Zombies in the markets

The unstoppable force known as the U.S stock market has climbed higher again on Wednesday, with the S&P500 chasing its pre-pandemic highs. A remarkable occurrence considering the history of Index recoveries from previous recessions where in some instances full price recovery was not discovered until nearly a decade later. Interestingly the minor differences in ‘recovery’ between the Russell 2000, the Nasdaq and the S&P500 which while all travelling in the same direction have not shared the same results.

Being that all three indexes are completely different composites it does make the comparison a little more obscure, but it’s the differences in the composite’s that highlight some of the issues. The tech sector has boomed through the pandemic hardships and that is evident with the drive for demand in ecommerce and cloud-based entities and of course in the Nasdaq which has rocketed to new heights. The S&P500 has had a similar trajectory to the Nasdaq, but that’s to be expected with so much of the Nasdaq mega caps being a part of the S&P.

And now this is where it gets interesting, I can’t help but wonder if the stimulus effects and the direct support that many businesses have received as also contributed to recoveries being lagged.

Take the Russell 2000 for example, even by the standards of the S&P and the Nasdaq it’s had a phenomenal run, but its just not quite as shiny. Maybe its because of the narrow division between the leaders on the other two, whose stock stars really have used their balance books as a weapon for acquisitions.

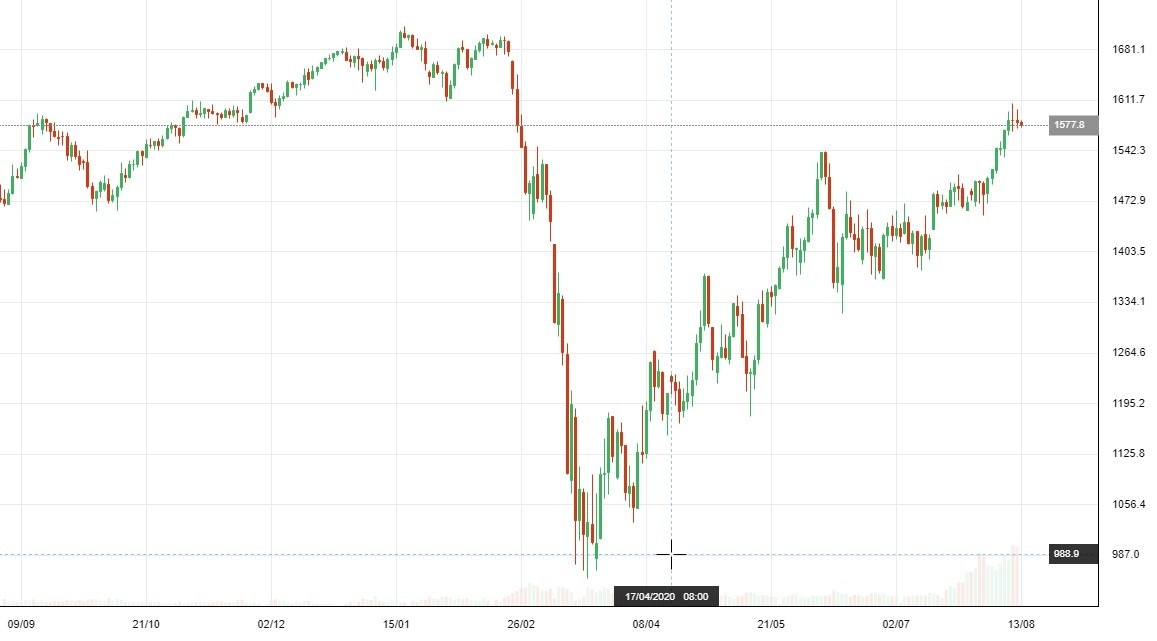

Russel 2000 - Daily

To a degree though there is some logic behind the zombie company pulling it all down a little to much. The Monetary and the Fiscal policy that we have seen over the last few months have been to the extreme sides of large, certainly much bigger than what we ever saw in the Global Financial Crisis. The sheer size of the stimulus and the injection to save businesses has me pondering how many would have died in the GFC, and for that matter, how many are going to be able to survive without the stimulus?

The next question I must ask myself as apart of my own analysis is how many of these entities in the Russell 2000, which is made of small caps, are on the tail ends of their respective business lives. Could the allocation of Monetary and Fiscal policy be better to accommodate those that are going to be here in the next decade?

Of course, optimism for the next decade of stimulus is to far of a stretch at this time, many of us are only as optimistic as a viable vaccine. And for the time being the companies that have been zombified are likely remain some where between life and death.

Author

Alistair Schultz

Independent Analyst