The start of August

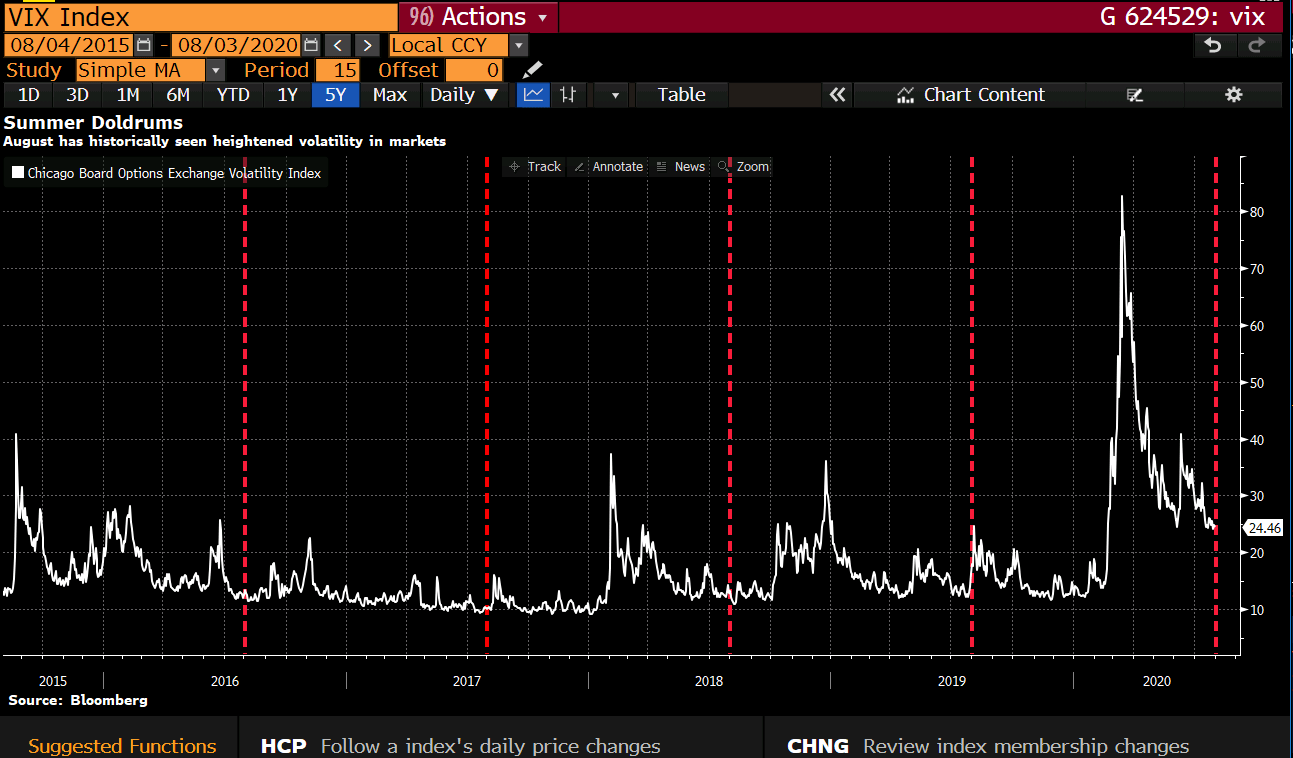

The generally received wisdom is that summer is a quiet month for trading. Traders are on holiday and markets quieten down. That’s the expectation among many. However, the reality is that August can be one of the most volatile trading months of the year. According to Bloomberg’s Market’s Live blog, the Cboe volatility index has risen an average of+11% in August over the past 15 years. So, August is time of volatility. Given the unusual nature of 2020, this could be a very volatile year!

Why does volatility rise in August?

Well, volatility rises in August for the very same reason that you sometimes get large price swings on the Sunday open in FX markets. Liquidity drops, volatility rises. Liquidity is basically the presence of orders in the market: buy limits, sell limits, buy on stops and then traders placing market orders etc. The more participants, the more liquidity. However, at the Sunday open there are often less orders and so liquid is said to be ‘thin’. This lack of liquidity in the markets can result in large price jumps as the price moves into liquidity voids (areas without many orders in) and skids through.Take a look at the chart below to see the volatility increase for August.

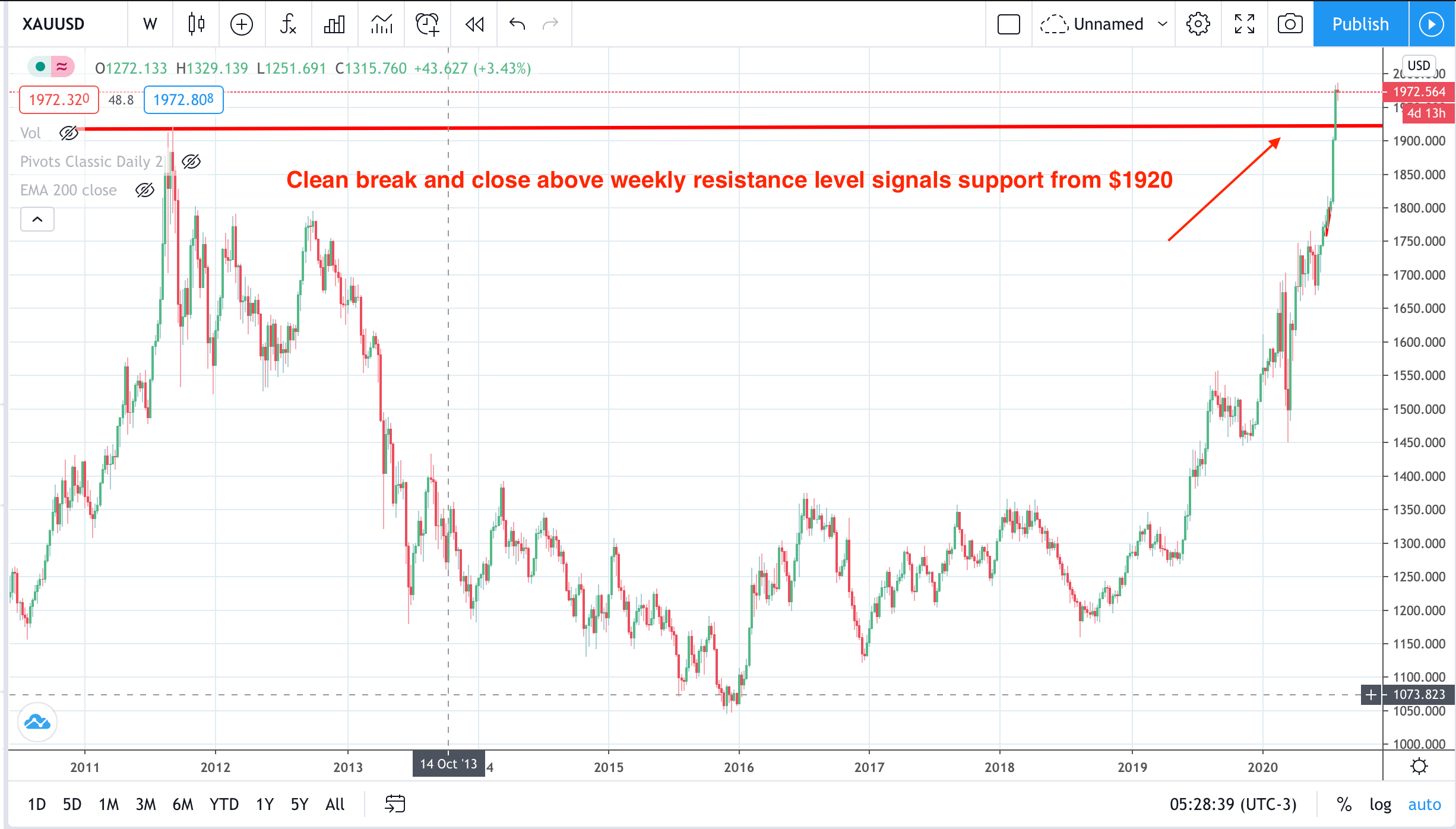

Could this be gold’s catalyst to hit $2000?

One chart to watch carefully is the gold chart. Many analysts see a pullback for gold in the near term, but the break and close beyond the weekly resistance level last week signals at least another attempt at a run for higher prices. Whether it makes new highs this week remains to be seen. However, a move higher in gold could combine with the thin liquidity of August and have a race to $2300 on the cards sooner than anyone expected. This is one chart to be keeping a close eye on as the USD index has resumed its move lower this am.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.