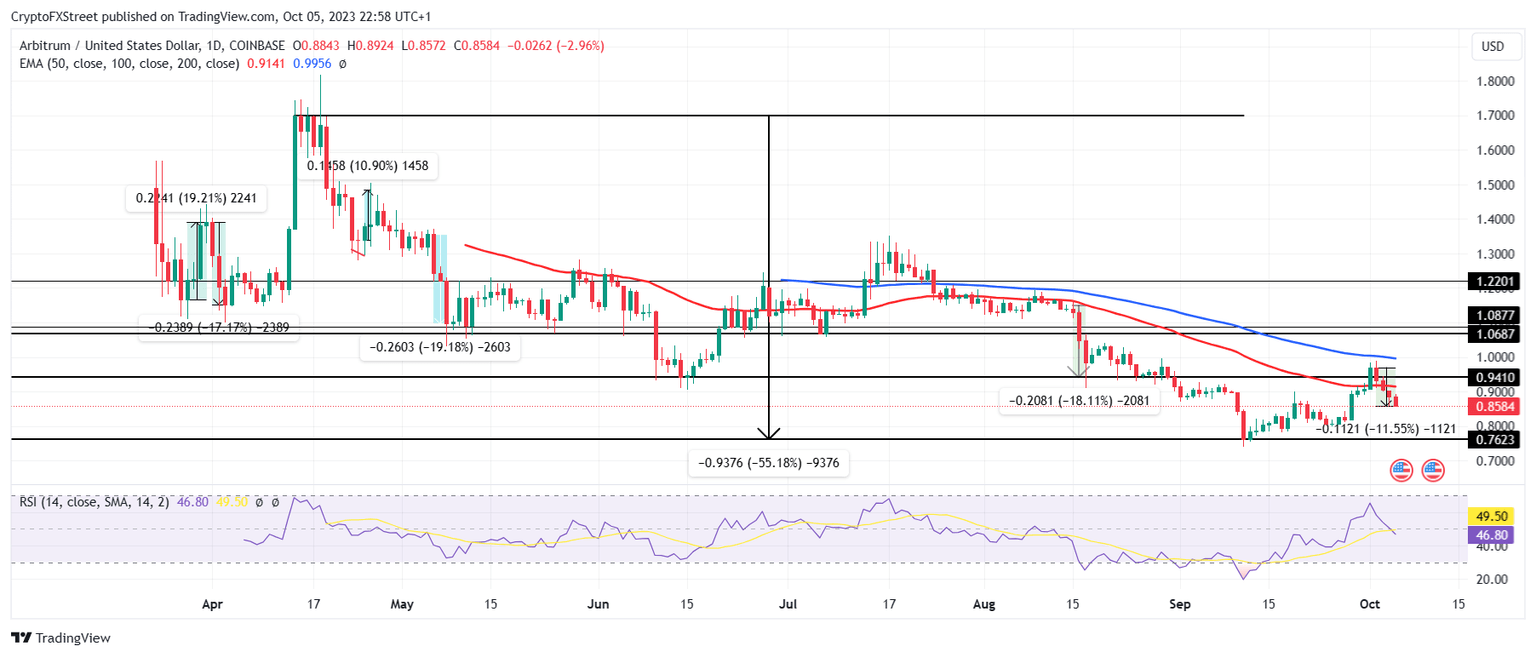

Arbitrum price has noted consistent red candlesticks for the past four days as the voting for the second round inched closer. Down by 11.5% in this duration, ARB slipped below the $0.90 mark and is currently exchanging hands at $0.85, losing the 50-day Exponential Moving Average (EMA).

The Relative Strength Index (RSI) clearly suggests a bearish momentum is building up as the indicator slipped below the neutral line at 50.0. Thus, if the bearishness extends, ARB could end up slipping to the year-to-date lows of $0.76, and the extension of Security Council elections could even lead to the altcoin marking a fresh 2023 low.

ARB/USD 1-day chart

However, if the round voting ends with a selection of six candidates for the council, the cryptocurrency could not have some bullishness. This would initiate recovery, potentially pushing Arbitrum price to flip the $0.94 barrier into a support floor. This bullish counter would not only invalidate the bearish thesis but also turn the 50-day EMA into a support line, which might push ARB beyond $1.00.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.