ApeCoin price recovery rally threatened, $16.68 million worth APE tokens due to flood markets in cliff unlock

- ApeCoin price is on a recovery rally, recording almost 10% in gains over the last five days.

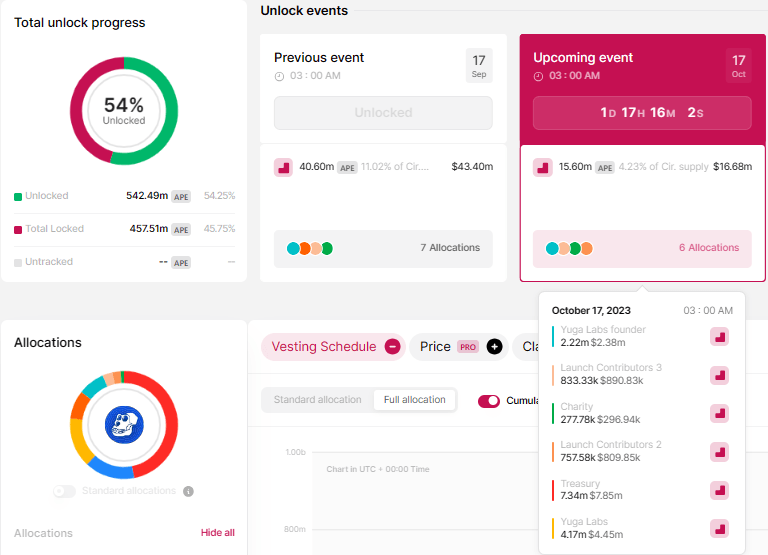

- 15.6 million APE tokens worth $16.68M will be unlocked on October 17, with some going to launch contributors or investors.

- The altcoin could experience some volatility, potentially derailing the recovery rally.

- A break and close above the $1.253 level would confirm the uptrend.

ApeCoin (APE) price has been bullish over the last week, recording high highs as part of a recovery rally. It comes after a steep downtrend beginning early October, and another steeper one that began in mid-August.

Also Read: ApeCoin holders oppose proposal to spend $12.1 million worth of APE for NFT series

ApeCoin price nurtures recovery rally

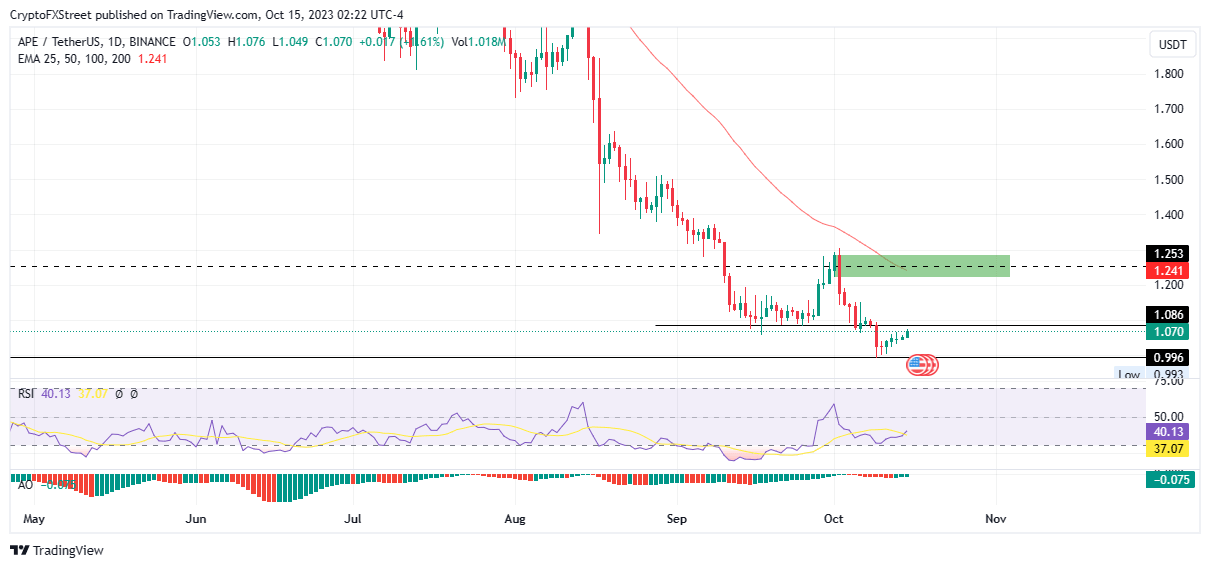

ApeCoin (APE) price is up 8% in the last week to the current price of $1.070. The price action over these past several days, characterized by higher highs culminates in a recovery rally that could see the altcoin vindicated from underneath the foothold of the $1.086 resistance level.

With the Relative Strength Index (RSI) northbound, momentum is rising, corroborated by the green histogram bars of the Awesome Oscillator (AO). A buy signal has also been executed, with the RSI crossing above the signal line. Nevertheless, the position of the RSI still under the 50 midline and the AO still in the negative zone shows that the odds still favor the bears.

With this outlook, chances that the recovery rally is premature remain high and ApeCoin price could face a rejection from the $1.086 resistance level. The ensuing selling pressure could send APE back to the support floor at $0.996, potentially breaking below this to tag the $0.993 range low.

APE/USDT 1-day chart

Meanwhile, the ApeCoin ecosystem has a cliff token unlock scheduled for October 17, two days out, which will see 15.60 million APE tokens worth $16.68 million flood the market in a cliff unlock. The tokens will be allocated to the Yuga Labs ecosystem and its founder, charity, treasury, and most interestingly, to the launch contributors. Launch contributors are basically the early investors, who participated in the token reaching its soft cap, the minimum amount raised before a token is launched. This cohort of community members is likely to sell for some quick profit.

The proceeding selling pressure adds to the downside potential that could see ApeCoin price correct from its ongoing recovery rally.

APE Token Unlocks

Conversely, increased seller momentum above current levels could see ApeCoin price breach the $1.086 resistance level, potentially extending to the supply zone extending from $1.220 to $1.289. A decisive move above the midline of this order block at $1.253 would confirm the uptrend.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.