US CRUDE OIL

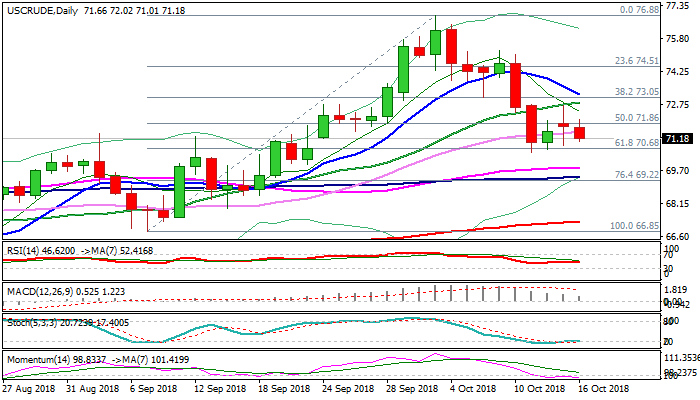

WTI oil was lower on Tuesday after recovery attempts previous day stalled and daily action ended in long-legged Doji, signaling strong indecision.

The prices came under pressure on report that production of US shale oil hit record high and on expectations of further of US oil inventories, with reports of fall of exports from Iran, partially offsetting negative impact.

Today’s action holds in red as negative fundamentals are supported by weak techs, which maintain bearish momentum.

Near-term focus turns on cracked Fibo support at $70.68 (61.8% of $66.85/$76.88 upleg) which so far contained repeated attacks, with break here to signal and end short consolidation and continuation of bear-leg from $76.88 (03 Oct high).

Firm break lower would expose psychological $70 support; daily cloud top ($69.89) and 55 / 100SMA’s ($69.83 / $69.41 respectively) in extension.

At the upside, rising 20SMA which capped Monday’s upticks ($72.81) marks pivotal barrier, break of which would provide relief.

US Crude stocks reports are in focus, with API report due today and EIA report on Wednesday, expected to provide fresh signals.

Res: 72.02; 72.81; 73.19; 73.47

Sup: 71.01; 70.68; 70.49; 70.00

Interested in Oil technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.