Fundamental Forecast for Dollar: Neutral

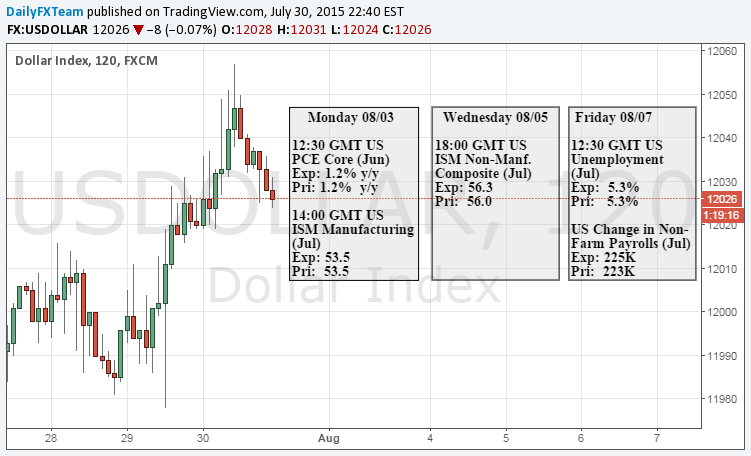

The week ahead will be bookended by key event risk – Monday’s PCE inflation report and Friday’s NFPs

A ‘neutral’ stance from the FOMC statement last week indicative of more bias than the market accounts for

Join DailyFX Analysts for daily discussions on the Dollar and FX markets at DailyFX on Demand

There are periods where the Dollar – and all other assets for that matter – finds its price action is divorced from the influence of regular event risk. This does not look to be one of those times. While there are still high-level fundamental themes still churning behind the scenes and Summer trading conditions seem to be in full swing for the capital markets, the focus has turned to very specific milestones. One of the most critical landmarks is the timing for the Fed’s first move to tighten lending rates. That represents both a competitive turn for the Greenback and a turning point for speculation supported by ‘easy money’. This past week, the Fed left some with a sense of ambiguity as to their intentions, but what they intended to do was to turn the focus back to the data.

Looking to the past week’s headlines, there were two particular events that drew the market’s attention: the FOMC rate decision and the 2Q US GDP release. On paper, both seemed to ‘meet expectations’. However, context puts their outcome in a different light. The painful 0.2 percent contraction in the economy reported in the ‘preliminary’ measure of 1Q GDP jeopardized the central bank’s intentions to normalize policy. Yet, with the subsequent update, the economy returned to a solid pace of expansion (2.3 percent) and the previous period’s reading was revised up to a less traumatic 0.6 percent growth.

A similar perspective shift comes from the Fed’s policy statement. While the communique from the policy makers wouldn’t promise any changes or times frames, their tone and assessment of the environment didn’t change from the previous meeting. That is significant as the June gathering was accompanied by updated forecasts where the Committee maintained a consensus forecast for 50 basis points (two standard 0.25 percent moves) worth of rate hikes this year. Had they been concerned, an air of caution would have replaced the concerted effort to prepare the masses for liftoff.

Gauging the course on interest rates – which FX traders are doing for yield advantage while capital market traders assess for low-cost speculation – is now the raison d’etre. For the Fed, the decision is not made but rather depends on a consistency in the general trend in data that we have seen unfold over the months. Should the current keep its pace or accelerate, a September rate hike will be the likely result. Should it subside, the probability shifts to a later start.

This week, we will come across two particular indicators in a busy docketthat are important for shaping rate expectations. Monday’s PCE deflator is the Fed’s favored inflation measure. Friday’s July labor report will generate headlines with its NFP print, but the policy speculation will center on the wages component – the wellspring of inflation. If this data misses or beats, few will miss the implications.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.