USD/JPY: First support at 109.20/10 for profit taking on any remaining shorts

USD/JPY, EUR/JPY, CAD/JPY

USDJPY saw a high for the day exactly at strong resistance again at 109.90/110.00.

EURJPY topped exactly at 128.70/75. Our shorts worked perfectly hitting target of 128.15/10 for an easy 60 pip profit. Now we are short again at first resistance at 128.55/65.

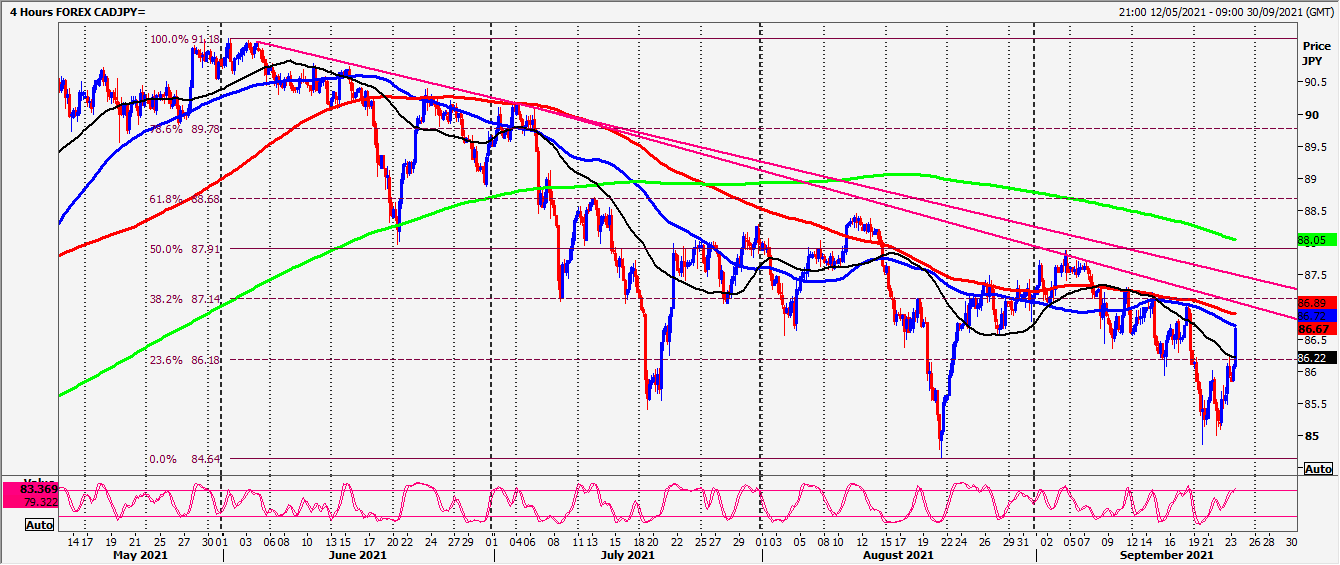

CADJPY we are short at strong resistance at 8610/20 with stops above 8640.

Daily analysis

USDJPY shorts at strong resistance at 109.90/110.00 target 109.60/70, perhaps as far as 109.40. First support at 109.20/10 for profit taking on any remaining shorts. Longs need stops below 108.95. Further losses test the August low at 108.80/70. A break below here is a sell signal.

Strong resistance at 109.90/110.00. Shorts need stops above 110.10. A break higher can target 110.30/40, perhaps as far as the August high at 110.70/80 for profit taking on any longs.

EURJPY first resistance at 128.55/65 (stop above 128.80) & again at 128.95/129.05. Stop above 129.15. Strongest resistance for this week at 129.35/45. Shorts need stops above 129.70.

Any shorts at 128.55/65 target 128.35 before a retest of 128.15/10. Support at the August low at 127.95/90. A break below 127.80 is a sell signal.

CADJPY we are short at strong resistance at 8610/20. Shorts need stops above 8640. A break higher meets strong resistance at 8690/8700. Try shorts with stops above 8725.

Shorts at 8610/20 target 8570/60, perhaps as far as 8535/30. Support at recent lows of 8485/65.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk

-637679813490454923.png&w=1536&q=95)