XAUUSD

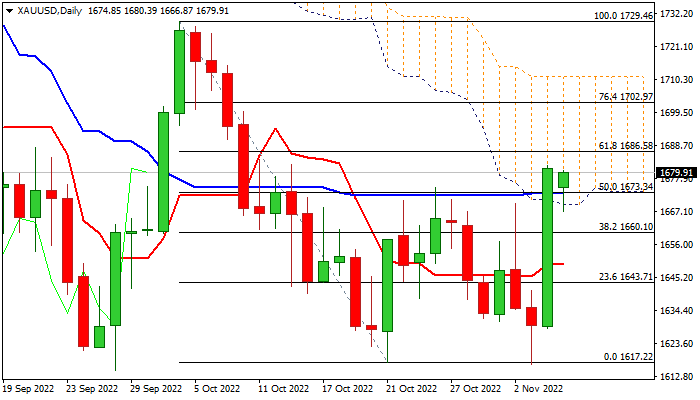

Spot gold holds firm bullish stance and consolidating under three-week high, posted after 3.2% rally on Friday (the biggest one-day rally since 24 June 2016), sparked by US labor data which raised hopes that the Fed may ease its aggressive stance in raising interest rates in the near future.

Fresh rally retraced over 50% of the $1729/$1617 bear-leg, leaving a double bottom ($1616/17), with penetration and close within thick daily cloud, adding to bullish signals.

Improved daily studies (strong bullish momentum / 10/20/30 DMA’s in positive setup) underpin recovery, which needs extension through $1680/$1686 pivots (55DMA / Fibo 61.8%) to confirm bullish stance and open way for attack at psychological $1700 barrier and daily cloud top ($1711).

Broken daily Kijun-sen / 50% retracement marks initial support at $1673, guarding more significant daily cloud base ($1669), loss of which would weaken near-term structure and risk deeper pullback.

Res: 1680; 1686; 1700; 1718.

Sup: 1673; 1669; 1660; 1649.

Interested in XAUUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD pulls back due to an upward correction in the US Dollar

AUD/USD is retracing its recent gains on Friday, following a rally on Thursday. The rally was propelled by a decline in the US Dollar as weak US Initial Jobless Claims indicated a more dovish outlook for the Federal Reserve. This helped offset pressure on the pair resulting from the RBA's less hawkish stance.

USD/JPY holds positive ground around 155.50 on Fed’s hawkish comment

USD/JPY trades on a stronger note around 155.50 on Friday during the Asian trading hours. The renewed US Dollar demand lifts the pair. Nonetheless, the verbal intervention and the hawkish comment from the Bank of Japan’s Governor Kazuo Ueda might cap the downside of the Japanese Yen for the time being.

Gold price extends the rally despite hawkish Fedspeak

Gold price gains momentum on Friday despite the modest rebound in US Dollar. The yellow metal edges higher as many economists expect a weakening labor market could prompt the Federal Reserve to cut interest rates sooner than currently expected to stimulate economic growth.

Ethereum waiting on a bullish trigger, Consensys CEO takes a jab at the SEC

Ethereum co-founder alleges that the SEC aims to stifle innovation through its enforcement actions against Ethereum-related companies. Grayscale CEO says he's optimistic the SEC would approve its spot ETH ETF application.

Rate cut optimism fuelled by higher US jobless claims

With Federal Reserve policy acting as the primary driver of investor sentiment in 2024, renewed optimism surrounding the possibility of rate cuts has propelled the Dow to its most significant rally since December. Additionally, the S&P 500 surged past the critical 5,200-point mark.