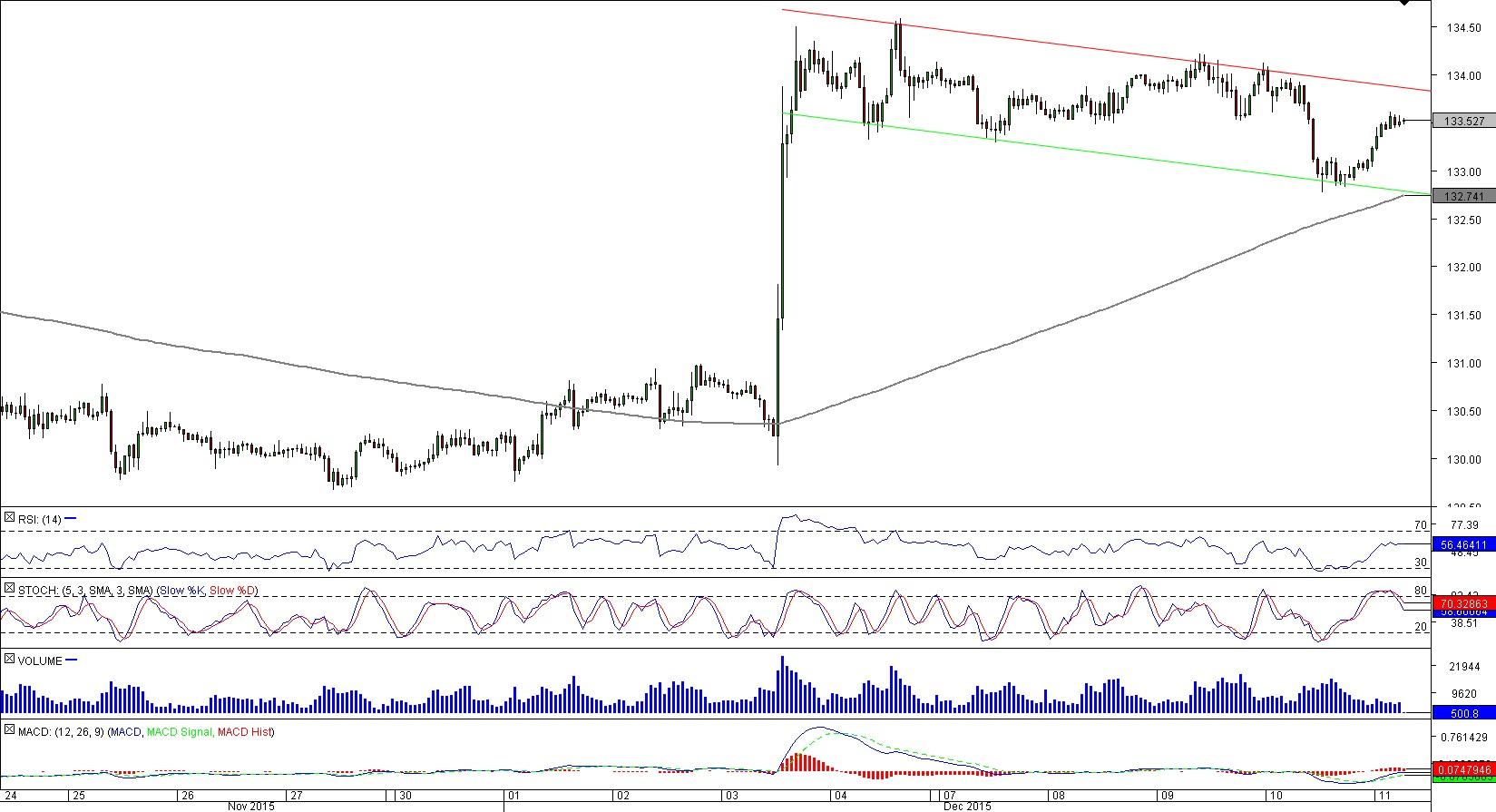

EUR/JPY 1H Chart: Channel Down

Comment: After a massive 400-pip rally a week ago EUR/JPY entered a bearish channel. Accordingly, the latest recovery of the Euro from 132.70 should soon come to an end, namely at the upper boundary of the pattern at 133.85.

However, as long as support at 132.70 remains intact, our outlook will be neutral, being that this demand level consists not only of the lower trend-line of the channel, but is also reinforced by the weekly PP and 200-hour SMA. At the same time, the technical indicators are mixed, and the SWFX market participants are undecided—the numbers of long and short positions are equal. Below this cluster the price will likely target November low at 129.70.

USD/TRY 1H Chart: Channel Up

Comment: USD/TRY has been bullish since the beginning of December, but soon there is going to be a serious test of the current upward momentum. In order to confirm its intentions to move higher, the currency pair will have to breach a solid resistance area at 2.9370/40, created by the weekly R1 and November high. Soon thereafter the US Dollar will be expected to begin a bearish correction from the upper trend-line of the channel, but in the longer term there will be a high chance of the rate probing the October 13 high at 2.9660. In the meantime, a close beneath 2.92 will imply a sell-of down to 2.90, where the weekly PP merges with the December 9 low and 200-hour SMA.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.