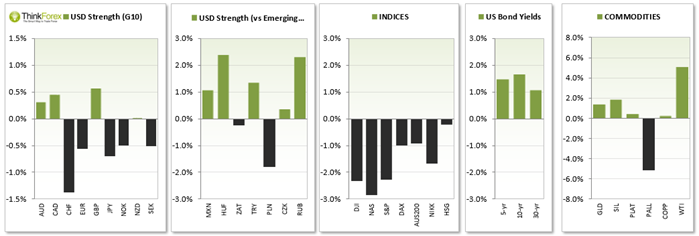

With US growth revised down again for Q4 GDT then Friday's Nonfarm Payroll data really needs to prevent further trouble at the multi-year highs for USD Index

US Dollar: The mixed data set from US last week provided the choppy price action and confused direction as expected as traders absorbed a further downgrade to Q4 GDP, soft retail sales alongside improving market conditions, housing sales and inflation m/m. Opening and closing the week around the same level, the volatile up and down spike created a Rikshaw Man Doji candle for the USD Index (DXY), effectively seeing bulls and nears 'calling it a draw' for the week. Traders will now shift their focus to Manufacturing, Trade Balance and the Nonfarm Payroll data this Friday. As employment is the only area that continues to look promising, in the event of an unexpected soft data set from this volatile release, we can expect a bearish follow-through by Dollar bears.

Australian Dollar: The Aussie starts the week on the back-foot following a 3-day losing streak. What makes the last three days more significant is that it erased half of the gains of the preceding two weeks, which at the time, was enjoying its most bullish rally since Jan '14. The fact it erased these gains so quickly will likely spook the bulls to paint a bearish overtone this week which is backed up by the Shooting Star Reversal candle on the weekly charts. Domestic data includes Trade Balance and Building Approvals, but this is relatively light compared to US calendar, making the closing price for AUDUSD more likely to be an American tale.

British Pound: GBPUSD As a momentum trader GBPUSD has lost my interest due to the overlapping and non-directional nature of the daily timeframe candles. Last week's inside week also highlights there is not enough of a catalyst to create a new trend on GBPUSD so again we eye US data for further clues. Traders are likely to focus on UK Manufacturing and Services PMI data to help assess the likelihood of inflation dipping below zero. Last week it came in at 0 for the first time.

Canadian Dollar: Canada are the only major Central Bank to release their GDP figures monthly so this, along with Trade Balance data, is the highlight for CAD traders. Traders were recently surprised to see BoC lower interest rates then equally surprised to not see a second consecutive rate cut (just like RBA) as the two central banks appear to be in lock-step regarding their rates. A soft GDP set should see traders assume a rate cut sooner and later to help support USDCAD and drive CAD crosses down further.

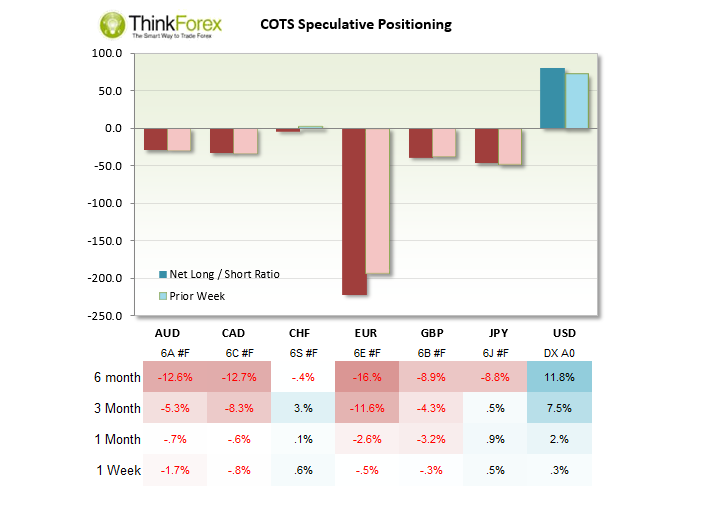

Euro: The main upside risk for EURUSD would likely be the GRExit scenario but, assuming this does not happen, trades continue to pile into net Short Euro contracts to assume further downside. As of Tuesday Euro bears were net short at their highest levels on record, so GRExit does not appear to be a concern according to this data set. German CPI could help provide some near-term support on EURUSD but any upticks on this pair are likely to be seen as more favourable prices to get short (if not already).

New Zealand Dollar: RNZDUSD appears on track to finish the month with a volatile candle of indecision (Doji with large range). W1 however produced a Shooting Star Reversal below 77c (bearish) to suggest near-term weakness with support at 0.744 and 0.732. Business confidence and GDT prices are the highlight with traders eager to know if last month's GDT contraction was one-off or continuation of a new trend.

GOLD: Currently meandering around $1200, the high of last week failed to breach $1223 resistance to produce a Shooting Star Reversal, warning of pending weakness below $1223. The rally up to this high was fuelled by tensions over Yemen but, when you consider we are not that far from the multi-year lows, the rally can be seen as subdued at best. However whilst we meander around the $1200 level it is likely to attract buying interest above this key level and selling interest below. A break above $1223 is required to break the March swing high and likely follow-through to $1255. If price can break below $1200 the $1175 is a likely near-term target.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.