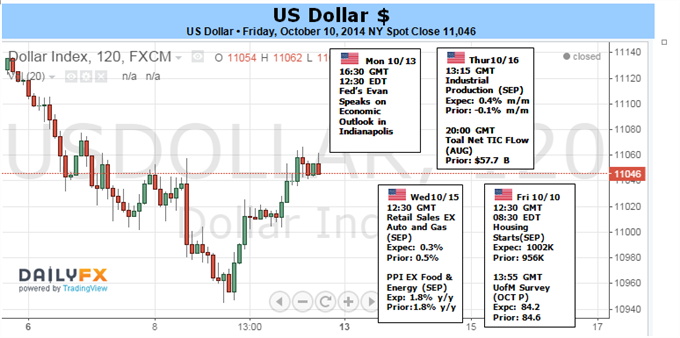

Fundamental Forecast for Dollar: Bullish

The Dollar Index finally called an end to its record-breaking 12-week consecutive rally

Traders have squeezed the premium from rate expectations, risk trends carries the dollar’s greatest potential

See the fundamental and technical forecast for the USDollar in our updated 4Q Forecast Trading Guide

The Dollar finally took a breather this past week. After 12 consecutive weeks of climb, the Dow Jones FXCM Dollar (ticker = USDollar) fell 0.7 percent. Yet, we shouldn’t be too hasty in calling for a full-scale reversal just because the record-breaking advance has been called to a close. Fundamentally, the greenback could be considered ‘stretched’ if we evaluated it on its more active drivers: the mass depreciation of its major counterparts and a build in interest rate expectations for the Fed. Yet, if this currency’s – and financial system’s – most omnipotent theme rears its head, we may have only seen its opening move. That theme: risk trends.

The FX market considers the US currency a ‘safe haven’. However, that does not necessarily mean that the Dollar will simply rise with every slip in equities or lurch from a volatility index. This particular player’s haven status reflects a more extreme sentiment. The USD is the most abundant reserve currency and the Treasury and money markets that it fronts are considered international standards for stability. Functionally, that means the Dollar’s appeal in the spectrum of sentiment really keeps in when investors demand liquidity – when the consideration for ‘return’ evaporates.

In the past five-and-a-half years, we haven’t seen many bouts of panic sweep over the global financial system and trigger the blind rush to liquidity. The market seizures in mid-2010 and mid-2011 are arguably the most prominent. Aside from these periods, ‘risk aversion’ has fallen comfortably within the constraints of complacency. The markets retreating just enough to draw short-term and opportunistic traders into the market to bid the dip and sell the risk premium. Hitting the level where the undercurrent changes and the ranks finally unwind in a meaningful way requires a scope and intensity. What we have seen last week may signal that long-awaited fraction in the serene backdrop.

We have watched as implied (expected) volatility measures have climbed over the past 2-3 months, while some of the financial systems more volatile risk assets (Emerging Markets, high-yield) and growth dependent assets (Euro, commodities) have been in retreat as well. This is evidence of scope – where sentiment is leading the way rather than just a localized or isolated situation in one area of the system. Scale, however, has remained ever elusive. Perhaps that is changing though. We ended this past week with the most stubborn of risk benchmarks – the S&P 500 – closing below its incredibly consistent trend channel floor going back to January 2013.

Is this simple technical cue the definitive shift in sentiment? No. A trend over half a decade in the making, will also take time to turn. Yet, we could very well be at the opening stage of the acceleration phase in that turn. Should we take that next step, an unwinding of risky positions and record leverage against a backdrop of thin open interest will heighten the demand for liquidity (stability). That is where the dollar would shine.

As we monitor the ‘risk’ theme closely, it is important to keep in mind the currency’s other primary fundamental avenues. If the spark doesn’t catch, the US rate speculation has stabilized after initially wavering on the dovish Fed meeting minutes. Officials’ remarks suggest they are still heading towards hikes and the calls for deferring a hike until end of 2015 or later are very few. Data in the week ahead poses limited volatility threat to this consideration. Alternatively, risk aversion would likely push back the lift off, but the Dollar would still gain through its safety appeal. As for the weakened position of its counterparts, the unflattering growth forecasts and warnings issued for the Eurozone, Japan and China keep this a bullish greenback lever whether sentiment collapses or not. – JK

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.