With employment conditions improving, an economist friend of mine thought the time was right to demand a raise from his boss. Without one, he said, he would be forced to consider his professional options. His boss listened calmly, reminded him of his forecasting record, and wished him well in his search.

Fortunately, he was able to retain his post with extensive groveling. The process taught him an invaluable lesson in the market for economists. After hearing the story, I think it will be a long time before I get aggressive during a compensation discussion.

I’m not the only one who has focused on wages recently. Central banks around the world have followed trends in compensation very closely for clues about the level of labor market slack. Unfortunately, wage growth may not be an ideal indicator for this purpose. Appreciating trends that affect the supply and demand for labor will be critical to avoid setting the wrong goal or misdiagnosing progress.

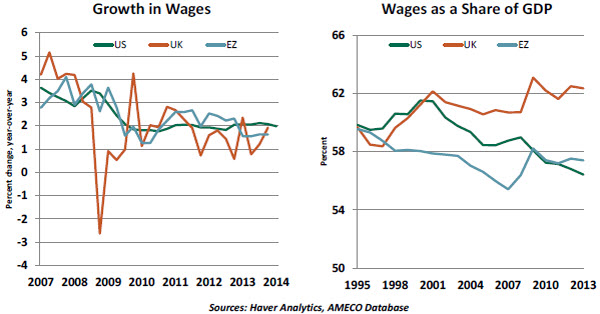

The Great Recession and its aftermath have not been helpful to growth in remuneration. Elevated levels of underemployment have increased the supply of labor relative to demand. The result has been a decline in the rate of increase in employee pay in many countries.

Ten years ago, annual pay increases of 3% to 3.5% were the norm, one to which many would like to return. (Note: the data on wages, which is often expressed as hourly or weekly earnings, does include salaried workers.) But leading economies have been stuck at 2% annual wage gains for some time.

This has been interpreted as evidence that we are far from full employment. After targeting the unemployment rate for a time, both the Federal Reserve and the Bank of England have de-emphasized this metric. To Janet Yellen, Mark Carney and others, part-time workers and those on the periphery of the labor force represent reservoirs of supply that should be more fully tapped. More substantial increases in wages would signal that this is occurring.

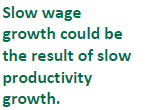

But slow compensation growth may be the result of factors other than slack in global labor markets. It is entirely possible that the wage growth consistent with full employment is significantly less than it once was.

Firstly, some downward pressure on compensation results from the drive by companies to maximize earnings. This is reflected in an increasing share of national income that goes to profits as opposed to wages. This trend has a tendency to reverse itself a bit during expansions, but the left-hand chart above seems to reflect a secular downturn in the wage share for the United States and the eurozone.  This likely reflects the ability of firms to shift work globally toward locations where labor costs are lower. The number of service occupations that lend themselves to global sourcing or technological penetration has expanded. These trends are likely to be sustained even as economic activity improves.

This likely reflects the ability of firms to shift work globally toward locations where labor costs are lower. The number of service occupations that lend themselves to global sourcing or technological penetration has expanded. These trends are likely to be sustained even as economic activity improves.

So structural changes in the way work is done may dampen any cyclical rebound. The flattening of the world has narrowed wage inequality among countries by raising wages in developing countries and holding them down in developed countries.

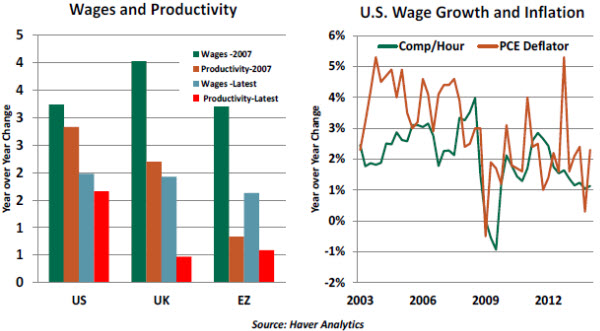

Secondly, wages are linked in the long-term to worker productivity. As we discussed in our piece on secular stagnation, productivity growth has been on a decline that pre-dates the Great Recession. Workers whose annual output grows more slowly will logically see their pay grow more slowly.

Reasons for the decline in productivity are varied, ranging from modest levels of government and business investment to the aging of the workforce. Absent a turnaround in these developments, the increase in the value of an hour of work will be slower than it once was.

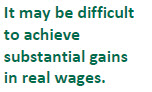

In light of this, it is entirely possible that economies could reach full employment without a return to the wage gains we used to enjoy. Waiting to normalize monetary policy in the hope of achieving this goal may be risky.  And we certainly don’t want to get wage gains for the wrong reasons. A significant body of economic research suggests that wages either lag inflation or are coincident with it. Workers who are paying more for things will collectively demand higher wages to keep purchasing power constant. Should monetary policy stay too easy for too long, inflation could exceed targeted levels and place upward pressure on pay levels. Nominal compensation would rise, but real compensation could easily fall.

And we certainly don’t want to get wage gains for the wrong reasons. A significant body of economic research suggests that wages either lag inflation or are coincident with it. Workers who are paying more for things will collectively demand higher wages to keep purchasing power constant. Should monetary policy stay too easy for too long, inflation could exceed targeted levels and place upward pressure on pay levels. Nominal compensation would rise, but real compensation could easily fall.

The world’s leading central bankers will gather later this month for their annual conclave in Jackson Hole, Wyoming. The theme of this year’s conference is reportedly “Re-Evaluating Labor Market Dynamics.” I certainly hope the participants will emerge with strategies to promote a little more wage growth; my friend and I have tuition bills to pay.

No Rest for the Weary

The month of August is usually a quiet one for European markets as its citizenry takes summer holidays. At times, it seems like a vacation game of musical chairs: the British go to France, the French go to Spain, and the Germans go to Italy. Blessed with beautiful native terrain, the Italians stay home.

Mario Draghi, president of the European Central Bank (ECB), was asked at the end of Thursday’s press conference if he would be heading home to Rome to enjoy a vacation. Having spent an hour discussing the precarious state of the eurozone economy, he looked like a man who could use some time off.

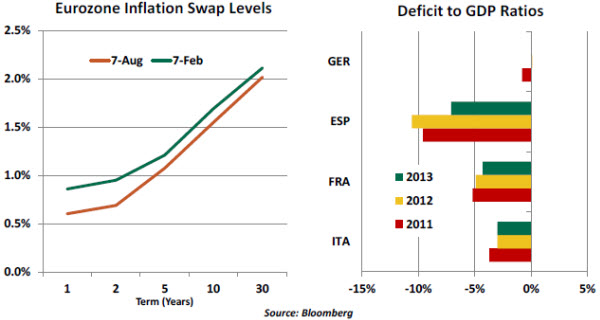

Characterizing the recovery as “weak, fragile, and uneven,” Draghi highlighted a series of downside risks to the outlook. Most prominent among them is the escalating battle of sanctions with Russia, which is already taking a toll on European growth. Lending continues to contract, and inflation continues to fall. Inflation expectations are also beginning to reflect diminished confidence that the ECB’s 2% target will be reached anytime soon.

Draghi invested a bit of time and passion noting the sluggish pace of structural change in many eurozone countries, going so far as to suggest that there be “shared sovereignty” over the process. Balance sheet adjustments in the public, private and financial sectors continue to be a headwind. Every member of the eurozone is carrying government debt or deficits that exceed limits specified in the Stability and Growth Pact.  The ECB is intensifying its preparations for additional stimulus, with central bank purchases of asset-backed securities under serious consideration. After a well-deserved break, let’s hope Mr. Draghi returns refreshed and ready to inspire his governing board to act.

The ECB is intensifying its preparations for additional stimulus, with central bank purchases of asset-backed securities under serious consideration. After a well-deserved break, let’s hope Mr. Draghi returns refreshed and ready to inspire his governing board to act.

Should Mortgage Risk Be Shared?

It is well-recognized that household debt, particularly home mortgage debt, played a significant role in triggering the 2008 financial crisis and deepening the Great Recession. In their book, “House of Debt: How They (and You) Caused the Great Recession, and How We Can Prevent It from Happening Again,” professors Atif Mian of Princeton University and Amir Sufi of the University of Chicago present an analysis of how the current features of a mortgage contract contributed to the crisis and how it can be modified to mitigate the damage in the future.

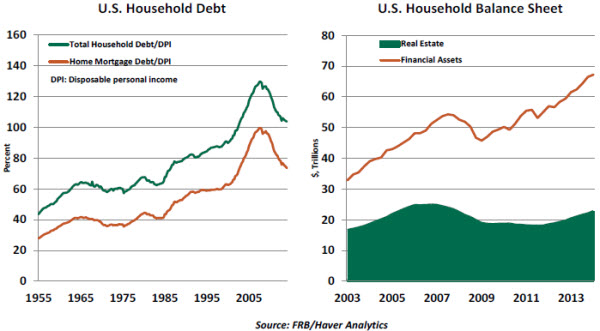

Their main thesis is that excessively indebted households were at the root of the economic crisis. Total household debt climbed to nearly 130% of disposable income by the third quarter of 2007, while home mortgage debt touched nearly 100% of disposable income.

The authors calculate that as of 2007, the poorest 20% of homeowners had a debt-to-asset ratio of 80%, while the richest 20% of homeowners has a leverage ratio of only 7%. Also, home equity accounted for 80% of the net worth of the lowest quintile and only 20% of the highest.

House prices fell about 30% from 2006 to 2009 and stayed low until the end of 2012. By contrast, stock prices recovered sooner. Those exposed to the housing sector incurred the largest losses, while households with relatively larger holdings of stocks saw their net worth recovered sooner.

A large number of households faced home mortgages exceeding the value of their homes, which led to foreclosures. The next step was a larger impact on housing sector, with fire sales of properties depressing prices of homes more broadly, which translated into a further decline in net worth of households and a reduction in consumer spending. To Mian and Sufi, mortgage debt destroyed middle class net worth, reduced aggregate demand and increased job losses.

The authors have been fierce advocates of debt forgiveness as a way of accelerating the recovery. Some of this has been done through government programs and through legal settlements with banks whose underwriting practices raised questions.  To institutionalize this going forward, Mian and Sufi propose a product they call a shared responsibility mortgage (SRM). SRM contracts allow for a reduction in mortgage payment if the local house price index declines. For example, if the local house price index declines 10%, the mortgage payment would decline by 10% while maintaining the original amortization schedule, effectively resulting in a reduction in principal.

To institutionalize this going forward, Mian and Sufi propose a product they call a shared responsibility mortgage (SRM). SRM contracts allow for a reduction in mortgage payment if the local house price index declines. For example, if the local house price index declines 10%, the mortgage payment would decline by 10% while maintaining the original amortization schedule, effectively resulting in a reduction in principal.

If prices move up, the mortgage payment would revert to the original amount but not exceed it. Another provision of SRMs is the capital gain-sharing feature. If the homeowner sells the house or refinances the mortgage, the lender claims 5% of the net capital gain.

The authors argue that if SRMs had been in place in 2007, they would have protected the wealth of the middle class and avoided the foreclosure challenge and associated costs. The reduction in consumer spending driven from loss in net worth would not have occurred. Banks would have been forced to account for their real estate problems earlier, instead of allowing them to drag out over time.

Of course, there are obstacles to the implementation of SRMs. Such products would introduce additional risks for banks and require them to hold more capital against their home loans. Some banks may be reluctant to offer them, and the rates on the new loans would likely rise. The authors worked out the cost of such financing and admit it is large. It is also not clear whether SRMs could be securitized as readily for investors to buy.

From a broader perspective, SRMs could enhance speculation in the housing market, as investors would have less downside risk. The possibility of red-lining is a valid consideration in situations where prices of homes are at risk of falling.

Mian and Sufi deserve credit for their innovative ideas about this very critical topic. Their recommendation is intriguing, but the practical impediments suggest we need to continue thinking about how to reduce the financial fragility that originates in the mortgage sector.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.