USD/CAD Outlook: Bears take a breather ahead of NFP/Canadian jobs report

- Another USD selloff on Thursday dragged USD/CAD to the lowest level since September 2017.

- Sliding crude oil prices did little to undermine the loonie or stall the sharp intraday downfall.

- Investors look forward to the US/Canadian monthly jobs report for a fresh directional impetus.

The USD/CAD pair witnessed aggressive selling on Thursday and dived to the lowest level since September 2017 amid a broad-based US dollar weakness. Expectations that the Fed will keep interest rates low for a longer period continued acting as a headwind for the USD. Apart from this, the underlying bullish sentiment in the financial markets further dented the greenback's safe-haven demand.

On the other hand, the Canadian dollar remained well supported by a more hawkish Bank of Canada. It is worth mentioning that the BoC reduced its weekly asset purchases at the April policy meeting and brought forward the guidance for the first interest rate hike to the second half of 2022. Even retreating crude oil prices did little to undermine the commodity-linked loonie or lend any support to the major.

Nevertheless, the pair tumbled to levels below mid-1.2100s but managed to regain some positive traction during the Asian session on Friday. The uptick lacked any obvious catalyst and could be solely attributed to some repositioning trade ahead of the closely-watched monthly jobs report from the US and Canada. The data will offer further clues about the central banks' policy outlook and provide a fresh directional impetus.

Economists anticipate another blockbuster NFP print from the US, showing that the economy added nearly one million jobs in April. Conversely, the Canadian labour-market recovery likely suffered a setback amid the imposition of stricter restrictions to contain the coronavirus pandemic. Market participants are expecting that the Canadian economy shed 175K jobs in April and the unemployment rate rose to 7.8% from 7.5% in March.

Short-term technical outlook

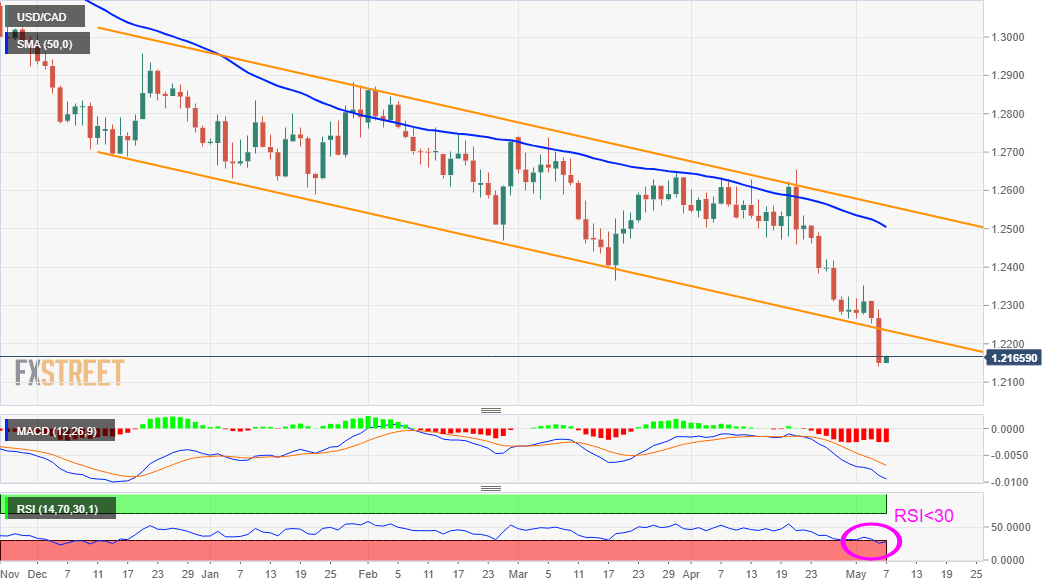

From a technical perspective, the overnight slump dragged the pair below support marked by the lower boundary of a five-month-old descending trend channel. The bearish breakdown might have already set the stage for an extension of a well-established downward trajectory witnessed over the past year or so. That said, extremely oversold RSI (14) on the daily chart warrants some near-term consolidation or a modest bounce before the next leg down.

That said, any meaningful recovery attempt is more likely to confront stiff resistance near the mentioned trend-channel support breakpoint, currently near the 1.2200 mark. Any subsequent positive move might be seen as a selling opportunity and remain capped near the 1.2265-70 horizontal zone. The pair seems all set to slide further towards the 1.2100 round-figure mark before eventually dropping to test September 2017 swing lows, around the 1.2070 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.