Fundamental Forecast for Euro: Neutral

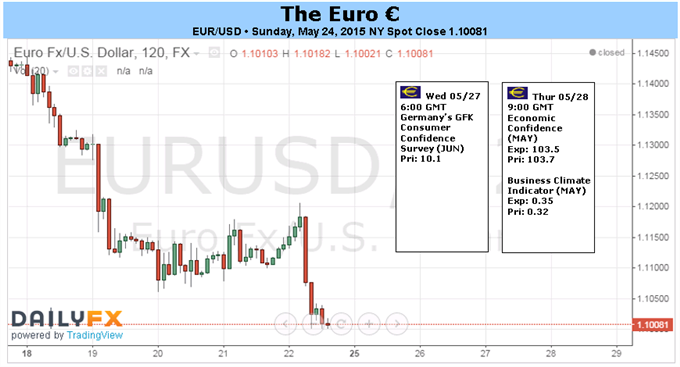

- EURUSD fell back to an important technical level of support by mid-week…

- …and eventually continued lower after the first blush dovish FOMC minutes.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

It was a very rough week for the Euro right from the get-go, as the 18-member currency wiped out all of its gains versus the US Dollar that had accumulated over the prior three-weeks. EURUSD plunged by -3.82% to $1.1008; EURJPY slipped by -1.98% to ¥133.76; and EURGBP fell by -2.28% to £0.7103. The main source of bullishness for the Euro – rising German yields – was abruptly removed from the equation by mid-week, when ECB Vice-President Benoît Coeuré said that the central bank would increase its pace of bond-buying in the short-run in order to balance out the lack of liquidity in markets (thereby making it more difficult for the ECB to achieve its monetary policy goals) in July and August.

In a sense, the ECB’s QE-driven trade – via the portfolio rebalancing channel effect – is dictating asset performances across the risk spectrum. In tandem, European sovereign yields are falling, the Euro is depreciating, and European equity markets are rallying. Investors are front-running the ECB by buying bonds and seeking riskier assets in the process; lower fixed income yields amid recently elevated inflation expectations dictates the need to seek out higher returns along the risk spectrum.

The ECB’s abrupt change of plans is coinciding with the beginning of a shift in US economic data momentum, which more or less has coalesced into the ideal environment for EURUSD declines. After weeks of disappointing economic data – unseasonably weak, even – the US economy has started to see patches of good data. Although the April FOMC minutes initially sparked some downside in the US Dollar, traders have quickly refocused to data released in the interim period since the last FOMC meeting: April US labor market data rebounding back towards its 12-month trend; and April US Housing Starts surging by over +20% to the highest level since November 2007.

The moment for EURUSD to stage a continued, meaningful rally may be behind us at present. While Greece is still a lingering backburner issue, its lack of impact on markets is a reflection of the lack of serious progress or erosion made with respect towards a long-term debt deal; traders have been lulled into a state of complacency and boredom. In turn, this means that Greece’s future potential as a catalyst is limited to explosive tail-risk scenarios only – markets simply don’t care for better or for worse.

If Greece does take a turn for the worse, which is possible with senior Greek government officials pledging to stick to their pre-election platform promises which run contrary to what Greece’s creditors want, there may be significant room for EURUSD to fall further. The market is no longer overcrowded in a short EURUSD position, with EUR speculative short positions having fallen for four straight weeks, and USD speculative long positions having risen for eight straight weeks. The short covering rally period has passed, and it will be easy for EURUSD to achieve further downside levels with so many traders now on the sidelines

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.