US CRUDE OIL

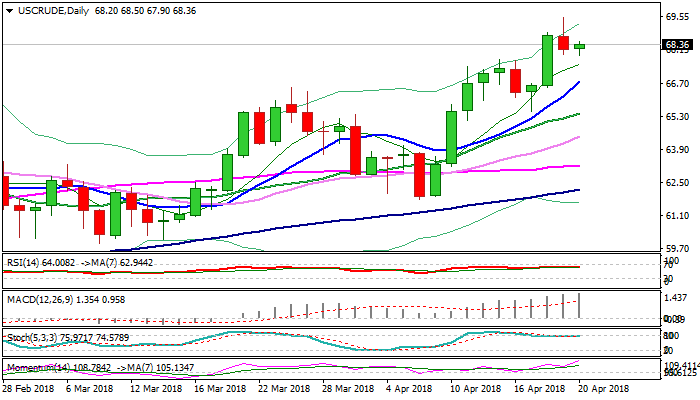

WTI oil holds within narrow consolidation on Friday, near new over three-year high at $69.54, posted on Thursday.

Bulls showed hesitation on approach to psychological $70 barrier and eased to $67.90 on overbought conditions.

Daily studies remain in firm bullish setup and supported by positive sentiment which keeps bullish bias for fresh $70 + advance.

OPEC members and Russia meet in Saudi Arabia and said that global oil glut has been virtually eliminated, mainly thanks to OPEC-led global supply cut action which so far gave good results in tightening global oil market.

Also, top world oil producers showed no signs of stopping the deal, with Saudi Arabia suggesting to extend program into 2019, however, traders will be closely watching next steps of OPEC, as some suggestions about easing output restrictions were heard.

Broader recovery from $26.04 (11 Feb 2016 low) could extend towards $76.35 (Fibo 61.8% of larger 107.45/26.04 downtrend) on firm break above $70 pivot.

Meanwhile, extended consolidation could be anticipated before bulls resume, with stronger downticks to face solid supports at $66.82/64 (rising 10SMA / previous high of 25 Jan).

Res: 68.50; 68.89; 69.54; 70.00

Sup: 67.90; 67.74; 66.82; 66.64

Interested in WTI technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.