AUD/NZD 4H Chart: Channel Down

Comment: The market is bearish since the beginning of November 2014, when AUD/NZD once again confirmed resistance at 1.13 after several unsuccessful attempts to breach it. Right now the currency pair is struggling to break support at 1.03, but the risks are skewed to the downside, and the Aussie is expected to keep descending until it reaches the lower boundary of the channel, while the down-trend at 1.0430 should stay intact. This scenario is reinforced by the technical indicators on the daily and weekly time-frames, as most studies are currently pointing south. However, the SWFX sentiment is strongly bullish—74% of all open positions are long.

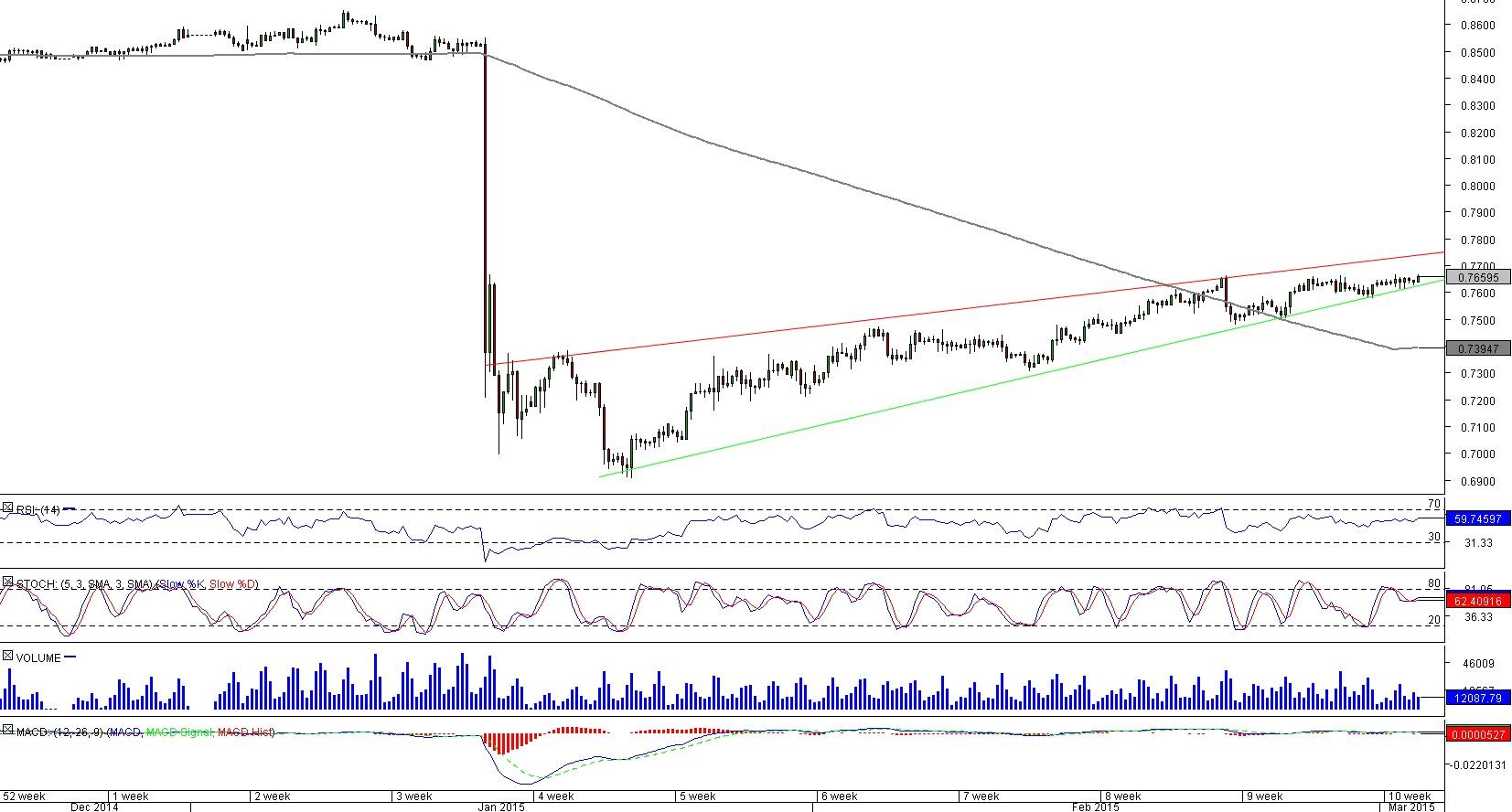

CAD/CHF 4H Chart: Rising Wedge

Comment: Soon after a removal of the peg and precipitous rally of the Franc, the currency started to lose value. However, demand for the Loonie, as evidenced by formation of the wedge, appears to be weakening at the moment. Consequently, the possibility of a reversal is increasing. Should the support line be violated, one of the first targets will be a cluster of supports at 0.75, where the Feb 24 low merges with the weekly S1 and monthly PP. If the selling pressure persists, which is likely, the next bearish wave may stop just beneath 0.74, where the weekly S3 coincides with the monthly S1 and 200-period SMA. Meanwhile, the SWFX sentiment is positive, with 70% of traders holding longs.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.