Stock bulls seem a bit more uneasy as they continue to hear increasing talk about rising corporate taxes and surging inflation.

Fundamental analysis

Treasury Secretary Janet Yellen taking a somewhat opposing stance to Fed Chair Jerome Powell. In case you missed the headline, Yellen is saying we might need a modest rise in interest rates to blunt some of the government spending we are seeing hit the street. Later in the day, Dallas Fed President Robert Kaplan reiterated the need for the Fed to begin a conversation about scaling back its bond-buying in an interview with MarketWatch. Kaplan says that's largely because he has greater confidence in the economy than he had a few months ago, but noted a "fog" around labor market participation rates that will take a while to clear.

Kaplan also noted that the Fed could remain “highly accommodative” without keeping rates pegged at zero. According to his assessment of the economy, Kaplan anticipates the Fed raising rates sometime in 2022, which is ahead of the timeline forecast by most Fed officials who don't see the benchmark being lifted until 2023.

Moral of the story, talk that the economy could "overheat" and push interest rates higher seems to be a bit more worrisome now on Wall Street. I don't think this anything most of us didn't see coming, but the question of how the Fed reduces liquidity and tapers is still the big question?

If the Fed can nail the dismount then no harm no foul, but if you believe the market is currently "priced to perfection" then there is absolutely no room for Fed error.

Some of the bigger and more experienced investors won't even like the thought of being this high up if the Fed is going to start unwinding.

A growing number of Wall Street traders expect the Fed's June 15-16 policy meeting could begin outlining plans for such moves.

Economic data

Investors today are anxious to see ADP's Employment Report for April which is expected to show around +850,000 jobs added. ADP's numbers can vary widely from the official Labor Department numbers, which are due out on Friday and expected to show close to +1 million jobs were added during April.

The ISM Services Index for April is also due today. The gauge hit a new pandemic high as well as an all-time record high in March.

Wall Street will be paying particular attention to the employment and prices components, which rose to pandemic highs last month as well.

Services activity accounts for about 75% of U.S. GDP so what's happening in the sector has broad implications for the overall economy. Earnings will likely be the main focus today with several big names reporting, including Allstate, Barrick Gold, Cerner, Etsy, General Motors, GoDaddy, Hilton Worldwide, HubSpot, MetLife, Paypal, Redfin, Rocket Companies, Scotts MiracleGro, Twilio, Uber, Volkswagen. And Wynn Resorts.

S&P 500 technical analysis

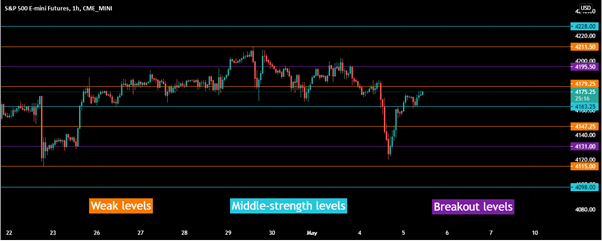

Yesterday’s breakout levels played very well. For today, the neutral zone is 4131 - 4195.5. Middle-strength level within this zone - 4163.25, weak levels - 4179.25, 4147.

In case of bullish breakout above 4195.5, look for weak level 4211.5 and middle-strength level - 4228. Bearish breakout below 4131 will target for 4115 - weak level and in extension 4098 - middle-strength level. Based on the intraday cycles, there are more chances for trading within the neutral zone today.

Important Note! For qualified breakout entry breakout level should turn into support/resistance. Don’t enter the trades without this price action confirmation.

No Representation Is Being Made That Any Account Will Or Is Likely To Achieve Profits Or Losses Similar To Those Discussed Within This Site, Support And Texts. Our Forecasts and other Texts on this Website Should Be Used As Learning Aids. If You Decide To Invest Real Money, All Trading Decisions Are Your Own. The Risk Of Loss In Trading Commodities and Stocks Can Be Substantial. You Should, Therefore, Carefully Consider Whether Such Trading Is Suitable For You In Light Of Your Financial Condition. Futures and stock trading is speculative. It involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.