Wall Street next week

1. Markets cannot go higher on valid fundamentals

We believe the short squeeze (soon) over and any good news MORE THAN built into markets. We also believe this is a time to be defensive rather than FOMO. Going forward economic activity caused by the pandemic should bottom out and a real recovery will happen, but one that is slow going and uneven. We see a U US economic recovery but stock markets NOT V, L or U but W.

In Q3 we project 10+% market correction from current levels.

- Currently a better than 98% chance a H1 2020 market bottom in place,

- Going forward there is currently a better than 85% chance markets in Q3 2020 will correct 10% or more from current levels.

RECOMMENDATION: 75% Protection Before June 22 & 100% Before August.

SOME KNOWN UNKNOWNS:

- US Politics (July & August - November ?)

- Oil (+ May & H1 June). l

- Covid Vaccine/treatment/testing & Reopening Progress + (May & June; October?)

- Debt Defaults - (ongoing)

- US GDP Negative - (Negative Q2 2020 with High Unemployment )

- Large short positions were a contrarian + signal & helped fuel current short squeeze

- Stock Buybacks & Dividends reduced or dropped -

- China Risk elevated (– June)

- Assorted geopolitical hotspots (black & white swan events) -

The Good News this = Opportunity

OUR VIEWS:

- There is very high risk in the market now until late Summer.

- IT IS TIME TO PROTECT/EXIT especially above 3150 SPX.

- POST SUMMER INVESTMENTS SHOULD BE TARGETED FOR A POST COVID-19 WORLD.

TRADERS SHOULD DAY TRADE OR HAVE VERY DEEP POCKETS;

- Current high volatility making directional bets dangerous.

- After hard rallies or market drops, it is smart to book profits.

INVESTORS REQUIRE A LONGER TERM HORIZON THAN NORMAL.

WE are no longer accumulating but selling stay-at-home stocks that have been winners from this crisis.

We will be planning a different strategy for the post November US Presidential Election.

Conservative investors may prefer to buy stocks less effected either way such as Water Utilities or high quality corporate bonds and hence generally have less downside risk.

AT THE RIGHT PRICE, AND RIGHT TIME FRAME THE COVID CRISIS REPRESENTS DANGER & OPPORTUNITY.

Commodity Trading:

GOLD ~1581 OB (+ Astro is Fall, ++ Astro Nov/Dec) First buy 14.88 Second Buy 14.80 Sold 16.50 & 1580 Rebuy < 1600 OB

Oil (+ Astro April-June). First Buy 30 Sold 35 Second Buy 21 Sold 38 Third Buy 21.22 Sold 39 [Fourth Buy 12/ Sold 24]

Silver ~15 OB (Astro is no longer negative cf March/April) First Buy was 11.80 stop 16.80

Copper <2.48 but is a deep pocket H2 2020 or 2021/2022 hold) Fully allocated otherwise potentially long term hold.

Our approach to trading markets is to enter early and exit early, lots of profit none-the-less.

Given market action last week, we accelerated our reduce/protect/sell in June. We are now have a short bias into August

DJIA BUYS 23185, 20000 SOLD 22400 Buy 20981, 22000 SOLD 23780// SOLD 27031

SPX BUYS 2400, 2300 SOLD 2550 & 2600// SOLD 3122 3180

NASDAQ BUY 7350, 7800 SOLD 9300// SOLD 9608, 9800

The Following prices are comfortable accumulation zones for us if/when next seen (late Summer?).

- DJIA 22500-23500

- NASDAQ 7400-8200

- SP 2600-2750

SAVE THE DATE:

July 15, 2020 2:44 pm ET AFUND 2020 Stock Market Update Online Seminar

KEY DATES: June 12, 18-22

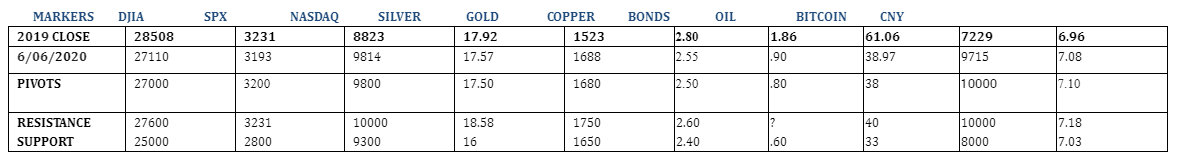

DJIA: 27000 PIVOT R1 27500 R2 28000 R3 28508

SPX: 3050 SUPPORT 3231 RESISTANCE?

NASDAQ: 9300 SUPPORT 9800 OR 10000 RESISTANCE?

GOLD: 1680 SUPPORT?

SILVER: WATCH

OIL: 38 PIVOT 40 OR 45 RESISTANCE

COPPER: 2.50 PIVOT

US 10 year WATCH

CNY 7.10 PIVOT

2019 CLOSE: DJIA 28508 SPX 3231 & NASDAQ 8823

2018 CLOSE: DJIA 23327 SPX 2506 & NASDAQ 6635

2017 CLOSE: DJIA 24719 SPX 2673 & NASDA 6903

2016 CLOSE: DJIA 19762 SPX 2238 & NASDAQ 5383

AFUND Fair Value: GOLD $1581.

Reduce Risk and Focus on Capital Preservation:

THINK TRADITIONAL SWISS AND PRESERVE CAPITAL: HEDGE AND PROTECT AGAINST DOWNSIDE RISK.

2. Our current focus is now on reducing portfolio risk:

Before Fall, we advise just buying special situations and/or accumulate highly undervalued quality stocks for the long term.

Favorite 2020 Sectors:

Entertainment, Mining, Select Health Care (lower cost/better outcome) & Technology (Undervalued & Highly Scalable)

Stock selection is important. When possible, we prefer to recommend stocks sporting strong cash flows, sound balance sheets & growing dividends.

Choose your favorite stocks and patiently bid for them at “ideal prices” if seen again [August?].

Use NO margin and always remember that it isn’t over the Fat lady sings [August?].

3. There are so many good buys in the precious metal space depending on your time frame and risk/reward desires

Review past WSNW and AFUND luncheons & conferences for many good ideas that should be quite profitable this coming Fall/Winter.

Copper remains undervalued largely as a pawn of the US/China trade spat & Wuhan Virus.

Short term it is now more attractive and longer term this remains a “deep pockets” BIG win.

Gold: Fundamentally there is short term decrease in mine supply COUPLED with increasing investor interest. We note gold is generally under Highly favorable astrological influences later in Q3 & Q4.

Longtime Gold bugs are happy that more generalist investors are beginning to join the party: In addition, major brokerage houses have $2000+ price targets. These views now seem more achievable especially if/when inflation fears resurface!

We believe gold valuations will largely sport at or above Fair Value in this Year of the White Metal Rat (2020).

Just as it was undervalued for a long time, it CAN and is likely to be overvalued for a LONG time.

While fundamentally gold is currently overvalued, in much of the Fall & Winter, the astro is positive for gold hence we maintain a full portfolio allocation.

We advise precious metal investors to pay attention to stock selection but only selectively add until August.

- Gold remains cheap geopolitical crisis insurance.

- For investors who cannot or will not buy the $US currency as well as investors who wish to safely and cheaply hedge their US$ exposure, ONLY GOLD IS AS GOOD AS GOLD!

- Once again some investors were hedging record equity prices by buying gold. They will not be unhappy.

Gold FV $1581= Commodity FV: 1500 + Currency FV: 1610 + Inflation Metal FV: 1450 + Crisis FV: 1764.

INVESTORS: We plan to stay LONG in 2020 (recommending a precious metal sector buy/hold rating and occasional hedging, selling or profit taking before the Fall).

We will be happy if allowed to BUY more Gold cheaper ideally < 1564 & Silver at that time in Q2 2020.

4. “The housing market is one part of the economy that’s showing a V-shaped recovery.”

Joel Kan, associate vice president, Mortgage Bankers Association

HW: With all crisis, there are winners and losers.

“History shows effectively no correlation between social, political turmoil and stock markets.”

David Trainer, CEO, New Constructs.

HW: “History” encompasses a lot more than the market posting a significant gain in 1968!

“I think the Fed will keep the Fed funds rate at the zero lower bound for at least another couple of quarters and then they’re going to have a re-entry problem.”

Brian Bethune, economist, Tufts University

HW: They certainly will have a re-entry problem.

5. READER: Will the market drop significantly because of the riots this week?

HW: Perhaps but in any case is toppy. The last two days made it seem that I was wrong in believing there is NO rush to buy. However the FOMO & Momentum crowd could intermediate term be crying in their soup.

READER: I'm a believer. Please send me prospectus for the Brooklyn Bridge!

HW: We will shortly! But there will be a delay due to demand overwhelming with FOMO investors!

READER: Do you think QE Infinity will likely minimize the astrological influence in August for a market pullback or correction etc.

HW: My view is similar to the latest revised review of Goldman Sachs who forecast a correction to 2750.

We have a current downside target of 2600 to 2750 SPX.

Author

Henry Weingarten

The Astrologers Fund

Henry Weingarten, was the founder of the NEW YORK SCHOOL OF ASTROLOGY and the NY ASTROLOGY CENTER and has been a professional astrologer for over forty years.