The Canadian dollar showed some movement in both directions last week, but finished the week unchanged, as USD/CAD closed at 1.3362. This week’s highlights are GDP and Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, Unemployment claims dropped sharply, but housing and consumer data missed expectations. Still, the US economy is doing fine, so a rate hike in December is more likely than not. In Canada, manufacturing inflation matched expectations.

Updates:

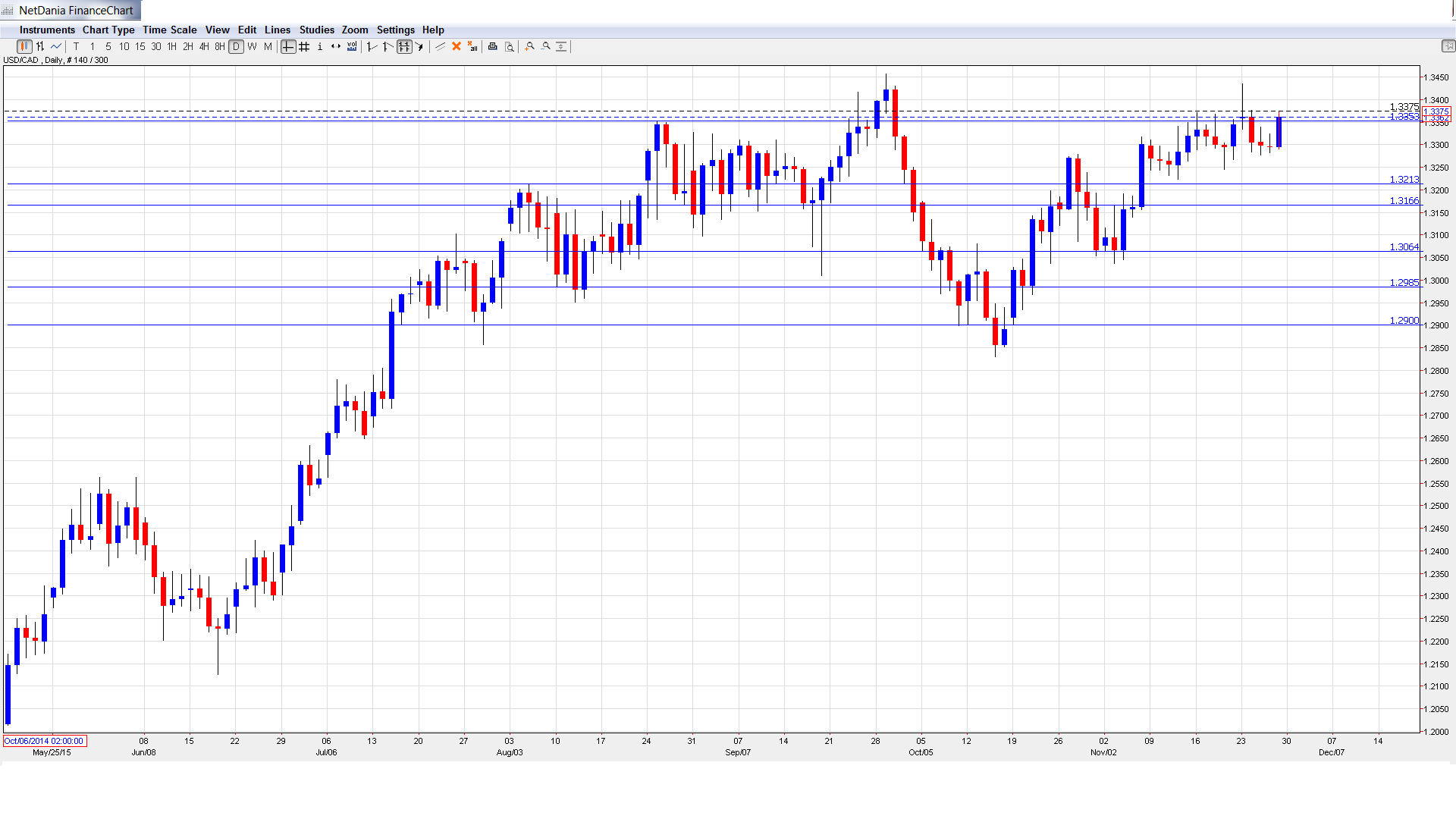

USD/CAD daily chart with support and resistance lines on it.

Current Account: Monday, 13:30. Current Account remained steady in Q2, posting a deficit of C$17.4 billion, which was within expectations. The markets are expecting a strong improvement in Q3, with a deficit estimated at C$15.2 billion.

GDP: Tuesday, 13:30. GDP is one of the most important economic indicators, and an unexpected reading can have an immediate impact on the movement of USD/CAD. GDP in September slipped to 0.1%, matching the forecast. Another gain of 0.1% is expected in the October report.

RBC Manufacturing PMI: Tuesday, 14:30. This PMI is an important gauge of the health of the manufacturing sector. The index has posted three straight readings below the 50 level, which is indicative of ongoing contraction in the manufacturing industry. Will we see an improvement in the November release?

BOC Overnight Rate: Thursday, 14:30. The BOC surprised the markets in July when it cut rates to 0.50%, down from 0.75%. The central bank is not expected to make another cut, but the accompanying rate statement could shed some light on the Bank’s view of the economy, which has not looked all that sharp recently.

Employment Change: Friday, 13:30. This key indicator should be treated as a market-mover by traders. The indicator surged to 44.4 thousand in October, crushing the estimate of 9.5 thousand. However, the markets are braced for a decline of 0.7 thousand in November. Will the indicator again surprise and beat the prediction? The unemployment rate is expected to remain at the round figure of 7 percent.

Trade Balance: Friday, 13:30. Trade Balance is closely linked to currency demand, as foreigners need to buy Canadian dollars in order to purchase Canadian goods and services. The trade deficit narrowed in September to C$-1.7 billion, slightly better than the estimate of C$-1.9 billion. No change is expected in the October release, with an estimate of C$-1.7 billion.

Ivey PMI: Friday, 15:30. Ivey PMI dipped to 53.1 points in October, shy of the estimate of 54.0 points. The markets are expecting a strong turnaround in the November release, with the estimate standing at 55.3 points.

* All times are GMT.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3357 and quickly climbed to a high of 1.3435, as resistance held firm at 1.3443. The pair then reversed directions, dropping to a low of 13277. USD/CAD closed the week at 1.3362.

Technical lines, from top to bottom

We start with resistance at 1.3759.

1.3587 was a cap in March 2004.

1.3443 was under pressure early last week. This line has held firm since late September.

1.3353 was breached and has switched to a support role. It is a weak line and could see more action next week.

1.3213 is an immediate support level.

1.3165 is the next support line.

1.3063 is protecting the symbolic 1.30 line.

1.2985 was an important cushion in September.

The very round line of 1.2900 is the final line of support for now.

I am bullish on USD/CAD

With a Fed rate hike priced in at about 75%, the greenback is set to make broad gains against its rivals. Canadian GDP and employment numbers are expected to be soft, so it could be a rough week for the loonie.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.