Aave Market Update: LEND/USD resumes growth, targets at $0.9000

Aave's LEND is now the best-performing digital tokens out of top-100. The coin has gained over 17% of its value in the recent 24 hours building on strong positive momentum of recent days. Aave left behind several major coins, including IOTA, Huobi Token, DASH and NEM, and settled at the 21st place in the global cryptocurrency market rating. Currently, the coin's market value is registered at $1.14 billion, and it is one of a few DeFi tokens in $1 billion league.

Aave enjoys positive fundamental news flow

As the FXStreet previously reported, the DeFi project has been experiencing stellar growth. Since the start of the month, the value of coins locked in Aave's smart contracts increased by over 170% and surpassed $1.4 billion.

Also recently, Aave has become the first DeFi project in the UK that obtained an Electronic Money Institution license of the British regulator. The license allows the company to issue digital cash alternatives and provide payment services. The community took the news as a reason for LEND buying.

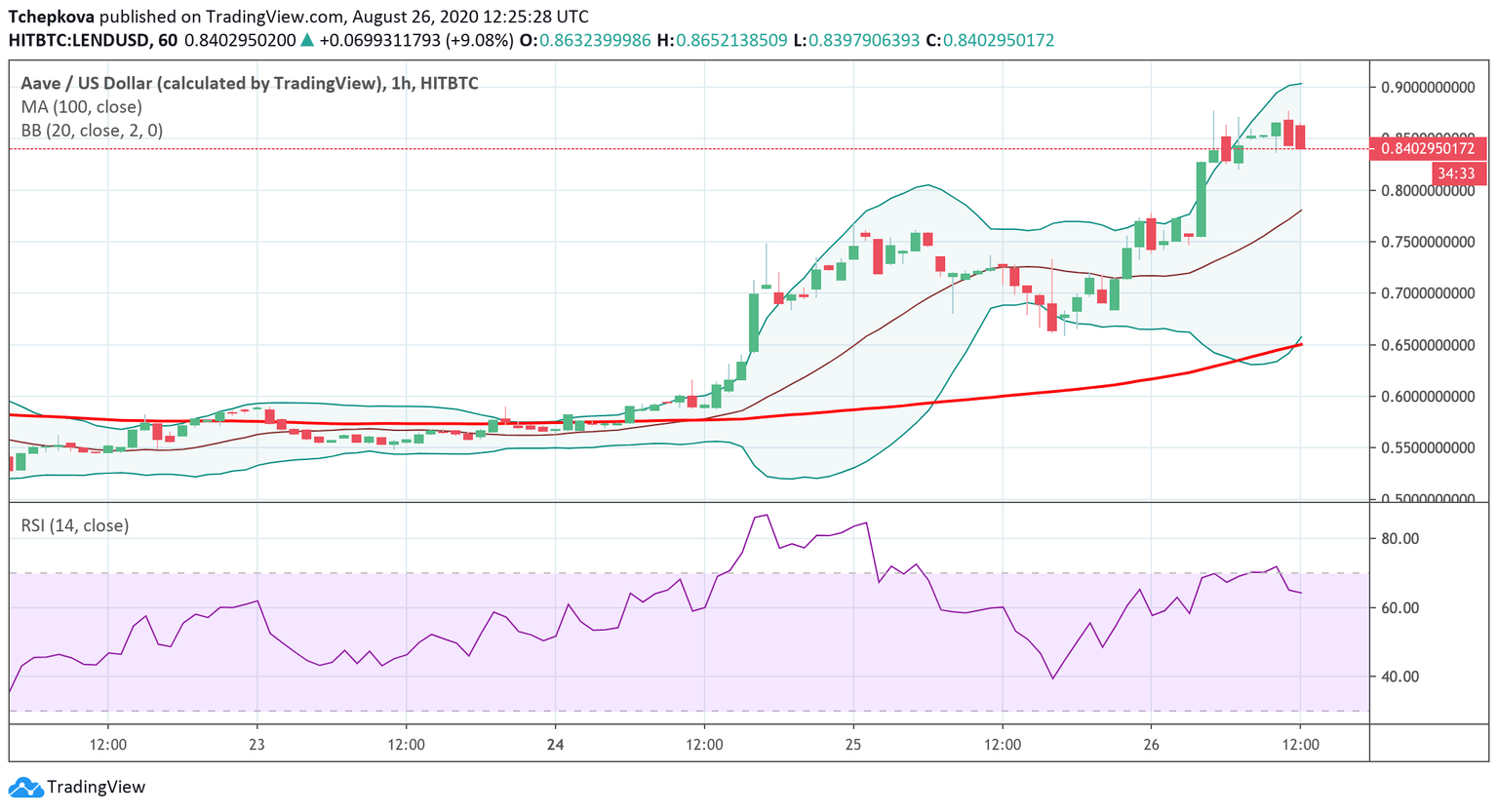

LEND/USD: The technical picture

LEND bottomed at $0.6616 on Tuesday and swiftly jumped above $8.00 during early Asian hours on Wednesday. At the time of writing, LEND/USD is changing hands at $0.8570 with the local resistance created by $0.8770. This barrier was tested twice in recent days. Once it is out of the way, the upside is likely to gain traction with the next focus on $0.9000 reinforced by the upper line of the 1-hour Bollinger Band.

On the downside, the first support comes at the psychological $0.8000. A sustainable move below this area will increase the downside pressure and bring $0.6500 (1-hour SMA100) into view.

LEND/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst