SushiSwap price takes the lead in the crypto market rebound as SUSHI whales go into buying spree

- Sushi price is up by 27% in the past 24 hours taking the lead despite the recent market sell-off.

- The digital asset aims for another leg up towards $8 as whales continue to accumulate.

Sushi has established a massive uptrend since November 2020 reaching a new all-time high at $7.79 on January 17, 2021, ignoring the first two days of volatile trading. The digital asset had a major 33% pullback but seems to be ready to resume the uptrend.

SushiSwap price on its way to $8 as whales keep accumulating

Despite Sushi price experiencing new all-time highs, whales have continued to accumulate even more coins as they believe the digital asset could rise even higher in the long-term.

SUSHI Holders Distribution chart

Since January 1, 2021, the number of whales holding between 100,000 and 1,000,000 SUSHI ($670,000 and $6,700,000) has increased from 18 to 39, a significant spike that indicates there is a lot of buying pressure behind the token.

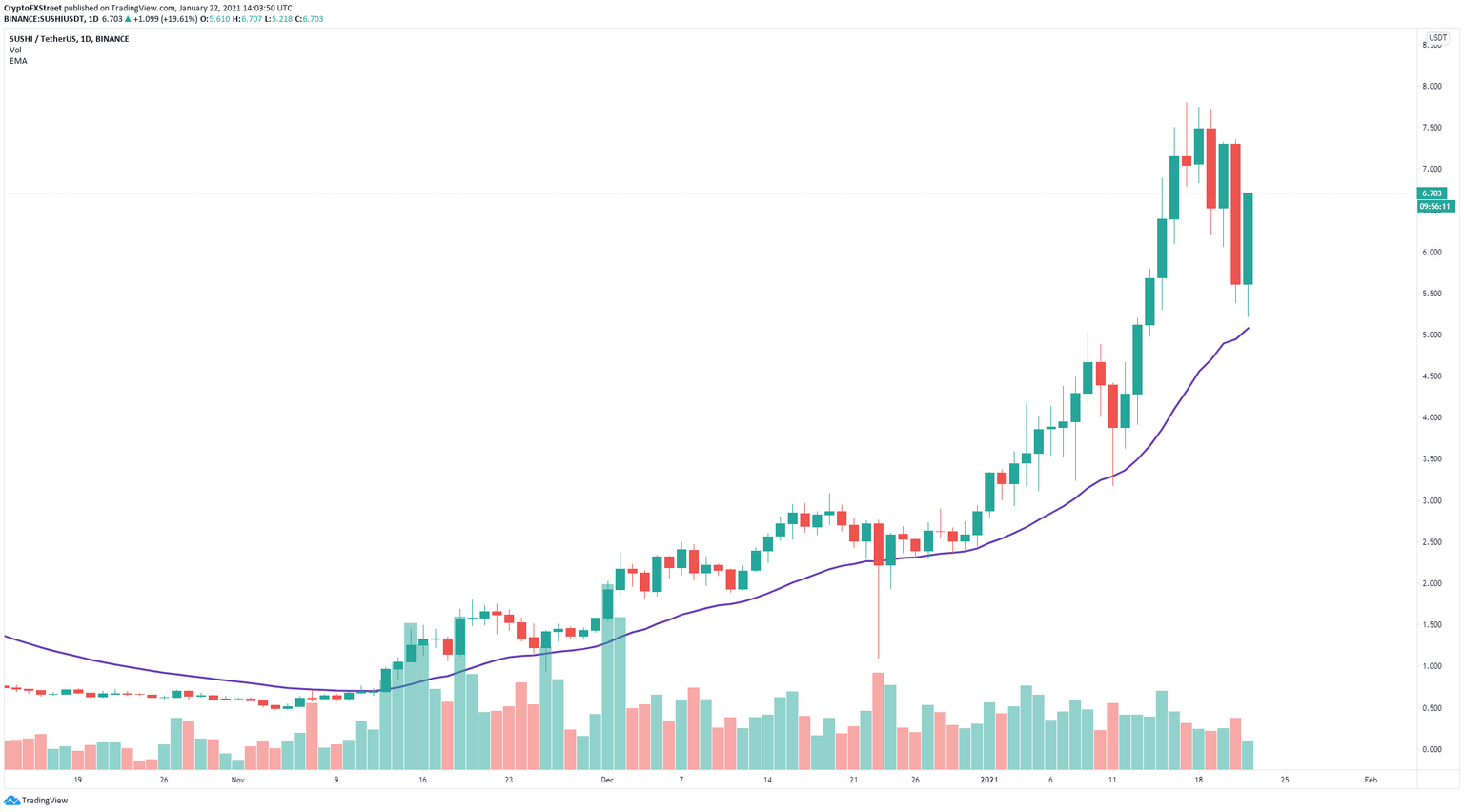

SUSHI/USD daily chart

On the daily chart, bulls have defended the 26-EMA once again, which has been a robust support level since November 13, 2020. The digital asset faces practically no resistance until $7.79 and aims to hit $8.

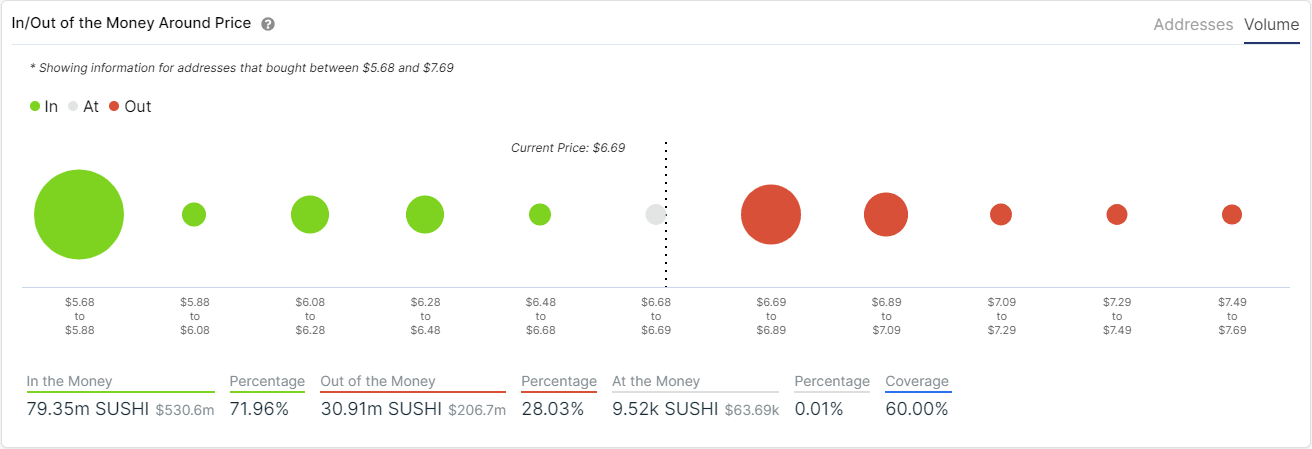

SUSHI IOMAP

This bullish perspective is corroborated by the In/Out of the Money Around Price (IOMAP) model which shows only one significant barrier between $6.69 and $6.89. A breakout above this range can easily drive Sushi price towards $8.

However, the model also indicates that support below $6.5 is fairly weak. If bulls cannot push Sushi above the only resistance area seen on the IOMAP, the digital asset could fall towards $6.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B14.58.13%2C%252022%2520Jan%2C%25202021%5D-637469210426165310.png&w=1536&q=95)