The European Central Bank (ECB) came, delivered, and made a difference this week. Investors and dealers were positioned for further disappointment from eurozone policymakers, but what “Super Mario” (read: ECB chief Mario Draghi) did has had a far greater impact on the market.

The ECB made a bold move to avert eurozone deflation and growth fears by slashing rates and setting the market up for a bond-buying program beginning next month. Interestingly, a few months ago the asset-backed securities (ABS) market did not have the significant structure or depth for the ECB, but now it is ready to be introduced in October. In addition, the ECB has kept open the possibility of taking further steps should inflation stay low and fail to move higher. This was a very different ECB, more aggressive than what the market is normally used to, especially after its June message that interest rates were at their lower bound. It’s safe to say few had expected the ECB to act as aggressively so soon.

Cut, Cut, and Introduce

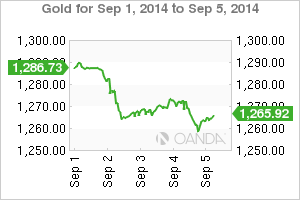

Draghi and company cut the ECB’s refinancing rate to +0.05% from +0.15% and its deposit rate to -0.2% from -0.1%. Again they pronounced that the ECB was now officially at the lower bound of interest rates and that no more rate cuts were possible. Few details of the new program were disclosed beyond it would include new and existing ABS, covered bonds, and mortgage-backed securities. Obviously, the market will have to wait to gauge the success of the TLTROs (targeted longer-term refinancing operation) and ABS/covered bonds programs. Until then the immediate impact is coming from the ECB’s negative interest rate policy. European money market rates out to three-year Euro OverNight Index Average, and the Bund curve, out to 2018, are all trading with a negative yield. From an investment perspective, investors will be forced to take on more risk as they search for a positive return.

Unanimity Rules

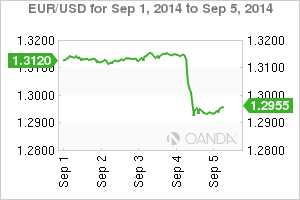

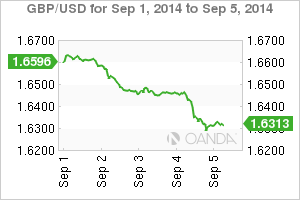

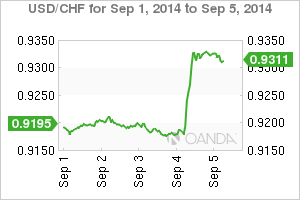

This week’s ECB decisions were not unanimous, only a “comfortable majority” was in favor of the moves. Market reaction to the news saw European equity indices rally and are looking to end the week close to their highs, while sovereign yield curves have notably steepened. The EUR has since plummeted with the 18-member single currency trading at a 14-month low (€1.2935). The ECB’s surprise rate cut will force other central banks to act. The knock-on effect will pressure the Swiss National Bank (SNB) to react (the threat of intervention) if EUR/CHF happens to penetrate its designated ‘floor’ established three years ago (€1.2000). The SNB’s next meeting is on September 18.

What to Expect Next Week

After the rollicking market action that ensued following Draghi’s performance, next week might seem like a bit of a letdown. Regardless, China kicks things off with its trade balance on Monday, its inflation numbers on Wednesday, and will close out the week with industrial production numbers on Saturday. Down Under, the Aussies will release business confidence numbers and give us more color on their job market. The Reserve Bank of New Zealand is not expected to do anything to its overnight rates (+3.5%) on Wednesday. Stateside, the U.S. will give us core-retail sales on Friday and will close out the week with the University of Michigan’s consumer sentiment survey.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD loses ground due to the absence of a hawkish RBA

The Australian Dollar has plunged following the Reserve Bank of Australia's decision to maintain its interest rate at 4.35% on Tuesday. Investors sentiment leaned toward a potentially more hawkish stance from the RBA, particularly after last week's inflation data surpassed expectations.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.