What to watch this week Central Banks, GDP, and Confidence

Monday 26 April

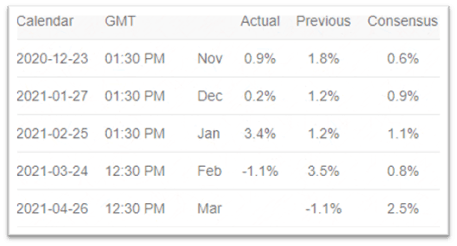

Orders of US-made Durable Goods are expected to lift 2.5% month-over-month when the March figure is released Monday. This report should be watched closely in the likely event the actual value deviates widely from the forecasted value. All year, the market has had significant trouble predicting the month-over-month value of Durable Goods Orders. Thus, an eye should be kept on this report at the beginning of the week. Traders of CAD, MXN, CNH, and EUR against the USD will be especially wary.

Tuesday 27 and Wednesday 28 April

A couple of Central Bank Interest Rate decisions are due this week. I will list them all in one go. They are incredibly important events, but all interest rates will likely remain as is, with no changes.

Tuesday: Bank of Japan is expected to leave the rate at -0.1%

Wednesday: The US Federal Reserve is expected to leave the rate at 0.25%. Further, the Fed will also be holding a press conference on the same day. Traders can use the conference to learn additional details concerning the US economic outlook. For instance, whether asset purchases by the organisation will be winding down.

Bonus decision: Next Tuesday, the Reserve Bank of Australia is expected to leave the rate at 0.1%

Thursday 29 April

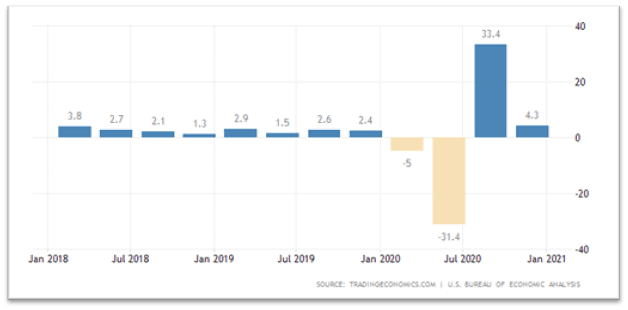

The quarterly US GDP Growth Rate is forecasted to come in at ~6.4%, which is a couple of percentage points higher than last quarter. Several rounds of stimulus checks, record planned infrastructure spending, and a successful vaccination program are helping the country lift economic performance. The Thursday GDP report should go some way in mitigating the fears of the proposed hike in the rate aimed at capital gains that swayed the stock market at the end of last week.

Friday 30 April

Closing out the week is a couple of confidence reports from Japan and Switzerland.

The consensus is that consumer confidence in Japan is pulling back slightly to 35.5 in April, from 36.1 in March. The downgrade reflects the new wave of Covid infections across Japan, resulting in recent government-imposed lockdowns and the potential postponement of the Tokyo Olympics. For context, the consumer confidence value for the past ten years has primarily floated in the 40 to 45 range.

The level of confidence in Switzerland is moving in the opposite direction than in Japan. Albeit The KOF Economic Barometer is a general economic index, rather than consumers focused. The confidence level is well above pre-covid levels. April is expected to record a confidence level of ~119.4, up ~1.5 points in March.

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.