Fundamental Forecast for Yen: Neutral

The Weekly Volume Report: Dollar Trying To Turn?

Build in US Dollar Buying Points to USDJPY Declines

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

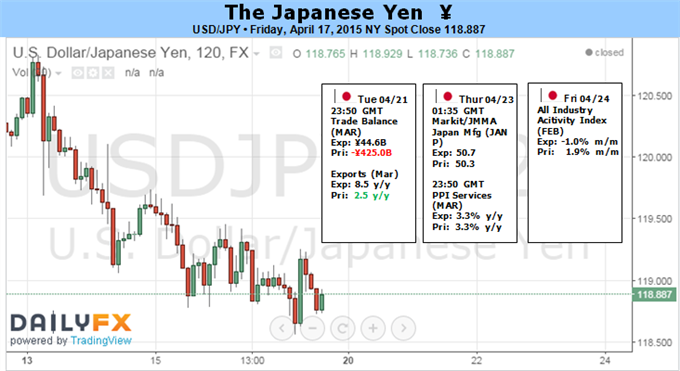

The fundamental event risks lined up for the final full-week of April may heighten the appeal of the Yen and spark a further decline in USD/JPY as the Japanese economy gets on a firmer footing.

With Japan expected to post a trade surplus for the first time since June 2012, prospects for a stronger recovery in 2015 may encourage the Bank of Japan (BoJ) to retain a wait-and-see approach at the April 30 interest rate decision as Governor Haruhiko Kuroda remains confident in achieving the 2% inflation target over the policy horizon. In turn, Japanese officials may continue scale back their verbal intervention on the local currency, and the bearish sentiment surrounding the Yen may continue to diminish over the near to medium-term as the central bank turns increasingly upbeat on the economy.

In contrast, the recent weakness in the U.S. may further dent expectations for a Fed rate hike in June, and another series of weaker-than-expected data prints may spark a larger correction in the greenback as interest rate expectations get pushed back. Despite expectations for a 0.6% rebound in U.S. Durable Goods, it seems as though lower energy prices are failing to drive private-sector consumption amid the ongoing weakness in retail spending, and another unexpected decline in demand for large-ticket items may trigger a larger correction in the greenback as it drags on the outlook for growth and inflation. In turn, we may see a growing number of Fed officials show a greater willingness to retain the zero-interest rate policy beyond mid-2015 at the April 29 meeting.

With that said, the improving terms of trade for Japan paired with the ongoing slack in the U.S. economy may prompt a further decline in USD/JPY, and the pair may continue to give back the rebound from March (118.32) amid the shift in the policy outlook.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.