This Week's Highlights

Swiss National Bank goes bonkers

Record moves in foreign exchange

FX Market Overview

The Swiss National Bank went rogue yesterday when they abandoned all rational thinking and just dumped their policy of linking the Euro-Swiss Franc exchange rate to 1.20 as they have for roughly 3 years. Russian gas policy and the upcoming European Central Bank QE program have obviously convinced them that heaps of funds would flow into Switzerland and they clearly didn't feel able to buy enough Swissie to stem the flow. Whatever their motive, the impact was epic. The Swiss franc gained 30% in a matter of minutes before settling back to a meagre 15% gain after half an hour or so. This was a momentous move by the SNB and they have faced a barrage of criticism for bringing bankers into disrepute!

That will crash Swiss inflation and devastate chocolate and cuckoo clock exports but the ramifications were felt farther afield. The euro weakened as funds flowed into the Swiss Franc. The Sterling - Euro exchange rate pushed above the recent resistance at 1.2850 and is still above €1.30 as I write. A test of €1.3150 at the interbank level is highly likely and that would make the euro the most affordable it has been since 2007. The Euro -US Dollar rate has fallen to levels not seen since 2003 but found some support there.

So while traders were dumping Euros and buying Swiss Francs they were also buying the Pound and US Dollar where the economies are in a different part of their economic cycle and where central bankers may be boring but at least they are rarely erratic.

There was other news and there were other data releases but quite frankly, who cared? US jobless claims rose,

Today brought Eurozone inflation data and the same from America. Inflation levels are depressed all around the world as energy costs drop and as retailers struggle to extract cash from consumers. So it was no surprise that the numbers were poor. Equally, US industrial production was a little weaker than previously due to the fall in demand from the major buying blocs in Europe, the US and Asia. That is entirely in line with expectations.

Aside from the markets, a chap on a commuter train in New York was so fed up with the homophobic ranting by a preacher who was delivering a sermon on Sodom and Gomorrah to the disinterested passengers that he took matters into his own hands. Rather than confronting the preacher he burst into song with a rendition of 'I've got a golden ticket' from Willy Wonka. He managed to drown out the preacher and received a standing ovation from the other passengers. Passive aggressive wins.

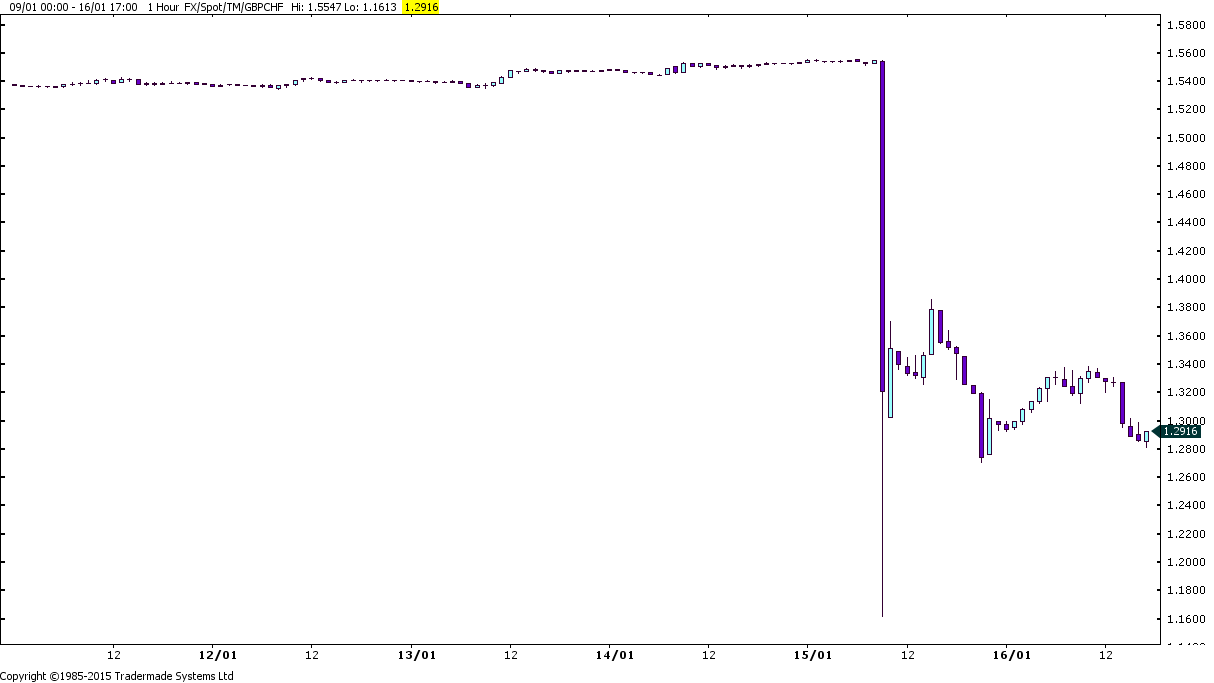

Currency - GBP/Swiss Franc

I have included this chart just to give you some measure of how volatile the Swiss Franc has been since the SNB made the decision to stop weakening their currency. For nigh on 3 years, the SNB has been selling CHF in order to keep it around 1.20 against the Euro but the impending ECB quantitative easing program scared the SNB into abandoning that plan. That led to a move from CHF1.56 to CHF1.16 and back to CHF1.30 in less than an hour. Now that is volatility.

Currency - GBP/Australian Dollar

Sterling's gains in other exchange rates are stronger than against the Australian Dollar but the upward trend in the Sterling – Aussie Dollar exchange rate is clear to see. The Pound is currently finding buyers around the A$1.84 level and, if this pair continues to head higher, the top of the range is the 2014 high around A$1.92. Weakness in commodity markets and in Chinese demand are keeping the Australian dollar weak but the comparative strength of the Australian economy and the attractiveness of the interest rate yield from Australia are all good news for the AUD and are maintaining demand. I suspect we will see another bounce in this pair next week so hang on tight.

Currency - GBP/Canadian Dollar

'The trend is your friend' is the old adage and you can see why when you look at the Sterling – Canadian Dollar exchange rate. Sterling buyers can grab themselves a bargain if the market dips to C$1.76 again and CAD buyers can fill their boots if we see a test of the top of the range at C$1.82. Unless we see this pair punch its way out of that range, use the trend channel to your advantage.

Currency - GBP/Euro

The phenomenal advance of the Swiss Franc after the SNB's announcement saw the Euro washed away in its wake. The Euro dived against both the Pound and the US Dollar and others. Sterling managed to make it to the 61.8% Fibonacci retracement level. That sounds like a whole heap of jargon but what it means is that this is a great level to be buying Euros in the short term. I would not be at all surprised to see a drop back to €1.2850 after that and maybe even a dip to €1.2750 (trendline support). But as long as those levels hold, the upward trend for this pair is secured as long as the European Central Bank plays nice and introduces a large scale Quantitative Easing package on the 22nd.

Currency - GBP/US Dollar

Events in Euro and Switzerland have added strength to the US Dollar and to sterling to a degree. The net result is that the Sterling – US Dollar exchange rate managed to make some gains but these were minor in comparison with the huge decline in the GBPUSD rate over the last 6 months or so. The support for the Pound is evident just above $1.50 but, having fallen from $1.72, the first significant level at which we could conceivably say the Pound has mounted a recovery would be $1.58. It would take a very significant catalyst to make that happen but, as we can see from the Swiss debacle, stranger things have happened.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD loses ground due to the absence of a hawkish RBA

The Australian Dollar has plunged following the Reserve Bank of Australia's decision to maintain its interest rate at 4.35% on Tuesday. Investors sentiment leaned toward a potentially more hawkish stance from the RBA, particularly after last week's inflation data surpassed expectations.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.