WTI OIL

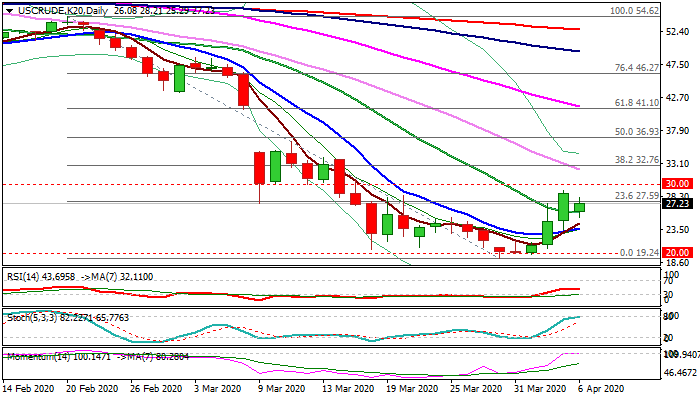

WTI oil regained traction and rose above $28 mark in European trading on Monday, following gap-lower opening in Asia. Oil started week at $26.07 after closing on Friday at $28.73, as traders feared further deterioration of the conditions after Saudi Arabia and Russia delayed a key meeting in which they are expected to discuss production cut that could help reduce global oversupply. Oil prices skyrocketed from critical $20 support last week after US President Trump announced that the deal between two biggest oil exporters is near. The sentiment improved on Monday after Kremlin said Russia is ready to cooperate with other leading oil exporting countries in attempts to stabilize global oil market. The OPEC+ meeting was postponed until Thursday due to technical reasons and traders will await the outcome which could further boost oil prices on positive result. Fresh advance needs to cover today's gap to generate bullish signal for attack at psychological $30 barrier, violation of which would expose pivotal Fibo barrier at $32.76 (38.2% of $54.62/$1924 descend). Flat momentum at the centerline and neutral RSI, accompanied with overbought stochastic on daily chart warn that bulls currently lack strength for more significant action and will await signals from fundamentals. Solid support lays at $25.97 (20DMA) and near-term bias is expected to stay with bulls while this support holds.

Res: 28.21; 28.46; 29.11; 30.00

Sup: 26.72; 25.97; 25.29; 24.17

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.