Aptos Price Forecast: Growing token adoption could break APT token's fall as buyer momentum grows

- Aptos price is down almost 70% since the January high of $18.90 amid a bearish trend.

- As token adoption and network activity grow, APT appears to have found support, potentially hinging for an upside move.

- While a break above the $9.17 level would radiate an uptrend, a fall below $5.26 would disgorge the optimism.

Aptos (APT) price has steadily descended since the beginning of the year amid growing volatility. Akin to the broader market, the token continues to suffer the brunt of a prolonged bear market and overall fear, uncertainty, and doubt (FUD).

Aptos price could be ready for a trend reversal

Aptos (APT) price is down a staggering 70% since the year began, consolidating within a descending parallel channel characterized by lower highs and lower lows. This technical formation indicates a bearish continuation of the overall trend. However, it can also be used to identify possible reversals depending on how bulls play their hand.

Aptos price, currently at $6.20, appears to have secured support after testing the $5.26 level during the June 10 trading session. With the Relative Strength Index (RSI) tipping upward, bullish momentum is rising, which could bode well for the APT token.

A sustained increase in buying pressure could see Aptos price ascend to confront the upper boundary of the falling parallel channel. A decisive break above the $9.17 resistance level could mark the altcoin's escape from the bearish governing pattern, suggesting the beginning of a northbound move.

Notably, the Awesome Oscillators (AO) were begging to tip in favor of the bulls, indicated by the green histogram. This points to the growing effort among bulls. If nurtured, it could also be an enabler for Aptos price.

APT/USDT 1-Day Chart

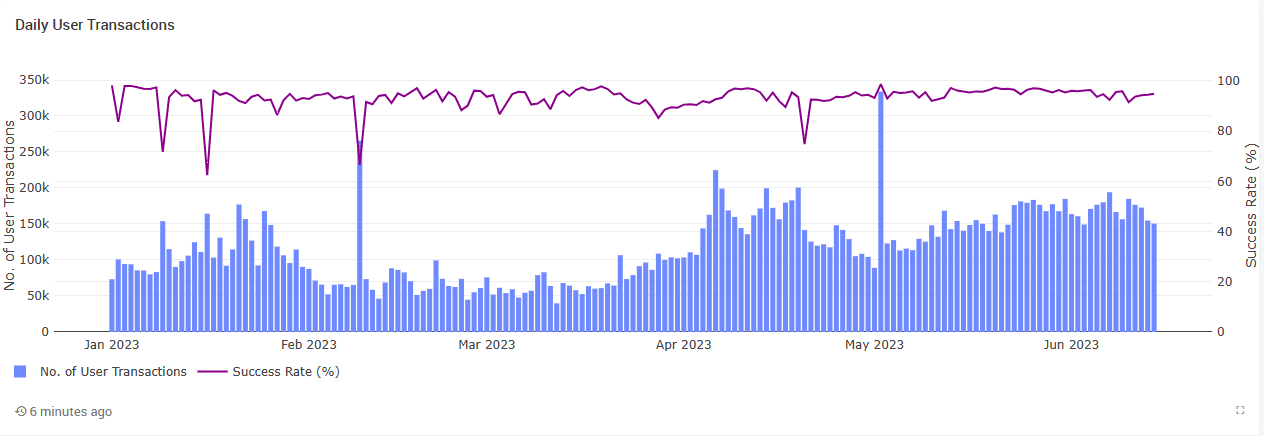

On-chain metrics from Aptos Analytics

According to data from Aptos Analytics, an aggregator that gives a clear view of information on the Aptos network, the ecosystem is recording notable growth. Specifically, there is steady but sustained growth in daily user transactions, increasing by a remarkable 278% between March 12 and June 16.

This metric helps to measure the total number of unique users who engage with the asset daily. It is also used to measure the token's success as the number of daily engaged users is ideally a measure of its value.

Based on the remarkable growth highlighted above, the boundless creativity and innovation in the APT network could bode well for Aptos price.

Despite the broad uncertainty in the industry, the steady growth in daily active transactions show Aptos investors focus on the protocol's deeper fundamentals to draw positivity. This is echoed by recent actions by Aptos developers to consolidate their efforts and drive the security and scalability of the protocol to a new level not seen in a Layer-1 (L1)protocol.

1, The number of active modules on Aptos has experienced a significant surge, increasing by a remarkable 1.5x since January 2023 This remarkable growth showcases the boundless creativity and innovation flourishing within our platform.

— Aptscan.ai (@aptscan_ai) June 14, 2023

Explore now https://t.co/D2VZsOBeHS pic.twitter.com/AqzEhEEjvv

For the layperson, Aptscan.ai explains that each active module (blue) represented above is a unique solution or functionality, contributing to the diverse applications available to the protocol's vibrant user community."

Nevertheless, cognizant of the AO indicator's position in the negative zone and the price strength of the RSI below 50, the odds still favor the bears. Therefore, an increase in selling pressure could see the altcoin fall below the $5.26 support level, potentially leading to a continued consolidation within the bearish technical pattern. Such a move could see the token retest the $3.12 support floor.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.