Aave price could rise 7% as AAVE community approves ABE Governance V3 activation

- Aave price is on a recovery rally steered by tailwinds from successful voting on the ABE Governance V3.

- AAVE could rise 7% to clear the $105.40 resistance level amid rising momentum and an activated buy signal.

- The bullish thesis will be invalidated once the price breaks and closes below the $80.00 support level.

Aave (AAVE) price is on course to recover the ground lost beginning early December after the decentralized finance (DeFi) token’s price was rejected from a barricade that has proved formidable time and again. As the token makes another attempt north, new bullish fundamentals could make the cause a success.

Also Read: AAVE price likely on the brink of bullish breakout according to on-chain metrics

AAVE community passes ABE Governance V3 activation

The AAVE community has unanimously voted in favor of the ABE governance V3 activation, which proposes the migration of the Aave Governance V2.5 to V3. With all permissions transferred to V3, all required smart contract upgrades will be executed as well as the other miscellaneous preparations. The vote also activates the Aave Robot systems as a requirement for optimal function of Governance V3.

— Aave Labs (@aave) December 14, 2023

With V3 comes the next model of the Aave governance smart contracts systems, which controls the entire Aave ecosystem in a completely decentralized nature.

Aave price eyes 7% gains as AAVE community unanimously votes in favor of V3

Aave price shows strength after finding support at the demand zone extending from $83.38 to $90.24. Buyer momentum from this order block has already sent AAVE market value up 13% with the potential for more gains as the Relative Strength Index (RSI) has already activated a buy signal when it crossed above the signal line (yellow band).

Every time the RSI crossed above the signal line, the price reacted with a strong move north. If history should repeat, Aave price could extend north, making a 7% climb to test the $105.24 resistance level.

Increased buying pressure above current levels could see Aave price flip this barrier into a support floor before collecting the sell-side liquidity residing above it. In a highly bullish case, it could extend even higher, potentially going as far as to clear the $110.00 range high and recording a new range high.

AAVE/USDT 1-day chart

On-chain metrics to support Aave price bullish outlook

On-chain metric from behavior analysis tool Santiment shows a spike in daily active addresses. It shows more unique addresses and therefore increasing crowd interaction as traders look to engage with AAVE.

There is also a noticeable spike in active stablecoin deposits, pointing to new money coming into the AAVE market, accentuating the bullish outlook.

AAVE Santiment Active stablecoin deposits, daily active addresses

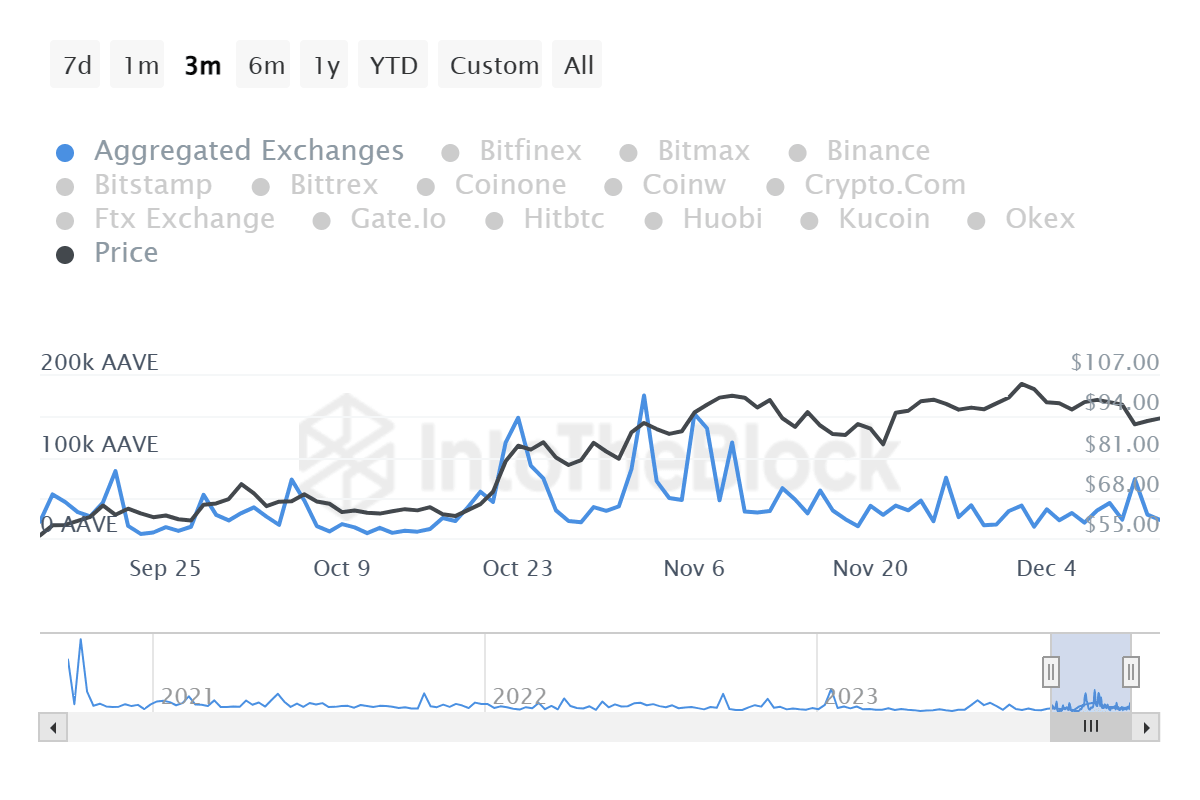

Elsewhere, on-chain aggregator IntoTheBlock’s inflow volume metric shows that the volume of AAVE tokens flowing into centralized exchanges has been reducing for the past three days, moving from 72,490 AAVE tokens on December 11 to 22,420 AAVE tokens on December 13. This constitutes a 69% drop in 48 hours and shows that interest in selling AAVE tokens continues to reduce.

AAVE inflow volume

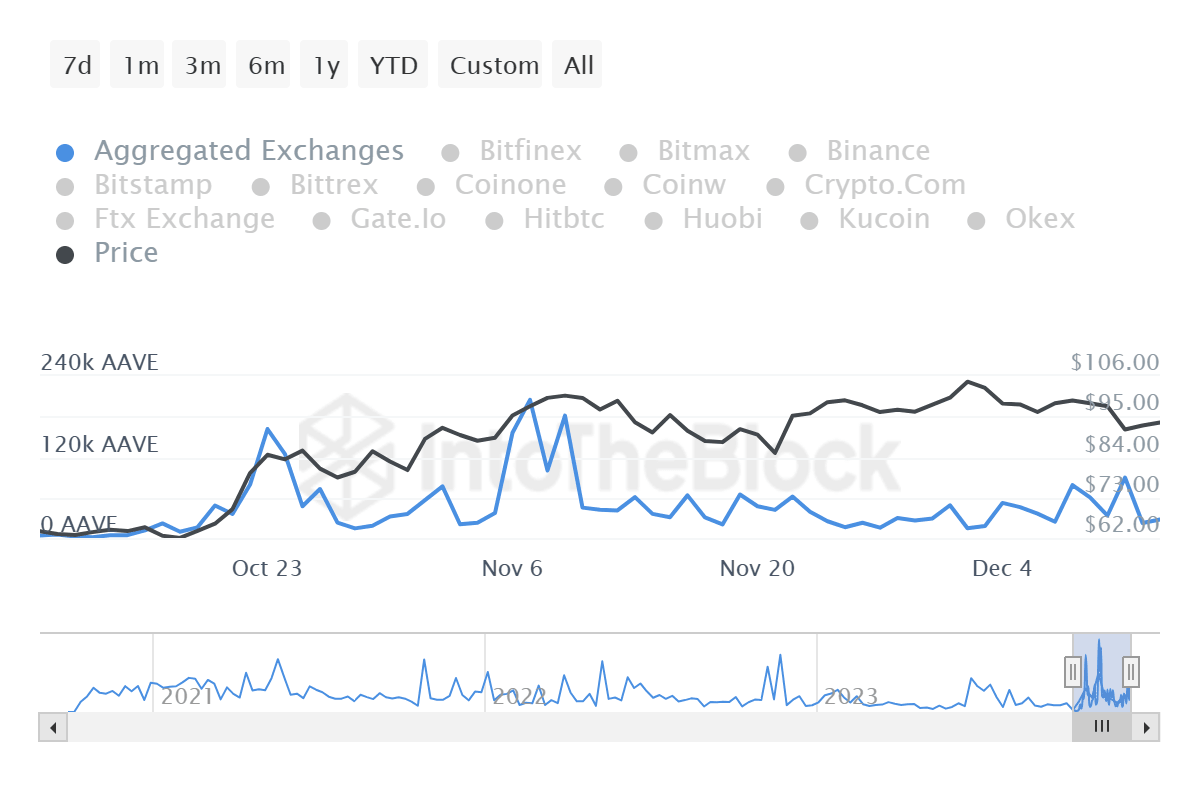

On the other hand, AAVE outflow volume has increased 23% in the same time frame, moving from 22,250 to 27,350 AAVE tokens as holders transfer their funds to self-custody.

AAVE outflow volume

Notably, moving tokens to exchanges always signals the intention to sell, which is bearish, while moving them out suggests an intention to hold, which effectively reduces selling pressure on the price.

On the flip side, if investors cash in on the 13% gain made so far, Aave price could pull south, falling back into the demand zone. If this order block fails to hold as support, AAVE could slip through to test the 80.00 psychological level. Such a move would constitute a 20% drop below current levels.

Investors looking to short Aave should watch for a decisive candlestick close below the midline of the demand zone at $86.81, which would confirm the continuation of the downtrend.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B21.47.37%2C%252014%2520Dec%2C%25202023%5D-638381787744423495.png&w=1536&q=95)