Fundamental Forecast for Japanese Yen: Neutral

ECB Move Drives EURUSD to 11-Year Low, EURJPY On the Edge

USD/JPY 1 Month into Consolidation; Could be a Triangle

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

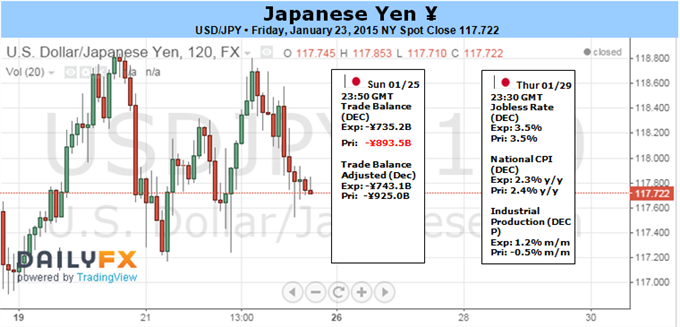

The fundamental developments due out next week may undermine the bullish forecasts surrounding USD/JPY should the Federal Open Market Committee (FOMC) scale back its hawkish tone for monetary policy.

Despite growing expectations for a Fed rate hike in mid-2015, the rotation within the voting committee may spur a material shift in the forward-guidance for monetary policy, and the central bank may sound increasingly cautious this time around amid the fresh batch of monetary support from the Swiss National Bank, European Central Bank and Bank of Canada. Indeed, the Fed may not way to get too far ahead of its major counterparts as it struggles to achieve the 2% target for inflation, and Chair Janet Yellen may show a greater willingness to further delay the normalization cycle especially as the advance 4Q Gross Domestic Product (GDP) report is expected to show the economy growing an annualized 3.2% versus the 5.0% expansion during the three-months through September.

At the same time, Japan’s Consumer Price Index (CPI) may also fail to encourage a bullish outlook for USD/JPY as the Bank of Japan (BoJ) continues to endorse a wait-and-see approach for monetary policy, and the pair remains at risk for a larger correction over the near-term as Governor Haruhiko Kuroda remains confident in achieve the 2% inflation target over the policy horizon. In turn, USD/JPY may continue to carve a sting of lower-highs going into February should the data prints drag on Fed interest rate expectations.

With USD/JPY struggling to push back above the 119.00 handle, the pair faces a risk for move back towards near-term support around the 117.00 handle, and the dollar-yen may make a more meaningful run at the January low (115.84) should the bullish sentiment surrounding the greenback fizzle.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.