USD/CAD 1H Chart: Rising Wedge

Comment: A jump to a five-year high of 1.1279 provoked a sharp depreciation of the U.S. Dollar against the currency of the neighbouring country, with USD/CAD losing over 420 pips during three weeks. However, after a slid to a threemonth low the pair managed to change its trend by entering a rising wedge pattern.

At the moment of writing, the currency couple was sitting near the lower limit of the formation that is a sign of a probable breakout. Nevertheless, the pair’s prospects are obscure since traders are not univocal on the pair– the proportion of short positions almost equals to the proportion of the long ones.

CAD/JPY 1H Chart: Double Bottom

Comment: A two-week rally that took CAD/JPY to more than a two-month high of 94.90 ended in the very beginning of April when the pair started an accelerating decline. The 88-bar long double bottom pattern being currently formed by the instrument also is a part of this long-lasting weakness.

However, now the era of losses seems to have come to an end as the pair finally managed to surpass the neck-line at 93.01 that means the breakout may have happened and as a result a sharp appreciation may lie ahead. Technical indicators support this idea, sending ‘buy’ signals for the short and long terms.

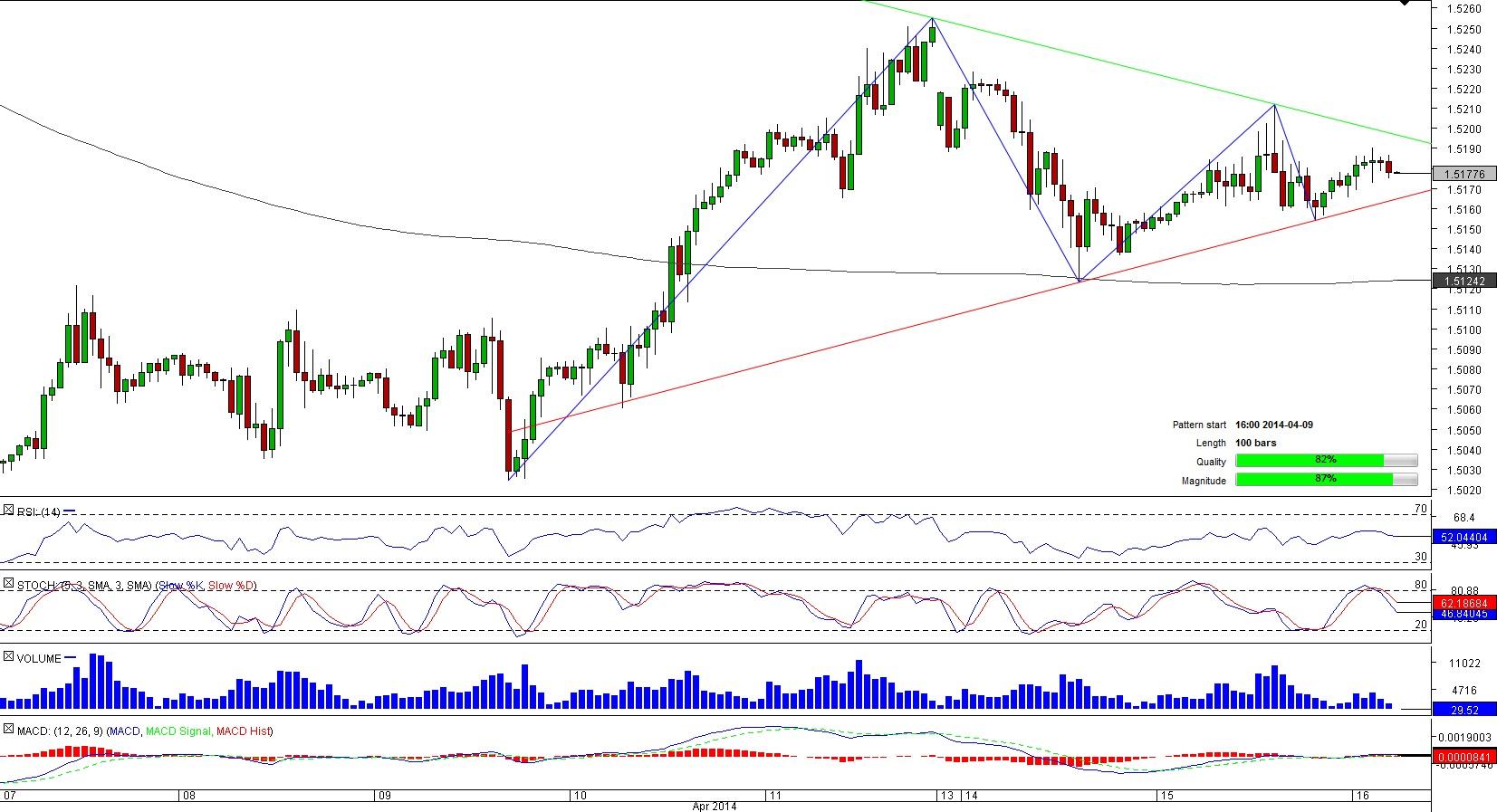

EUR/CAD 1H Chart: Triangle

Comment: The Euro demonstrated a similar strength against the Canadian Dollar as the U.S. currency did in mid-March. However, this time a rise from a two-month low helped the pair to shape a triangle pattern that now 100-bar long and has both quality and magnitude above average.

Now EUR/CAD is unremittingly nearing the apex that will be reached later in the day. This signifies that the pair is on the verge of a breakout that will either give the currency couple an impulse for a rally or put a heavy drag on the instrument. Technical numbers fail to provide any hint regarding the pair’s move in the nearest term but point to a weakness in the long-term.

AUD/CHF 1H Chart: Falling Wedge

Comment: Since early April when AUD/CHF attained a five-month high of 0.8325, the currency couple has been in the down-trend that led to formation of the steadily converging bearish corridor.

At the moment, the pair is vacillating below the short- and long-term SMAs, albeit slightly. In the hours to come, AUD/CHF may attempt to break through its SMAs meandering close to 0.8256 as almost two thirds of market participants bet on appreciation of the pair. Meanwhile, technical signals are neutral for the next one and four hours but send ‘buy’ signal for longer period.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.