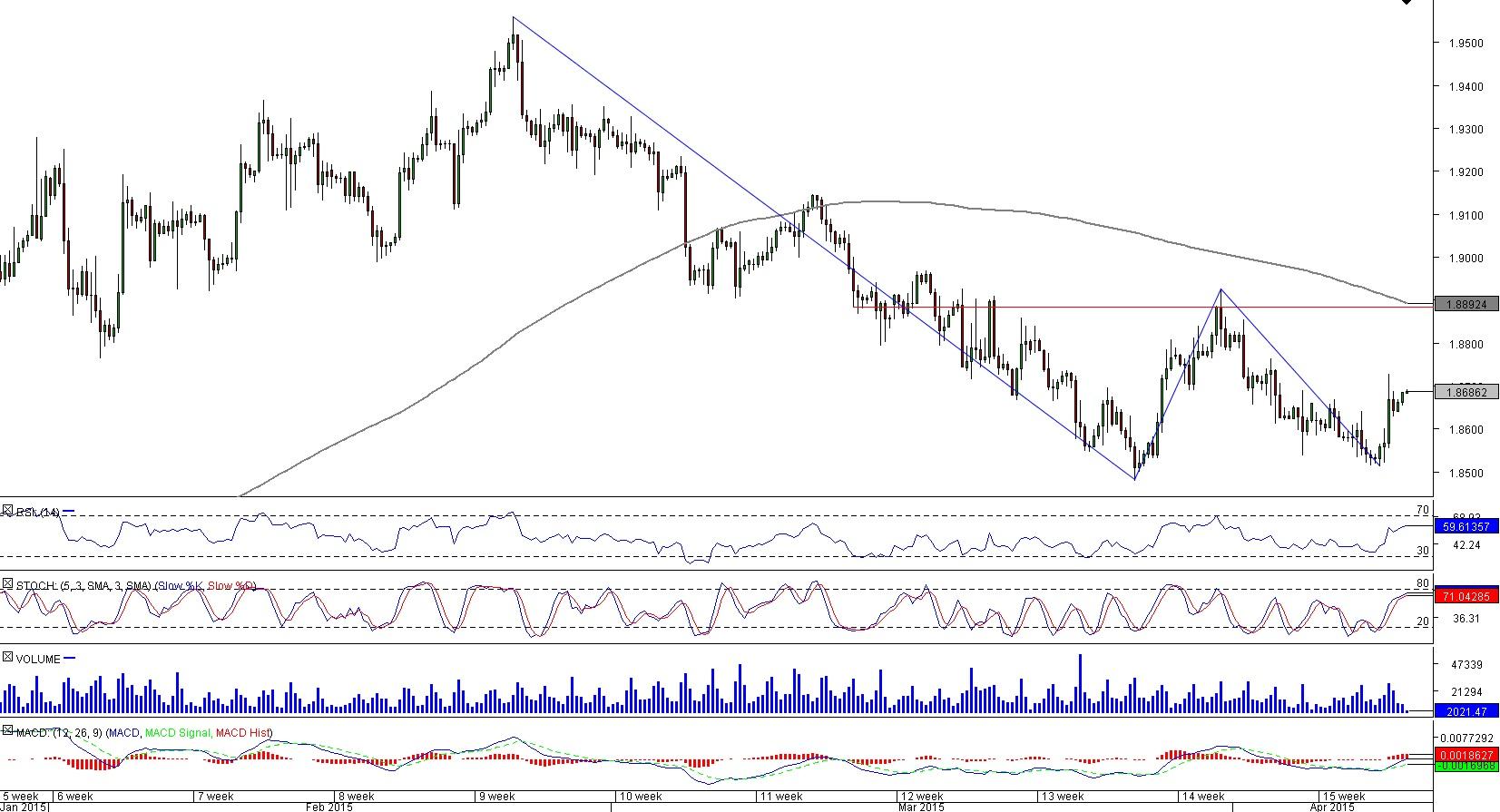

GBP/CAD 4H Chart: Double Bottom

Comment: Although from a fundamental perspective the Sterling appears to be fairly weak, the technicals are suggesting the time has come for the British Pound to outperform its peers. Specifically in the GBP/CAD pair, we see emergence of a double bottom pattern that implies a reversal of the recent sell-off. At the same time, we must note we are still rather far away from the neck-line, which needs to be broken to confirm its intention to reach the Feb high at 1.9559. Meanwhile, the technical indicators, with the exception of the daily ones, are mostly pointing upwards, and the SWFX sentiment is strongly positive, with three fourths of all positions being long.

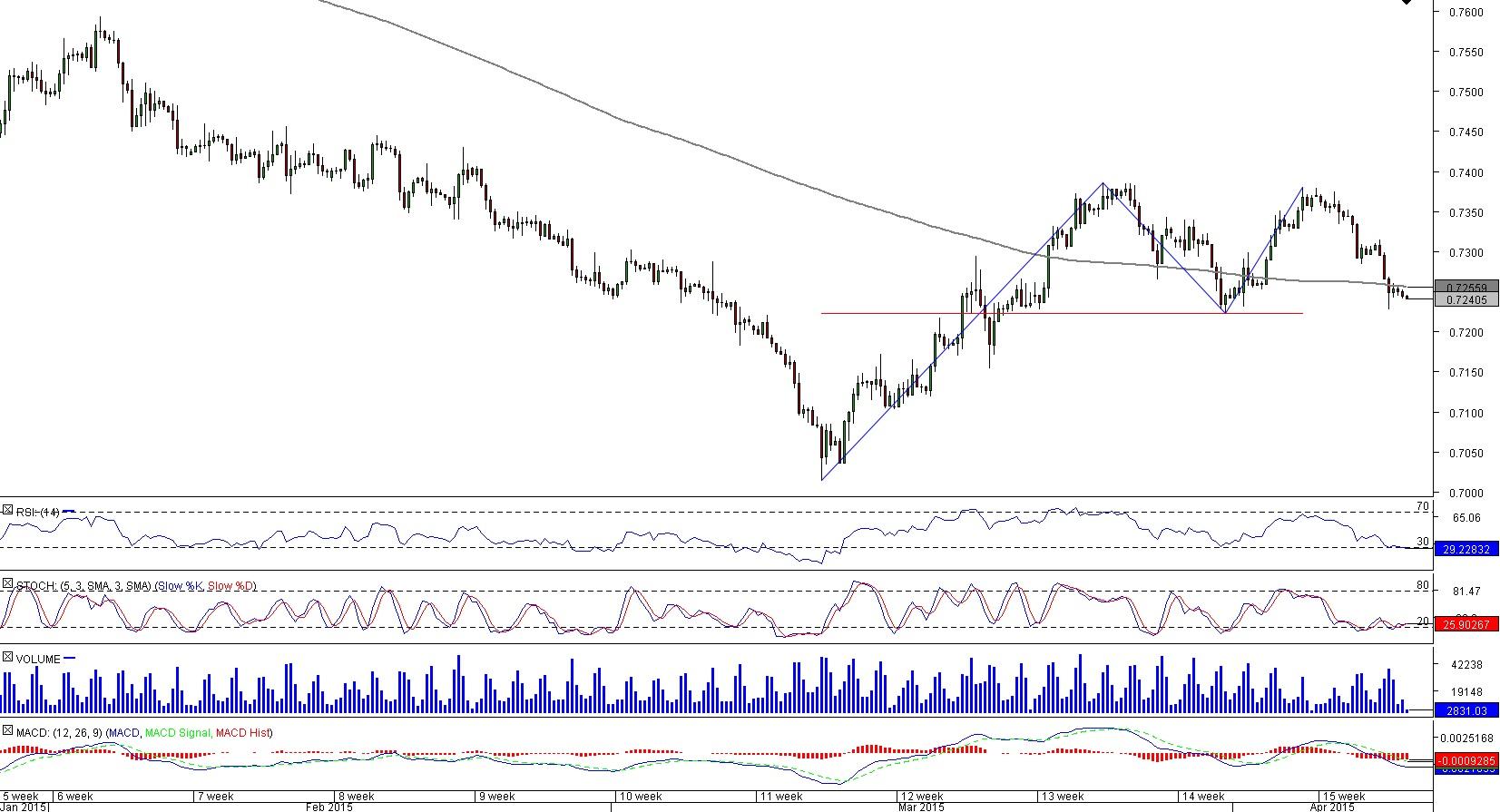

EUR/GBP 4H Chart: Double Top

Comment: EUR/GBP prepares to launch an attack on a strong support level at 0.7220. This is the neck-line of the recently formed double top pattern, and it is reinforced by the monthly pivot. If the currency pair succeeds, the price may afterwards fall towards the Mar low near 0.70, though there is also the monthly S1 nearby at 0.7043 that can potentially stop a decline.

Alternatively, if demand at 0.7220 is sufficient to satisfy supply and trigger a rally, major resistances are at 0.7266 (weekly S1 and 200-period SMA) and at 0.7384 (Mar high). At the same time, the SWFX market participants prefer to be short the Euro. Currently only 38% of open positions are long.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.