EUR/NZD 1H Chart: Channel Down

Comment: The single European currency has been in the down-trend against kiwi since mid-February and in the last day of the month it started to shape a channel down pattern that pushed the currency couple to a four-month low of 1.6197.

Now the pair is retreating from its short-and long-term SMAs at 1.6376/0 that have recently intersected forming a ‘death cross’. However, market players are not losing faith in the instrument and expect EUR/NZD to regain upside in the hours to come. More than 73% of orders are placed to buy the pair.

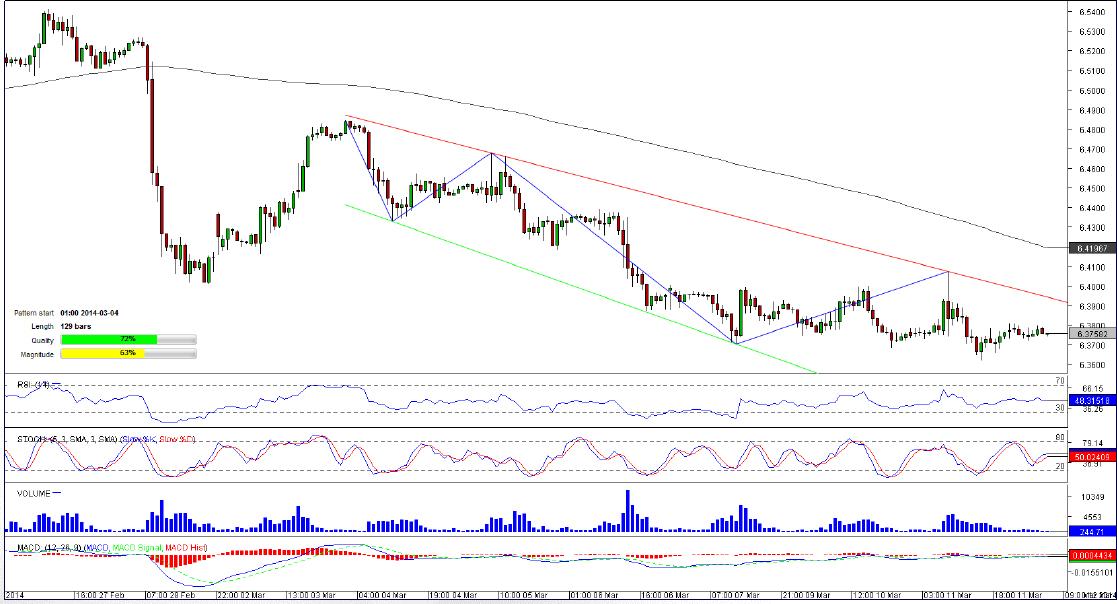

USD/SEK 1H Chart: Broadening Falling Wedge

Comment: A sharp decline performed by USD/SEK in second part of February has led to a formation of the broadening falling wedge pattern that is around 130-bar long now. Recently, the currency couple has bounced off a six-month low of 6.3617 and now it is likely to target the 50-hour SMA at 6.3792. Market sentiment also props up this idea, with almost 86% of traders being bullish on the pair. If USD/SEK breaches its short-term SMA it will move up to the daily pivot point at 6.3816 above which there is only the level of 6.3837/78 (H4 R2, R3) that may prevent the pair from attaining the pattern’s upper boundary and attempting to break out of the tunnel.

USD/SGD 1H Chart: Triangle

Comment: A 247-bar long triangle shaped by USD/SGD in the last days of February and first weeks of March is on the verge of being broken through. The currency couple approached the upper limit several hours earlier and given bullishness on the market as well as proximity of the apex that is likely to be reached on March 13, we may witness the breakout followed by an accelerating advance before long. Technical indicators also bolster the bullish scenario, sending ’sell’ signals for short and medium terms.

USD/NOK 1H Chart: Descending Triangle

Comment: Having reached a four-year high of 6.3146 early February, the U.S. Dollar commenced a retreat against the Norwegian Krone. A decline was steep, pushing the pair to a six-month low of 5.9542 during less than a month. However, the drop may be halted in the days to come as the pair managed to regain strength after diving below the lower trend-line of a 98-bar long descending triangle pattern. Besides, the pair has recently broken the resistance of the pattern that may mean that bullish breakout has happened and the pair may enjoy a sharp rally in the hours to come.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana network has been sensational since the fourth quarter (Q4) of 2023, making headlines with a series of successful meme coin launches that outperformed their peers.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.