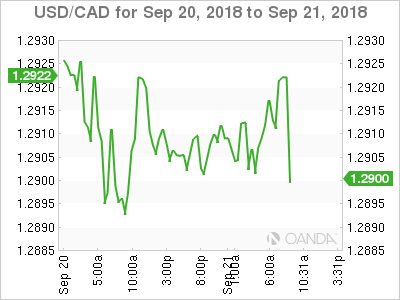

The Canadian dollar is trading sideways in the Friday session, after posting strong gains in the Thursday session. Currently, USD/CAD is trading at 1.2924, up 0.13% on the day. On the release front, Canada releases key consumer data. CPI is expected to post a rare decline, with an estimate of -0.1%. Retail Sales is forecast to rebound and record a gain of 0.6%. There are no major releases out of the U.S.

The U.S dollar is broadly lower this week, and the Canadian dollar has jumped on the bandwagon, posting gains of close to 1%. On Thursday the pair dropped to 1.2884, its lowest level since June 11. However, the Canadian currency’s gains have been pared due to pressure on oil prices. If this continues, the Canadian dollar could surrender some of its recent gains.

The US-China trade war is heating up, with the two economic giants exchanging tariffs this week. On Monday, U.S President Trump announced 10% tariffs on some $200 billion worth of Chinese goods. China quickly responded, slapping 10% tariffs on $60 billion in US exports. These tit-for-tit tariffs have become a familiar script, only this time investors haven’t panicked and snapped up U.S dollars. Investors are somewhat relieved that the tariffs are just 10%, and China is taking measures to reduce the effect of the tariffs on its economy, including increasing stimulus and infrastructure spending. Global growth remains strong, despite the tariff spat. However, China has also threatened to cancel upcoming trade talks with the U.S, in protest of the recent U.S tariff.

Yen at two-month low versus dollar on Wall Street surge

Central Banks up the ante to normalize interest rates

USD/CAD Fundamentals

-

8:30 Canadian CPI. Estimate -0.1%

-

8:30 Canadian Retail Sales. Estimate 0.6%

-

9:45 US Flash Manufacturing PMI. Estimate 55.1

-

9:45 US Flash Services PMI. Estimate 54.9

Open: 1.2905 High: 1.2919 Low: 1.2898 Close: 1.2924

USD/CAD Technical

|

S3 |

S2 |

S1 |

R1 |

R2 |

R3 |

|

1.2515 |

1.2666 |

1.2830 |

1.2970 |

1.3067 |

1.3160 |

USD/CAD showed little movement in the Asian session and posted small gains in European trade

-

1.2830 is providing support

-

1.2970 is the next resistance line

-

Current range: 1.2830 to 1.2970

Further levels in both directions:

-

Below: 1.2830, 1.2666 and 1.2515

-

Above: 1.2970, 1.3067, 1.3160 and 1.3292

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.