What ProAct Forex Target Traders See: We are currently sitting @ 1.1002 in a large range. A couple of different scenarios: 1: Bullish: a move to the 0.214 Fibo @ 1.1236 area and 2: Bearish: A break down to the double bottom support @ 0.0710. The average daily true range (ATR) for the pair currently is 82 pips.

————————————————————————--

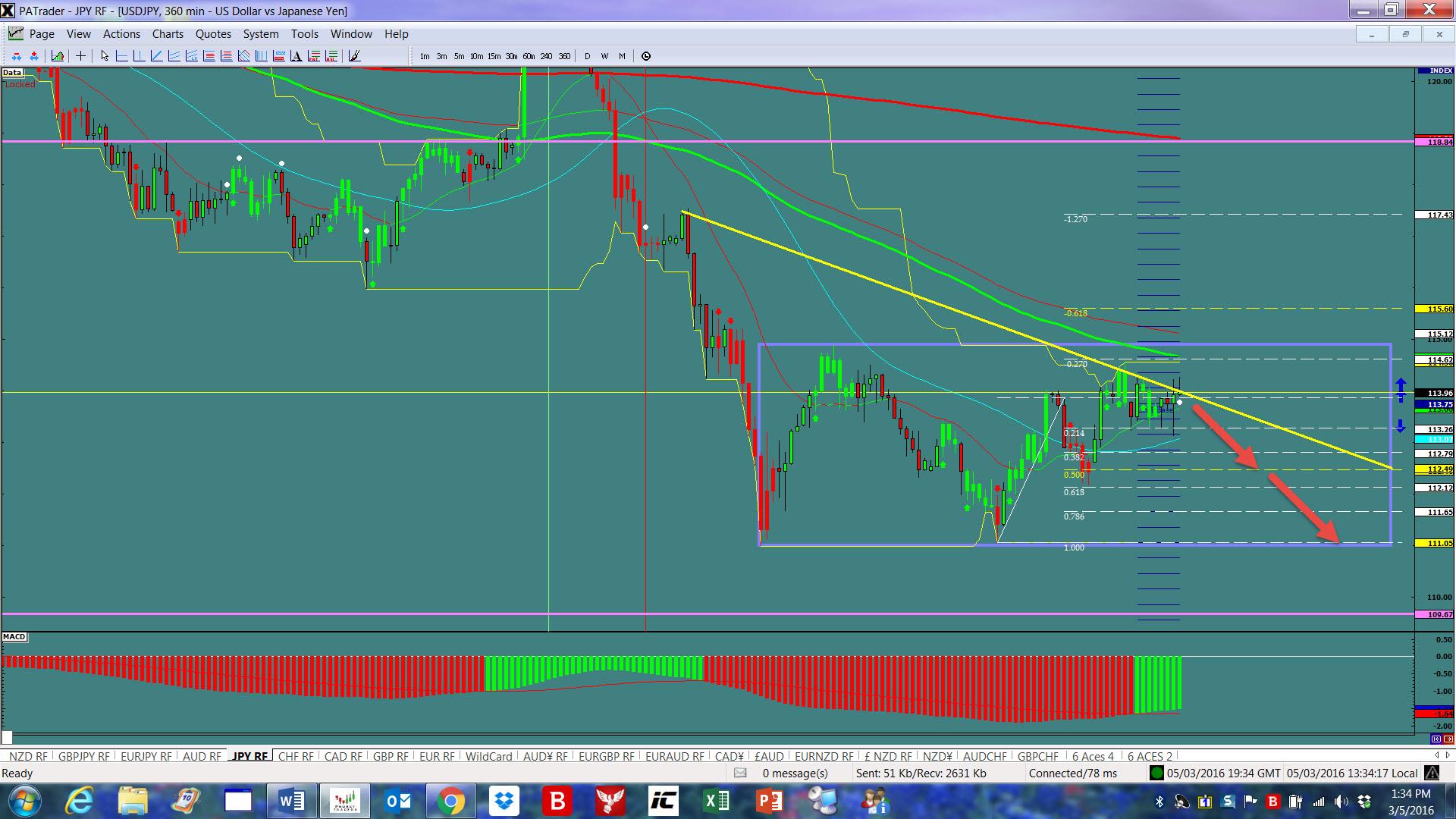

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 113.96 ( 3 pips from this time last week). We are ranging and looking for a move first to the 0.500 Fibo and then to the range bottom @ 111.05 area. The average daily true range (ATR) for the pair currently is 76 pips.

——————————————————————————–

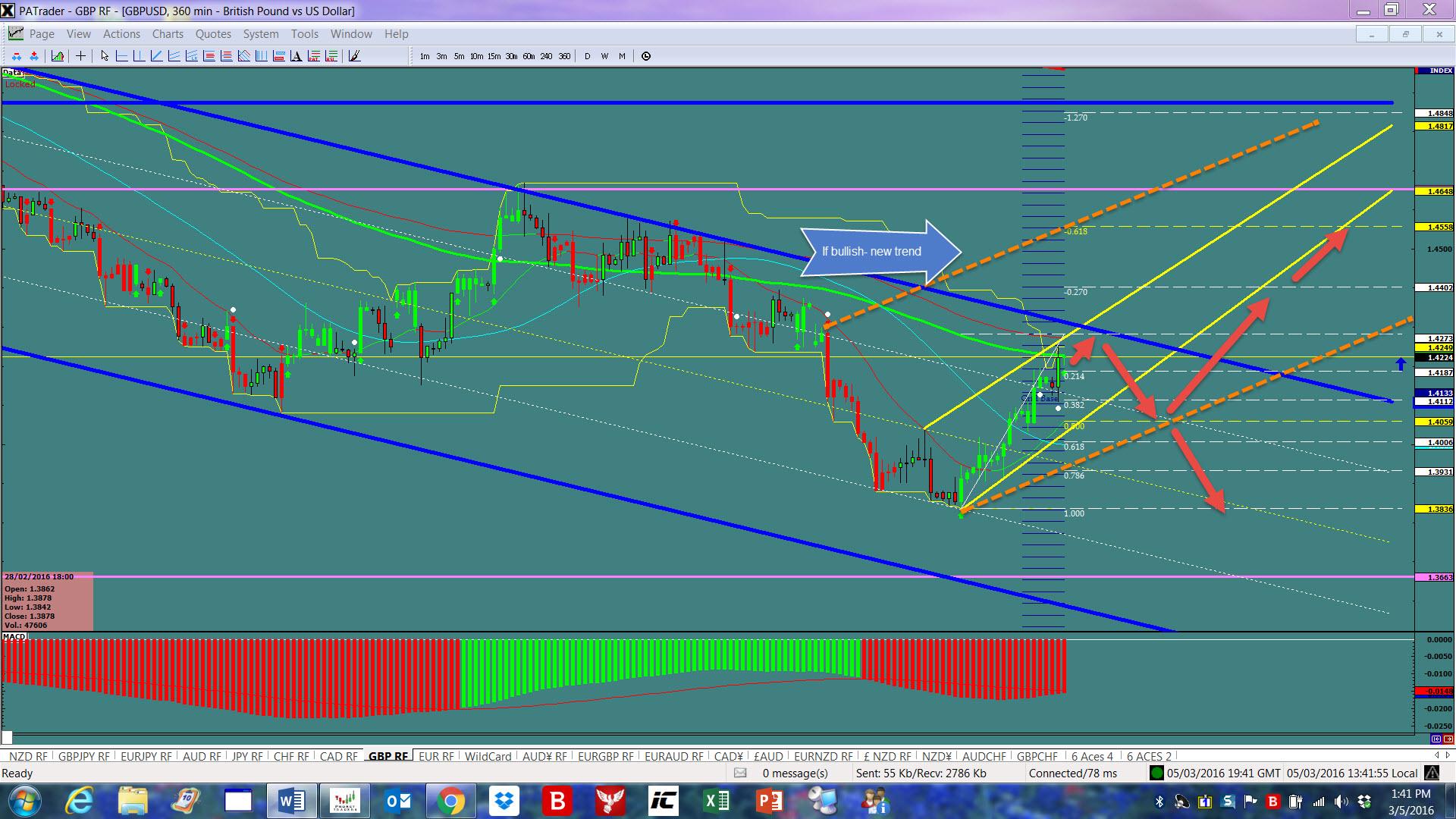

$GBPUSD

What ProAct Forex Target Traders See: Cable is currently @ 1.1224. A couple of different scenarios: 1: Bullish: a move to the 0.618 Fibo @ 1.4558 area and 2: Bearish: A break down to the double bottom support @ 1.3836. The average daily true range (ATR) for the pair currently is 141 pips.

——————————————————————————–

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7452 in a large range. We are looking for a finishing move to the range top @ 0.7500 then reversal and an overall target of the 0.618 Fibo @ 0.7084. The average daily true range (ATR) for the pair currently is 80 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

AUD/USD loses ground due to the absence of a hawkish RBA

The Australian Dollar has plunged following the Reserve Bank of Australia's decision to maintain its interest rate at 4.35% on Tuesday. Investors sentiment leaned toward a potentially more hawkish stance from the RBA, particularly after last week's inflation data surpassed expectations.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.